GameFi 2.0: Bagaimana Permainan Blockchain Dapat Keluar dari "Perangkap Uang Cepat, Retensi Nol"?

Pengantar: Gelembung Emas dan Realitas Pahit GameFi

Sejak awal, GameFi (Game + Keuangan) telah membawa misi ganda untuk membentuk ulang industri game dan model ekonomi aset digital. Pada tahun 2021, dipacu oleh narasi DeFi yang terus berlanjut dan tren NFT yang meledak, GameFi muncul sebagai salah satu sektor paling menarik dan penuh imajinasi di ruang kripto. Dengan konsep inovatif 'Mainkan untuk Menghasilkan', proyek-proyek seperti Axie Infinity dan StepN menarik sejumlah besar pengguna. Pengguna aktif harian (DAU) mencapai jutaan, harga token melonjak puluhan kali lipat, dan GameFi sementara mengungguli protokol DeFi utama, menjadi sektor paling padat pengguna dalam ekosistem kripto.

Namun, di balik kemakmuran ini terdapat ketidakseimbangan struktural dalam model ekonomi dan logika perilaku pengguna. Banyak proyek GameFi pada dasarnya bukan game, melainkan produk keuangan berisiko tinggi yang menyamar sebagai game. Perilaku pengguna inti adalah arbitrase, bukan hiburan. Untuk menarik lalu lintas, tim proyek secara luas mengadopsi strategi insentif token inflasi tinggi, menciptakan pola pertumbuhan "kursi musik". Setelah harga token berputar di luar kendali, pemain keluar secara massal, dan ekosistem runtuh dalam semalam.

Beberapa proyek bintang melihat harga token mereka anjlok lebih dari 90%. DAU turun tajam, ekosistem retak, dan pemain melarikan diri, mengantarkan GameFi ke "musim dingin kripto." Kesulitan "menghasilkan uang cepat tetapi gagal mempertahankan pengguna" mengungkapkan kelemahan mendasar dari model GameFi 1.0: kurangnya pemutaran, insentif yang tidak seimbang, desain yang didorong spekulasi, dan model ekonomi yang rapuh. Ketika "Play-to-Earn" gagal membentuk lingkaran yang berkelanjutan, pemain akhirnya tidak menghasilkan uang atau bertahan untuk gameplay.

(Axie Infinity – Sumber: Google, 8 April 2025)

Hari ini, GameFi berada di persimpangan jalan baru. Panggilan untuk GameFi 2.0 semakin keras terdengar. Fokusnya telah bergeser dari airdrop dan inflasi pengguna buatan, menuju pencapaian simbiosis antara gameplay dan insentif ekonomi. Paradigma baru seperti 'Main dan Miliki,' 'Gratis untuk Dimainkan + Kepemilikan On-chain,' dan 'Partisipasi Pendapatan Aset On-chain' semakin populer, bertujuan untuk membangun ekosistem game blockchain yang benar-benar dapat mendukung jutaan pemain, menawarkan konten yang bermakna, dan memupuk komunitas yang berkembang. Semakin banyak pengembang game Web2 dan investor tradisional yang mencoba peruntungan di game Web3, berusaha untuk membangun kembali jalan menuju GameFi yang berkelanjutan melalui integrasi teknis dan mekanisme inovatif.

Artikel ini bertujuan untuk menganalisis secara sistematis evolusi historis, model ekonomi, tren data, dan pergeseran teknologi dalam sektor GameFi, dan untuk mengeksplorasi bagaimana GameFi 2.0 dapat mengatasi tantangan awal dan membuka masa depan game blockchain yang menarik, dapat dipertahankan, dan menguntungkan.

Kenaikan dan Keruntuhan GameFi 1.0: Sebuah Retrospektif Sejarah

Studi Kasus: Kenaikan dan Keruntuhan Axie Infinity

Axie Infinity adalah salah satu proyek paling awal dan representatif di ruang GameFi. Pada puncaknya di pertengahan 2021, permainan tersebut memiliki lebih dari 2,5 juta pengguna aktif bulanan dan bahkan melampaui Honor of Kings dalam pendapatan bulanan. Kapitalisasi pasar gabungan dari token in-game-nya, SLP dan AXS, melebihi $10 miliar. Di negara-negara seperti Filipina, itu memicu fenomena budaya di mana orang “mencari nafkah dengan memerangi monster.” Model intinya berkisar pada pemain yang membeli Axie NFT (hewan peliharaan digital) untuk bertarung dan berkembang biak, menghasilkan token SLP yang dapat diperdagangkan dalam proses tersebut, memenuhi janji “Bermain untuk Mendapatkan”. Namun, mulai dari Q1 2022, model Axie mulai terurai dengan cepat.

