暗号資産取引所

暗号資産取引所の概念

デジタル化の波に駆り立てられて、暗号資産市場は急速な成長を遂げています。2009年のBitcoinの誕生以来、暗号資産の数は着実に増加し、市場は拡大を続けています。関連データによると、2025年初頭現在、世界の総暗号資産市場の時価総額は3兆ドルを超え、暗号資産取引参加者の数も年々増加しています。この新興の金融セクターにおいて、暗号資産取引所は投資家をデジタル資産の世界につなぐ重要な架け橋として機能しています。彼らは暗号資産取引のための重要なプラットフォームを提供するだけでなく、全体的な暗号資産エコシステムの繁栄と発展に大きく貢献しています。

画像ソース:https://www.coingecko.com/

暗号資産取引所は、基本的には、ユーザーがビットコインやイーサリアムなどのさまざまな暗号資産を購入および販売できるオンラインプラットフォームです。これは、株式や債券を取引する従来の株式取引所と同様に機能しますが、ユーザーはデジタル暗号資産を取引します。暗号資産取引所の主な機能は、買い手と売り手がデジタル資産を交換できるマーケットプレイスを提供することです。さらに、取引所は取引を円滑にするために買い注文と売り注文を照合する重要な役割を果たします。

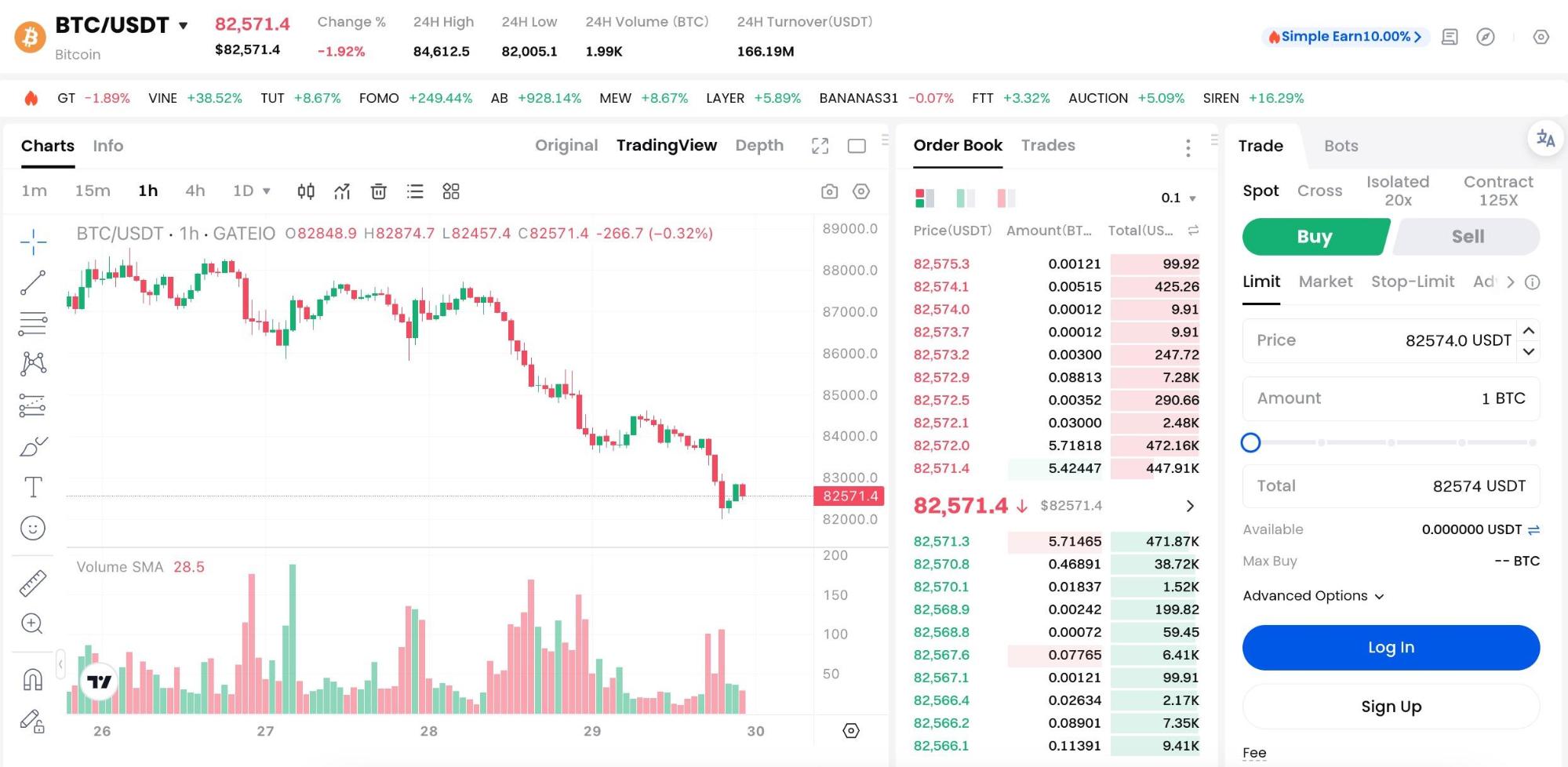

例えば、投資家がBitcoinを購入したい場合、取引所で現在の市場価格を確認し、買い注文を出すことができます。取引所は、そのマッチングアルゴリズムを使用して、利用可能なリスティングから適切な売り手を特定し、取引を実行します。このプロセス全体を通じて、取引所は市場情報の集約者、価格発見メカニズム、取引マッチングのファシリテーターとして機能します。

一般的な注文の一種は、リミット注文であり、投資家がビットコインを購入したい特定の価格を設定する注文です。売り手の提示価格が買い手の指定価格と一致すると、取引が実行されます。

画像ソース:https://www.Gate.com/trade/BTC_USDT

暗号資産取引所の分類

取引モデルの観点から、暗号資産取引所は主に2つのタイプに分類されます:中央集権型取引所(CEX)と非中央集権型取引所(DEX)です。

(1) 中央集権取引所 (CDX)

