ゲスト投稿: ウォレットとプロトコルがビットコインをオンチェーンの世界に架け橋する方法。

約10年にわたり、Bitcoinは暗号エコシステムの礎として立ち続けてきました。その分散化、検閲耐性、証明可能な希少性が評価されています。しかし、市場規模の支配力と再燃するハイプにもかかわらず、Bitcoinは、暗号の最も活気のあるセクターの1つであるDeFiとはほとんどつながっていません。

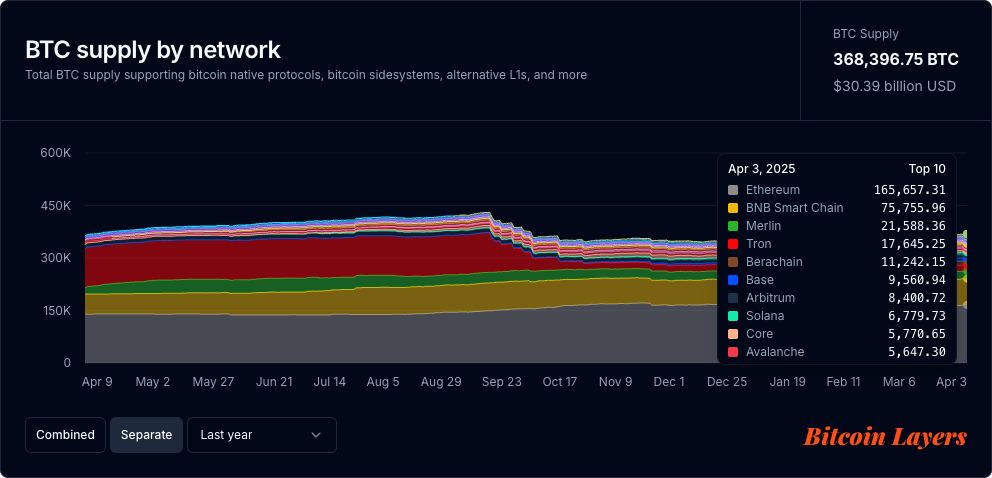

ビットコイン・レイヤーズによると、DeFiで使用されているBTCの価値は約300億ドルで、その総供給量のわずか1.875%に過ぎません。一方、イーサリアムはDeFiに約500億ドルのETHをロックし、その供給量の約23%を占めています。

この格差は、今日のビットコインの物語における核心的な緊張を浮き彫りにしています。BTCは莫大な価値を持っていますが、そのうち比較的少ない部分が収益機会を提供するためにチェーン上で活用されています。そのギャップは、ビットコインをDeFi経済に取り込み、BTCが生産的な資本資産として活用できる方法を開くための包み込み、ステーキング、およびその他の方法についてのイノベーションの波を促しています。

ビットコインレイヤー*:ネットワークによるBTC供給、包まれたすべてのBTCを表示

イーサリアムのDeFiエコシステムは、借入、貸出、ステーキング、取引などのツールで爆発しています。それに対して、ネイティブのビットコインは特に新規ユーザーにとって生産的に使用することが難しいままです。取引時間が遅く、手数料が変動し、しばしば高額であり、ビットコインのアーキテクチャにはイーサリアムベースのアプリケーションを支えるプログラム可能性が欠けています。

これは、より広範な暗号通貨の景観が成熟する中で重要な問題を提起しています: ビットコインはオンチェーンエコノミーに意義深く参加できるでしょうか?もしそうなら、どのようにして日常的なBTC保有者を、橋、包装トークン、そして馴染みのないアプリの試練を強いずにオンボーディングすることができるでしょうか?

問題:Bitcoinのデザイン対DeFiの有用性

ビットコインは、現在のスマートコントラクトの表現力とは異なるプログラム可能性のために構築されていませんでした。ビットコインは、エクスプレッシブさよりもセキュリティと分散化をProof-of-Work(PoW)を通じて優先しており、これにより、堅牢な価値保管手段となっていますが、スマートコントラクトや複雑なDeFiアプリケーションでの利用には適応しにくい状況となっています。その結果、ネイティブのビットコインは、イーサリアムやソラナなどのチェーン上で繁栄している合成金融エコシステムから大きく排除されています。

歴史的に、回避策が存在してきました:

- Wrapped Bitcoin:ユーザーはBTCをERC-20トークンに変換して、イーサリアムベースのDeFiにアクセスします。これにより、トークンの流動性が不透明であり、BTCについて必ずしも1対1で裏付けられていないため、第三者の管理者によって保持されているカストディリスクが導入されます。

- プロトコルの橋渡し:クロスチェーンプラットフォームを使用すると、BTCを他のエコシステムに移動できます。ただし、手動での橋渡しは、非技術者にとって特に摩擦、複雑さ、リスクが伴います。

- カストディアルプラットフォーム:Coinbaseなどの中央集権型サービスはBTCの利回りを提供しますが、ユーザーは管理権を放棄し、BTCではなくポイント、ステーブルコイン、または独自のトークンで利回りを受け取る必要があります。

これらの選択肢のそれぞれには、ビットコインの中心的な理念であるセキュリティ、シンプルさ、ユーザー主権に挑戦するトレードオフがあります。

オンボーディングギャップ:なぜUXがまだ重要なのか

2024年のBTCの蓄積,river.com

Bitcoinを保有しているユーザーが、資産をさらに活用したいと考えている場合、利回りを得たり、オンチェーンガバナンスに参加したり、DeFiを試したりすることに興味があるかもしれませんが、その入り口は分散しており、直感的ではなく、しばしば抵抗があります。インフラは成熟してきましたが、ユーザーエクスペリエンスはまだ遅れており、競争相手は他のブロックチェーンだけでなく、TradFiとも競合しています。

この摩擦は、主要なオンボーディングのギャップを生み出しています。ほとんどのユーザーは、パワフルなDeFiユーザーになろうとしているわけではありません - 彼らは、迷路のようなアプリケーション、ブリッジ、およびプロトコルをナビゲートせずに、簡単で安全な方法で純資産とBTC保有を増やしたいと考えています。最近のビットコイン購入者の大多数が、ブローカー、ETF、およびマイケル・セーラーのストラテジーのような製品を介してオフチェーンであることが明らかです。

次のウェーブのユーザーをオンチェーンに引き込むために、単なるオフチェーンの保有者である代わりに、ツールはこの複雑さを犠牲にすることなく抽象化する必要がありますが、コントロール、セルフカストディ、透明性を損なうことなく。そこで新興プロトコルとモダンなウォレット体験が本当の違いを生み出し始めています - ユーザーフレンドリーなDeFiプリミティブへのアクセスを提供しながら、ビットコインの精神を保ち続けています。

より良いUXは単なるあると便利なだけでなく、ビットコインの次の段階の採用にとって必須のインフラストラクチャです。

オンチェーンBTC収益と生産性への新しいアプローチ

新たなソリューションがいくつか登場しており、それぞれがトレードオフのバランスを異なる形で持ちながら、BitcoinをDeFiでより使いやすくすることを目指しています。

1. ステーキング、リステーキング、& ポイントベースの利回りプログラム

プラットフォームのようなバビロンそしてロンバードポイントやリワードトークンを通じて、通常はステーキング/リステイキングを介して、特典や将来のエアドロップと引き換えることができる、ビットコイン関連の収益プログラムを提供しています。これらのシステムは、エアドロップやプラットフォーム固有のトークノミクスを追い求める初期採用者や暗号ネイティブに魅力的であることがあります。これらの製品は、通常、BTCをラップされたBTC標準に変換し、その後、さまざまなプログラム/製品内で資産をロックして可変収益を得ることで構成されます。オンチェーントレーダーにとっては、高い収益が得られる場合がありますが、暗号通貨の使用方法や資金の送金、ラップ、入金の方法をより深く理解する必要があります。

メリット:

- 収益機会の幅広いスペクトル

- 通常、セルフカストディアル

デメリット:

- 報酬はBTCでは支払われません

- 通常、ロックアップ期間が必要です

- 報酬の長期的な価値の不確実性

2. ビットコイン Layer 2s & メタプロトコル

開発のようなライトニングネットワーク, Rootstock(RSK)、アルカン, そして新興のLayer 2、Botanix and スタークネットBitcoinに新機能、プログラミング可能性、そして速度をもたらしています。これらの革新により、迅速な支払い、NFT、スマートコントラクトのような機能などのユースケースが可能となりました。その結果、ユーザーはBTCを使用して資金をロックしてネットワークを保護したり、市場メイキングに参加したり、貸付や借入を行ったり、さまざまなプロトコル上でwrapped BTC標準をサポートするために資産を変換したりするなど、幅広いDeFiの機会にアクセスできるようになりました。これらのネットワークを構築するチーム数が増えるにつれて、Bitcoinベースの収益機会のエコシステムは拡大し続けています。