Model Ekonomi Inti:

- Pemain mendapatkan SLP dengan membesarkan Axies, terlibat dalam pertempuran PvP, dan menyelesaikan misi.

- Pemain baru harus membeli Axie NFT untuk masuk ke dalam permainan.

- SLP bisa digunakan untuk berkembang biak dan meningkatkan Axies atau dijual langsung untuk keuntungan.

Mengapa Gagal:

- Ketidaksesuaian Penawaran dan Permintaan Pasar: Model ekonomi sangat bergantung pada aliran konstan pemain baru, sehingga tidak berkelanjutan. Harga NFT yang tinggi membuat pemula mundur, menyebabkan pertumbuhan pengguna terhenti.

- Inflasi Parah: Produksi harian SLP jauh melebihi permintaan untuk membakarnya. Dengan tingkat inflasi harian mencapai 4%, nilai token secara cepat terdilusi.

- Motivasi Pemain Satu Dimensi: Sebagian besar pemain bergabung semata-mata untuk keuntungan, menunjukkan sedikit minat pada gameplay itu sendiri. Lebih dari 90% dari basis pengguna terdiri dari “petani emas” Asia Tenggara.

- Ekosistem Tertutup: Aset dalam game memiliki keterbatasan interoperabilitas dan tidak dapat beredar secara bebas di luar game. Komposabilitas on-chain rendah.

- Pembobolan Ronin Bridge: Pada Maret 2022, serangan hacker terhadap jembatan Ronin menyebabkan kerugian aset sebesar $600 juta, yang lebih lanjut mengikis kepercayaan pengguna.

Di awal tahun 2022, Axie mengumumkan transisi ke versi “Asal” baru,” dengan tujuan untuk mendesain ulang permainan dan sistem ekonominya. Namun, runtuhnya harga token telah memicu krisis kepercayaan besar. Hampir tidak mungkin untuk mendapatkan kembali pengguna awal, yang mengakibatkan penurunan pengguna dengan cepat dan keruntuhan siklus ekonomi yang cepat. Kasus ini menandai puncak—dan awal dari akhir—dari GameFi 1.0. Keruntuhan Axie tidak hanya menghancurkan mitosnya sendiri tetapi juga memicu guncangan kepercayaan besar di pasar GameFi, menjadi domino pertama dalam ledakan gelembung permainan blockchain.

Studi Kasus: Lonjakan dan Runtuhnya StepN

Sebagai proyek “Move-to-Earn” paling populer pada awal 2022, StepN menyaksikan token GMT-nya melonjak lebih dari 100 kali lipat dalam beberapa bulan, menarik pengguna dari seluruh dunia ke platformnya. Pengguna bisa mendapatkan token GST sebagai imbalan dengan membeli sepatu NFT dan cukup berjalan atau berlari, menciptakan momentum awal yang kuat. Antara Maret dan Mei 2022, pengguna aktif harian (DAU) StepN melonjak dari puluhan ribu menjadi lebih dari 800.000. Saat token pengelolaannya GMT mencapai puncaknya di $4, StepN muncul sebagai aplikasi blockchain revolusioner.

Stepn (Source: https://www.stepn.com)

Sorotan dari Desain Mekanisme Ekonomi:

- Model token ganda: GMT (token tata kelola) + GST (token hadiah). GMT diposisikan untuk tata kelola dan penangkapan nilai jangka panjang.

- Sistem terpadu tingkat NFT dan konsumsi energi, dengan loop dalam game dibangun seputar tingkat sepatu, energi, kelangkaan, dan faktor lainnya. Pengguna perlu membeli sepatu NFT dan berolahraga (lari/jalan) untuk mendapatkan hadiah GST.

- Kampanye insentif dan pertumbuhan komunitas global yang viral, yang digabungkan dengan mekanika GPS dan berbasis aktivitas untuk mencegah bot dan kecurangan.