中央集権化取引所は現在、市場で最も一般的なタイプです。これらの取引所は、従来の金融機関のように、中央の管理組織を持っています。ユーザーの身元を厳密に確認し、通常はユーザーに本人確認書類や銀行カード情報などを提供するよう要求し、KYC(顧客確認)プロセスを通じて取引のコンプライアンスを確保します。取引プロセス中、ユーザーは暗号資産を取引所の口座に入金する必要があり、取引は取引所のサーバーを介してマッチングされます。

画像ソース:https://www.coingecko.com/en/exchanges

世界的に有名な取引所Binanceと同様に、典型的な中央集権型取引所です。Binanceは2017年に設立され、急速に発展してきました。2024年現在、バイナンスは500種類以上の暗号資産の取引サービスを提供しており、オプション、現物取引、コイン証拠金契約、その他のさまざまな取引商品をカバーしています。その取引システムは、毎秒約140万件の注文を処理でき、非常に大きな取引量で優れたパフォーマンスを備えています。バイナンスで取引する場合、ユーザーは便利な取引体験を楽しむことができます。このプラットフォームは幅広い取引ペアを提供しており、ユーザーはある暗号資産を別の暗号資産にすばやく交換したり、法定通貨で暗号資産を購入したりできます。たとえば、ユーザーは米ドルをビットコインに交換したり、イーサリアムをライトコインに交換したりできます。

よく知られたGate.comは、典型的な中央集権取引所でもあります。Gate.comは2013年に設立され、世界中で最も古い暗号資産取引プラットフォームの1つです。1000種類以上の暗号資産に対する取引サービスをユーザーに提供し、スポット取引、マージン取引、永続契約などのさまざまな取引をカバーしています。その取引システムは安定して効率的であり、高頻度取引リクエストを処理してスムーズな取引を確保する能力を持っています。Gate.comで取引することで、ユーザーは幅広い取引オプションを体験し、さまざまな暗号資産を簡単に交換することができ、さらに、人気のある暗号資産を法定通貨で購入することもサポートしています。

画像ソース:https://www.Gate.com/

中央集権型取引所にも特定のリスクが存在します。すべてのユーザーの資産が取引所に集中して保存されているため、取引所がハッカー攻撃や内部管理の問題に苦しんだ場合、ユーザーの資産のセキュリティが脅かされます。たとえば、2018年には、日本の暗号資産取引所Coincheckがハッキングされ、約5億30万ドル相当の仮想通貨が盗まれ、多くのユーザーに巨額の損失をもたらしました。この事件は、中央集権型取引所の資産保管のセキュリティリスクを露呈しました。