メリット:

- ビットコインのユースケースを拡大します

- Bitcoinのアーキテクチャに整合性を保ちます

- オンチェーンで収益を得る方法に関する幅広い選択肢

デメリット:

- まだ比較的早く、分断されています

- 中級から上級レベルの理解が必要です

- 他のスマートコントラクトチェーンで既に存在するユーティリティを構築するためには、大量の開発リソースが必要です

3. スマートウォレット統合、& ネイティブBTC収益

ウォレットのようなブラーヴォス(開示:私はここで働いています!)は、ユーザーがBitcoinを手動でラップする必要なく、または取り扱いを放棄することなく、ネイティブBTC収益を得るための機能を提供します。ユーザーは、ウォレットを介して直接BTCを投資することができ、通常の障害を乗り越えたり、外部アプリを使用したりする必要がありません。入金、ラップ、ブリッジなどの複雑な手順は、BTCが特定のDeFi戦略に展開されるまで、バックグラウンドでシームレスに処理されます。このユーザーフレンドリーなアプローチは、技術的背景や暗号通貨の経験に関係なく、BTC収益を誰にでもアクセス可能にするよう設計されています。

利点:

- 利回りはBTCで支払われます(ポイントやプロキシトークンではありません)

- 手動のブリッジングや第三者の保管はありません

- デフォルトでセルフカストディアル

- 初心者向け

デメリット:

- ラップされたBTCへの変換に依存しています

- ブリッジングメカニズムとイールドプロトコルインフラストラクチャに対する信頼が必要です

ビットコインの進化する役割:オンチェーンにおける大局観

ビットコインの物語は長い間、「価値の保存」という中心を成してきました。これは信頼性のある役割を果たしてきました。しかし、オンチェーン経済が成長するにつれて、ビットコインがこの新興金融スタックにより完全に統合し、信頼性のある支払いインフラとしての約束を果たすためのプレッシャーが高まっています。

それを行うために、分散性やユーザー信頼を犠牲にすることなく、新しいインフラストラクチャは、これらの機会を技術的な専門知識を必要とせずにアクセス可能にする必要があります。また、ビットコインの原則を放棄することなく。

これは意味します:

- 収量は、派生資産ではなくBTCで支払われるべきです

- カストディはユーザーとともに残る必要があります

- 複雑さは抽象化されなければならず、ユーザーに移されてはいけない

Products like Braavos、ロンバード, バビロンこの記事で言及されている他のものは、これらのアイデアがどのように実装されるかの例です。ユーザーにステーキングを通じて収益へのアクセスを提供するか、Bitcoinサポートを直接自己保管オプションに埋め込み、その背後の複雑さを自動化することにより、彼らはBitcoinersにDeFiをよりアクセスしやすくし、Bitcoinエコシステムを完全に離れることなく提供しています。

ギャップを慎重に埋める

ビットコインのオンチェーン経済への移行は一晩で起こるわけではありません-そしてすべきでもありません。注意、シンプルさ、自己主権はビットコインの理念の基盤です。しかし、これらの価値を尊重しながら新しい機能を提供するツールが増えるにつれて、BTCの広範な暗号経済における役割が進化しています。

今、課題は、オープンでセキュアであり、何よりもアクセス可能なシステムを構築することです。次の10億人のユーザーがビットコインを介してオンボードする場合、彼らは自分たちがいる場所に合ったエクスペリエンスが必要であり、より幅広いユーザーにアクセス可能である必要があります。

免責事項:

この記事は[から転載されました銀行のない]. すべての著作権は元の著者に帰属します [@Web3zy]. If there are objections to this reprint, please contact the Gate Learnチームは迅速に対応します。

責任の免責事項:この記事で表現されている意見は、著者個人のものであり、投資アドバイスを構成するものではありません。

記事の翻訳は、Gate Learnチームによって他の言語に行われます。言及がない限り、翻訳された記事のコピー、配布、または盗用は禁止されています。

関連記事

トップ10のビットコインマイニング会社

ステーブルコインとは何ですか?

BTC保有者の分布

ブロックチェーンについて知っておくべきことすべて