Mengapa Gagal:

- Harga sepatu yang melambung meningkatkan hambatan masuk, mengembangnya nilai NFT menjadi gelembung spekulatif, di mana pelaku buruk mengusir pengguna yang asli. * Sistem secara struktural bergantung pada pengguna baru yang mensubsidi yang sebelumnya. Insentif berlebih membuat harga GST tidak dapat dipertahankan.

- Platform ini diserbu oleh “pemburu airdrop” dan alat skrip, dengan loyalitas pengguna yang rendah. Begitu harga GMT dan GST mulai turun, berjalan menjadi “tidak sepadan,” mendorong pengguna untuk keluar dengan cepat.

- Tekanan regulasi yang meningkat, termasuk pembatasan KYC dan GPS yang ditargetkan pada pengguna arbitrase lintas wilayah, memaksa banyak orang keluar dari sistem.

Pada akhirnya, basis pengguna aktif StepN turun drastis dari jutaan pada puncaknya menjadi kurang dari 50.000. Meskipun tim mencoba implementasi multi-rantai dan melakukan penyesuaian dalam permainan, mereka gagal mengatasi tantangan-tantangan mendasar dari GameFi 1.0. Trajectory StepN mencerminkan gambaran lebih luas dari lanskap GameFi 1.0: tim proyek bertindak lebih seperti manajer lalu lintas dan harga token daripada pembangun dunia game yang berkelanjutan.

Akhir Permainan dari Model Bermain untuk Mendapatkan

Pada intinya, "Mainkan-untuk-Mendapatkan" GameFi 1.0 adalah model pertumbuhan yang didorong oleh spekulasi. Kelemahan terbesar dari GameFi 1.0 bukanlah pada konsep itu sendiri, tetapi pada prioritas insentif keuangan lebih dari pengalaman bermain sebenarnya. Hal ini mengakibatkan beberapa kelemahan bawaan:

GameFi 1.0 Kerentanan

Mekanisme GameFi 1.0 dengan mudah berkembang menjadi gelembung "kursi musik", di mana begitu pertumbuhan pengguna melambat atau nilai token menurun, seluruh ekosistem runtuh dengan cepat, kadang-kadang bahkan memasuki "spiral kematian." Kegagalan GameFi 1.0 menawarkan pelajaran peringatan paling berharga untuk proyek masa depan dan menimbulkan pertanyaan penting untuk GameFi 2.0:

Bagaimana kita bisa membangun ekosistem gaming terdesentralisasi jangka panjang yang benar-benar menyenangkan untuk dimainkan, mampu mempertahankan pengguna, dan menawarkan peluang penghasilan yang stabil?

Wawasan Data GameFi Terbaru (2024-Q1 2025)

Gambaran Industri: Penurunan Pengguna, Volume Transaksi, dan Pendanaan Secara Keseluruhan

Sejak paruh kedua tahun 2024, jumlah keseluruhan dompet on-chain aktif di proyek GameFi terus mengalami penurunan. Berdasarkan data komprehensif dari Footprint, DappRadar, CoinGecko, dan platform lain, per Q1 2025:

- Alamat dompet GameFi aktif telah turun 74% dari puncaknya pada tahun 2022 sebanyak 1,6 juta pengguna aktif harian, kini stabil sekitar 350.000-450.000 per hari.

- Total volume transaksi dalam game blockchain telah turun sekitar 58% dibandingkan dengan periode yang sama pada tahun 2023. Namun, porsi volume yang dipegang oleh proyek-proyek kelas atas telah meningkat menjadi 70%, dengan aktivitas harian sangat terpusat pada beberapa pemimpin seperti Pixels, Mavia, dan Big Time.

- Peluncuran proyek baru turun 80% dari tahun ke tahun, dan sebagian besar proyek baru memiliki umur kurang dari 90 hari. Lebih dari 80% proyek GameFi memiliki kurang dari 500 pengguna aktif harian, menunjukkan distribusi ekosistem yang sangat tidak merata.

- Total pendanaan GameFi turun dari $3.2 miliar pada tahun 2022 menjadi $650 juta pada tahun 2024, meskipun modal tetap terkonsentrasi dalam proyek-proyek berkualitas tinggi.

Total Pendanaan GameFi

Dalam hal retensi pengguna:

- Lebih dari 70% pengguna GameFi berhenti dalam waktu 7 hari setelah interaksi pertama mereka;

- Rata-rata tingkat retensi 30 hari berada di bawah 8%, jauh lebih rendah dibandingkan dengan game Web2 tradisional (biasanya 25%–40%);

- Perilaku pengguna didominasi oleh pola “berinteraksi dan keluar”, dengan keterlibatan jangka panjang yang sangat sedikit.