(2) 分散型取引所(DEX)

分散型取引所は、中央管理機関のないブロックチェーン技術に基づく比較的新しいモデルです。分散型取引所の最大の特徴はプライバシー保護です。ユーザーは通常、取引時に個人情報を提供する必要がなく、取引プロセスは匿名であり、ユーザーのプライバシーを大きく保護します。さらに、取引や操作は公開スマートコントラクトを介して実行され、誰もが取引記録を表示および検証できるため、高い透明性と監査可能性が提供されます。

Image Source:https://www.coingecko.com/ja/exchanges/decentralized

分散型取引所では、ユーザーは自分の資産を常に自分で管理し、取引所に預ける必要はないため、資産がハッキングされたり凍結されたりするリスクが軽減されます。たとえば、一部の分散型取引所では、ユーザーがウォレットの秘密鍵で取引に署名し、承認することで、資産を第三者に委託する必要はありません。ただし、分散型取引所には制約もあります。現時点では、取引速度が比較的遅く、ブロックチェーンネットワークの処理能力に制約があるため、取引確認時間が長くなります。さらに、取引インターフェースの使いやすさも改善する必要があります。初心者ユーザーにとって、操作は比較的難しく、ある程度、大規模な普及を制限しています。

暗号資産取引所を選ぶ方法

暗号通貨取引所を選択する際、投資家は複数の要因を考慮する必要があります。何よりもまず、最も重要なセキュリティです。投資家は、取引所がユーザーのデータや資産を暗号化するために複数の暗号化技術を採用しているかどうか、コールドストレージウォレットを使用して資産の大部分をオフラインのコールドウォレットに保管することでユーザー資産を保護し、ハッキングのリスクを軽減しているかどうかなど、取引所が堅牢なセキュリティ対策を備えているかどうかを調べる必要があります。

次に手数料です。さまざまな取引所の料金基準は大きく異なります。一部は取引金額の一定割合(0.1%〜0.5%など)を請求し、他の取引所は各取引に固定料金を請求します。投資家は取引頻度と金額に基づいて手数料が低い取引所を選択する必要があります。たとえば、高頻度取引者は比例手数料が低い取引所が適していますが、低頻度の大口取引者は固定手数料と比例手数料の両方を考慮する必要があります。

さらに、取引ペアの豊富さも重要です。投資家がさまざまな暗号資産に投資したい場合、幅広い取引ペアを提供する取引所を選択する必要があります。たとえば、一部の大手取引所は数百の暗号資産に対する取引ペアを提供しており、投資家の多様な投資ニーズを満たしています。

さらに、顧客サービスの質を見落としてはいけません。取引プロセス中に問題が発生した際に投資家が適時かつ効果的な支援を受けることは重要です。これには、取引所が24時間顧客サービスを提供しているかどうか、顧客サービスの対応力、問題解決能力などが含まれます。

リスク警告と将来の展望

暗号資産市場が進化し続ける中、取引所はより安全で効率的、ユーザーフレンドリーになることが期待されています。暗号化技術の進歩、マルチシグネチャメカニズム、向上したブロックチェーンのスケーラビリティによって、取引の安全性とスピードが向上します。さらに、取引所はAIによる投資アドバイザーなどのパーソナライズされたサービスを導入することがあり、ユーザーエクスペリエンスをさらに最適化するかもしれません。

ただし、規制上の不確実性は依然として重要な課題となっています。異なる国々での暗号資産規制に対する姿勢は異なっており、突然の政策変更は取引所の運営に影響を与える可能性があります。また、極端な価格の変動や操作などの市場リスクも投資家にとって懸念事項です。

これらのリスクを回避するために、投資家は暗号通貨取引に従事する際に、常に情報を入手し、注意を払い、十分に調査された投資決定を下す必要があります。

関連記事

Piコインを売却する方法:初心者向けガイド

Forkast (CGX): ゲームやインターネット文化向けに構築された予測市場プラットフォーム

Radiant Multi-Signature Attackを使用したBybitハックの分析を例に

$MAD: MemesAfterDark – The Ultimate Degen Token

Piノード:誰もが参加できるブロックチェーンノード