Perubahan Struktural dalam Ekosistem GameFi 1: Peningkatan Konsentrasi Arus Modal dan Pendanaan

Meskipun basis pengguna GameFi secara keseluruhan telah berkontraksi, "Efek Matthew" menjadi semakin jelas. Proyek-proyek terkemuka seperti Pixels, Big Time, dan Mavia menarik sebagian besar pengguna setia dan dukungan modal.

Gambaran Pendanaan Proyek Unggulan

Tren Utama yang Diamati:

- Modal semakin mengalir ke proyek-proyek dengan konten berkualitas tinggi dan tim yang berpengalaman.

- Platform-platform yang berfokus pada infrastruktur seperti ImmutableX dan Ronin telah mengamankan putaran pendanaan baru.

- Proyek Play-to-Earn (P2E) konvensional semakin sulit untuk mengumpulkan dana, karena investor sekarang lebih menekankan retensi jangka panjang dan keterlibatan pengguna yang nyata.

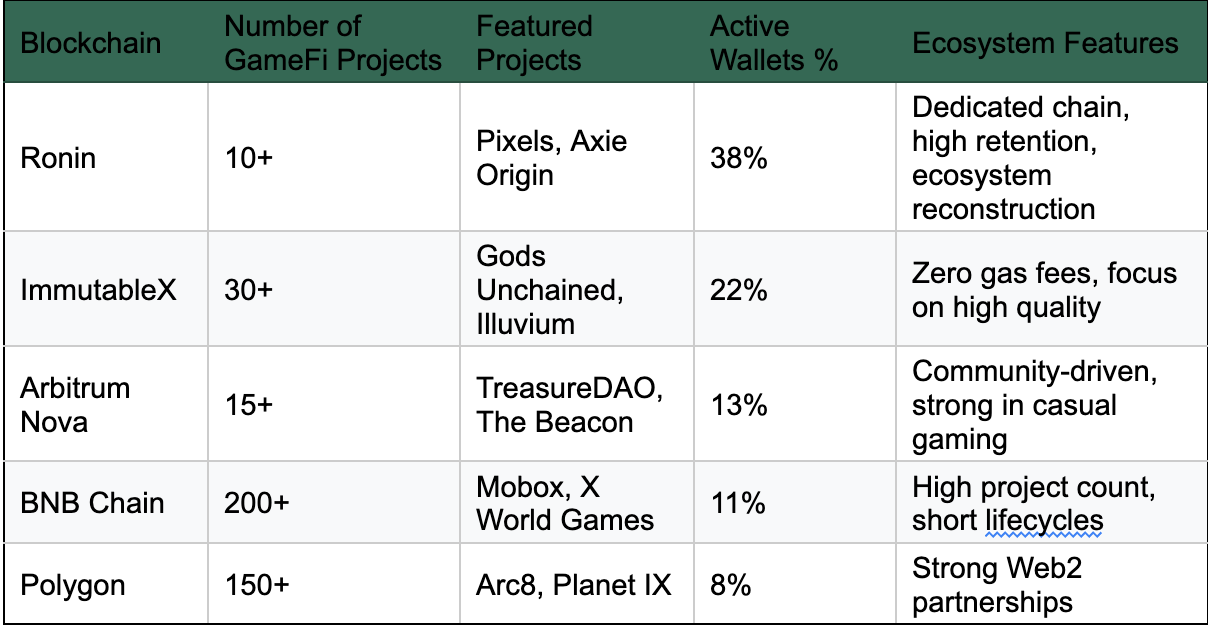

Perubahan Struktural dalam Ekosistem GameFi 2: Lanskap Komparatif Rantai GameFi Utama—Rantai Spesialis Mengungguli

Top 5 Ekosistem GameFi (Q1 2025):

Top 5 Ekosistem GameFi

Setelah kejatuhan Axie, Ronin telah kembali dengan membangun kembali ekosistemnya dan menambahkan proyek unggulan baru seperti Pixels. ImmutableX memimpin dalam aktivitas transaksi berkat pengalaman perdagangan NFT bebas gasnya. Sementara Polygon dan BNB Chain masih menjadi tuan rumah terbesar proyek GameFi, kualitas konten tetap sangat tidak merata. Selain itu, model AppChain muncul sebagai tren baru dalam infrastruktur GameFi. Solusi seperti zkSync + L3, Ronin, dan Xai Network menawarkan lingkungan berbiaya rendah, TPS tinggi yang disesuaikan untuk penempatan yang didedikasikan. Penyiapan ini membantu game blockchain menghindari persaingan sumber daya dengan protokol DeFi, DEX, dan dApps lalu lintas tinggi lainnya.

Profil Pengguna yang Berkembang: Dari “Petani Emas” menjadi Co-Creators Konten

Di masa lalu, pengguna game blockchain terutama terkonsentrasi di wilayah ekonomi yang belum berkembang seperti Asia Tenggara dan Amerika Latin, dengan motivasi utama mereka adalah “mencari uang melalui bermain game.” Namun, hari ini, demografis pemain telah mengalami transformasi yang signifikan:

- Generasi baru pengguna menempatkan nilai yang lebih besar pada kualitas visual, desain seni, fitur sosial, dan kepemilikan aset.

- Organisasi pemain berbasis DAO, guild, dan pencipta konten semakin aktif dalam ekosistem GameFi.

- Pemain lebih bersedia untuk berpartisipasi dalam tata kelola, konten yang dihasilkan pengguna (UGC), dan pencarian yang didorong oleh komunitas.

- Konsep seperti identitas terdesentralisasi (DID) dan sistem loyalitas berbasis data on-chain sedang mulai muncul secara bertahap.

Terobosan Strategis untuk GameFi 2.0: Dari Keuntungan Spekulatif hingga Ekosistem yang Berkelanjutan

Kegagalan GameFi 1.0 tidak menandakan akhir dari model “Mainkan dan Dapatkan”. Sebaliknya, itu menaikkan standar untuk bentuk dan mekanisme yang mendasarinya. GameFi 2.0 tidak sepenuhnya meninggalkan elemen keuangan—sebaliknya, itu menekankan filosofi “Mainkan Terlebih Dahulu, Dapatkan Kemudian”. Yaitu: Gameplay harus mendorong keterlibatan pengguna, sementara model ekonomi yang dirancang dengan baik memastikan retensi jangka panjang.

Perubahan Desain Inti: Dari Arbitrase Token ke Imersi On-Chain

GameFi 2.0 bertujuan untuk membebaskan diri dari model-model awal yang ditandai dengan penarikan tunai instan, pengguna yang oportunis, dan pertumbuhan yang didorong oleh gelembung, dan malah mengadopsi strategi kunci berikut:

Kerangka Perbandingan: GameFi 1.0 vs 2.0

Inovasi Model yang Berkembang

1. Mainkan-dan-Miliki(P&O)

Diperkenalkan pertama kali oleh proyek-proyek seperti Illuvium, Big Time, dan Pixels, model ini menekankan 'bermain sambil memiliki.' Konsep intinya meliputi:

- Pemain mengumpulkan sumber daya langka, aset NFT, gelar, tanah, dan aset on-chain lainnya melalui gameplay.

- Aset-aset ini memiliki utilitas praktis dalam permainan, seperti meningkatkan kekuatan tempur, membuka instansi baru, atau memengaruhi kemajuan cerita.

- Beberapa aset diintegrasikan ke dalam sistem pengaturan on-chain atau pemungutan suara DAO, menciptakan jalur dari partisipasi pemain hingga evolusi permainan.

2. Mod-to-Earn / Buat-untuk-Hasilkan

Model ini membawa konsep tradisional mod permainan (konten yang dibuat pengguna) ke dalam blockchain, memungkinkan pencipta menerima insentif berbasis aset langsung:

- Pemain dapat menyesuaikan elemen gameplay seperti peta, skin, aturan, dan lainnya (seperti yang terlihat di The Sandbox).

- Konten yang dibuat dapat dicetak sebagai NFT, dengan para pencipta mendapatkan royalti dari perdagangan pasar sekunder.

- Melalui ZKP (Bukti Tanpa Pengetahuan) dan DID (Identitas Terdesentralisasi), sistem melindungi atribusi pembuat dan mekanisme distribusi pendapatan.

Arah ini terutama dipengaruhi oleh kebangkitan ekosistem pencipta yang didukung AI, termasuk AI NPC dan alur cerita yang dihasilkan secara prosedural, menjadikannya area konvergensi utama antara GameFi dan AIGC.

3. Integrasi SocialFi + GameFi

Proyek-proyek seperti The Beacon dan Heroes of Mavia menempatkan fokus yang kuat pada interaksi sosial sebagai mekanik inti permainan. Fitur utamanya meliputi:

- Pemain membangun hubungan sosial melalui pembentukan aliansi, membuat guild, dan berpartisipasi dalam dungeon runs.

- Sistem pengaturan DAO mendorong partisipasi melalui struktur berbasis tugas dan penghargaan poin kehormatan.

- Data sosial pemain diubah menjadi prestasi on-chain, memfasilitasi airdrop, pengembangan skor kredit, dan aplikasi lainnya.

Lima Elemen Kunci untuk Membangun Ekonomi Game yang Berkelanjutan

Untuk keluar dari “spiral kematian,” GameFi 2.0 harus mencapai sistem lingkaran tertutup di lima dimensi berikut:

- Inflasi Terkendali dan Keseimbangan Penawaran-Permintaan: Model ekonomi harus menerapkan mekanisme yang berkelanjutan untuk produksi dan pembakaran token, dengan insentif yang terkait langsung dengan perilaku pengguna.

- Utilitas Nyata NFT: Bergerak lebih dari sekadar "aset JPEG" dengan mengintegrasikan NFT secara mendalam ke dalam mekanisme permainan, seperti kunci ruang bawah tanah, alat perkembangan karakter, atau hak pendapatan berbasis lahan.

- Strategi Segmentasi Pengguna: Memenuhi berbagai jenis pemain—gamer hardcore, anggota gilda, dan pemain kasual—dengan menawarkan jalur partisipasi multi-tiered.

- Mekanisme Governance DAO: Mendorong keterlibatan komunitas dalam membentuk pembangunan dunia dan penciptaan konten, mengubah gagasan 'pemain sebagai desainer' menjadi kenyataan praktis.

- Transparansi Data dan Interaksi On-Chain: Memperkuat logika di balik aset on-chain untuk menghilangkan isu kepercayaan yang disebabkan oleh kontrol terpusat, memastikan transparansi dan verifikasi di seluruh ekosistem.

Kerangka Brainstorming GameFi 2.0 (Sumber: GameFi 2.0 | Tokenomics dan Model Bisnis Berkelanjutan - JamesBachini.com)

Evolusi Paradigma Teknis: Inovasi Infrastruktur dalam Permainan Blockchain

Terobosan GameFi 2.0 tidak hanya terletak pada pembaruan model ekonominya tetapi juga pada peningkatan sistematis fondasi teknologinya. Infrastruktur baru sedang mengubah cara operasi, skala, dan pengalaman pengguna yang disampaikan oleh game blockchain.

Layer 2 dan AppChains: Kinerja Tinggi, Penyokong Komputasi Terdesentralisasi

Permainan blockchain tradisional yang dibangun di Ethereum mainnet telah lama mengalami batasan seperti biaya gas tinggi dan konfirmasi transaksi yang lambat. Sejak 2023, infrastruktur berikut telah menjadi pilihan utama untuk implementasi GameFi:

Contoh nyata: Setelah Pixels bermigrasi ke Ronin AppChain, biaya gasnya turun 90%, pengguna aktif harian (DAU) melonjak melebihi 800.000, dan retensi pengguna meningkat dua kali lipat.

Tepi Integrasi AI dalam Permainan Blockchain

AI sedang muncul sebagai variabel baru dalam ekosistem GameFi, dengan perkembangan kunci di area berikut:

- NPC AI yang Didorong oleh Kecerdasan Buatan (Non-Player Characters): Model Bahasa Besar (LLM) memungkinkan dialog karakter dinamis dan alur cerita bercabang, menciptakan pengalaman naratif yang sangat fleksibel.

- Konten yang Dihasilkan oleh Kecerdasan Buatan (AIGC): Pemain dapat menghasilkan peta, peralatan, atau NPC dengan mengunggah petunjuk teks, seperti yang terlihat dalam proyek seperti Endless Clouds.

- AI untuk Pengendalian Risiko dan Anti-Cheat: Model AI menganalisis perilaku on-chain untuk mendeteksi bot dan skrip curang.

- Alat Operasional yang Didukung AI: Membantu tim proyek dalam distribusi aset, analitika pasar, dan ramalan perilaku pemain.

Sistem Identifikasi Tersebar dan Reputasi On-Chain

GameFi 2.0 menempatkan lebih banyak penekanan pada kontinuitas identitas on-chain pengguna, daripada memperlakukan pengguna sebagai peserta arbitrase sekali pakai. Teknologi Identitas Terdesentralisasi (DID) telah menjadi komponen inti dari infrastruktur ini:

- Pemain membangun skor reputasi melalui perilaku on-chain, seperti tingkat penyelesaian level, partisipasi dalam pemungutan suara tata kelola, dan pembuatan konten.

- Metrik ini diubah menjadi kredensial on-chain (mis., Token Soulbound atau SBT) yang digunakan untuk menentukan bobot tata kelola, kelayakan airdrop, dan pencocokan tugas.

- Bukti Pengetahuan Nol (ZK) diperkenalkan untuk meningkatkan perlindungan privasi pengguna.

Proyek-proyek seperti Galxe dan platform RaaS modularizing komponen sistem reputasi untuk integrasi mudah ke dalam game blockchain.

Komposabilitas dan Evolusi Modul Keuangan dalam GameFi

Proyek GameFi generasi mendatang tidak lagi menolak atribut keuangan. Sebaliknya, mereka mengadopsi pendekatan modular untuk mengatur sistem ekonomi mereka dengan cermat:

- Pinjaman didukung NFT: Pemain dapat melakukan staking aset game tingkat tinggi sebagai jaminan untuk meminjam USDC untuk permainan lebih lanjut.

- Dalam-Game AMM (Automated Market Makers): Memungkinkan penetapan harga dinamis untuk peralatan, keterampilan, dan sumber daya lainnya, menciptakan pasar internal yang mandiri.

- Sistem Sewa: Memungkinkan pemain baru untuk menyewa karakter NFT dan berpartisipasi secara terus-menerus tanpa biaya masuk yang tinggi.

Kemajuan logika yang dapat disusun mendorong GameFi menuju arsitektur DeFi-Lite, memungkinkan rentang aset game yang dapat diinteroperabilitas dan terfinansialisasi yang lebih luas.

Analisis Proyek Perwakilan: Studi Kasus GameFi 2.0

GameFi 2.0 tidak lagi menjadi konsep spekulatif - telah divalidasi oleh pengguna nyata dan data on-chain di beberapa proyek aktif. Bab ini menganalisis sejumlah judul GameFi 2.0 yang menonjol, memeriksa model ekonomi mereka, mekanisme retensi, dan infrastruktur teknologinya.

Pixels (Ekosistem Ronin): Sebuah Keajaiban Retensi dari SocialFi + Farming

Sorotan Kinerja:

- Melebihi 1 juta pengguna aktif harian mulai di Q4 2024

- Setelah bermigrasi ke Ronin, biaya transaksi turun 90%, dan retensi pengguna meningkat dua kali lipat

- Mengumpulkan $40 juta pada Februari 2025, dengan dukungan dari Animoca, Sky Mavis, dan orang lain

Pemecahan Mekanik:

- Gameplay: Pertanian gaya pixel dan simulasi kehidupan dengan interaksi sosial terintegrasi; MMO ringan yang menekankan kerjasama

- Model Ekonomi: Sistem dual-token ($PIXEL + $BERRY), di mana $PIXEL digunakan untuk kontrol deflasi, dan $BERRY digunakan untuk mendorong perilaku pemain

- Mekanisme Retensi: Pemain menghasilkan data perilaku yang kontinu melalui peningkatan pertanian, quest NPC, dan berbagi sosial

- Aset On-Chain: Tanah, karakter, dan perlengkapan semuanya NFT dan dapat diperdagangkan di pasar peer-to-peer

- Operasi Komunitas: Open DAO governance, dengan hak pengelolaan tanah dipegang oleh guild pemain

Poin Penting:

Inti kesuksesan Pixels terletak pada hambatan masuk rendah, keterlibatan sosial yang kuat, dan model ekonomi berlapis-lapis. Dengan menyematkan elemen on-chain ke dalam kerangka gaya Web2 yang mengingatkan pada Club Penguin, berhasil menembus hambatan antara pengguna spekulatif dan pemain berretensi tinggi.

Illuvium (Immutable zkEVM): Standar Baru dalam Game Blockchain Berkualitas AAA

Sorotan Kinerja:

- Mencapai lebih dari $100 juta TVL selama fase beta-nya

- Dibangun di atas Immutable zkEVM, secara signifikan meningkatkan efisiensi rendering dan penyelesaian on-chain

- Dikenal luas sebagai perpaduan antara Pokémon dan World of Warcraft dalam game blockchain

Analisis Mekanik:

- Permainan: Permainan pertempuran dan strategi berkualitas AAA di mana pemain menjelajahi dunia terbuka untuk menangkap dan melatih makhluk yang disebut Illuvials

- Model Ekonomi: Fitur staking, penjualan tanah, dan pertanian hasil; inflasi dikelola melalui $ILV dan $sILV

- Sistem Aset: Semua makhluk, skin, dan petak tanah adalah NFT dan mendukung kompatibilitas lintas rantai

- Jalur Kemajuan Pengguna: Dari Free-to-Play → Earn-to-Upgrade → Peserta Pengaturan DAO

- Ekonomi Kreator: Mendukung pengembang eksternal dalam membangun dungeon kustom dan mode permainan menggunakan SDK-nya

Poin Penting:

Illuvium adalah representasi pertama dari kualitas produksi kelas konsol yang sejati dalam GameFi 2.0. Desain ekosistemnya secara dekat menyerupai model Web2 'Games as a Service (GaaS)', tetapi memperkenalkan kepemilikan aset on-chain untuk melengkapi lingkaran penangkapan nilai - membentuk paradigma baru di mana konten berkualitas tinggi mendorong ekonomi dalam game.

Treasure DAO (Arbitrum): Sebuah Dunia GameFi Dimana Konten Adalah Aset

Gambaran Ekosistem:

- Menciptakan alam semesta multi-game yang saling terhubung, termasuk Bridgeworld, Smolverse, dan lainnya

- Menggunakan $MAGIC sebagai token asli yang menghubungkan semua game dalam ekosistem

- Dikendalikan oleh komunitas dengan kuat, dengan pengaturan DAO yang erat terkait dengan aliran aset

Rincian Mekanik:

- Gameplay: Difokuskan pada penciptaan konten dan pengalaman berbasis naratif, dengan progresi nonlinear dan pembangunan dunia yang dipimpin oleh pemain

- Model Ekonomi: $MAGIC digunakan untuk pencetakan aset, transaksi dalam game, dan interaksi lintas proyek

- Konektor Aset: Memanfaatkan komposabilitas untuk memungkinkan interoperabilitas aset di seluruh game—seperti sistem peralatan bersama

- Model DAO: Pemain dapat memperoleh imbalan token melalui pemilihan komunitas, menulis cerita lore, dan bersama menciptakan konten dunia

Poin Penting:

Treasure DAO mengubah kreasi konten on-chain menjadi kegiatan yang mendapatkan insentif, menjadikannya contoh utama dari pergerakan GameFi 2.0 menuju ekosistem yang didorong oleh UGC. Ini telah berhasil membangun platform ekosistem game yang sesungguhnya, bukan hanya judul mandiri.

Outlook masa depan dan Tantangan yang Diharapkan untuk GameFi 2.0

Meskipun GameFi 2.0 telah membuat kemajuan besar dibanding pendahulunya, namun masih menghadapi beberapa tantangan struktural dan bottleneck evolusioner. Bab ini menguraikan tren industri utama dan memperkirakan hambatan potensial, beserta solusi yang disarankan.

Tren 1: Transisi dari “GameFi” ke “Permainan On-Chain

GameFi 1.0 sangat fokus pada narasi keuangan—token dan return—sedangkan GameFi 2.0 menekankan permainan on-chain, keterbukaan, dan co-creation yang didorong oleh pemain.

Cerita telah berkembang dari “Bermain untuk Mencari” → “Bermain dan Memiliki” → “Membangun untuk Mencari” → “Mencipta untuk Memiliki.”

Di masa depan, game blockchain akan semakin menyerupai dunia virtual on-chain atau negara digital, di mana aset, hubungan sosial, dan aturan permainan tercatat secara permanen on-chain.

Trend 2: Permainan Blockchain Akan Menjadi Aplikasi Pembunuh untuk L2s dan Rollups

Dengan kemajuan teknologi zk, lapisan ketersediaan data (DA), dan rantai permainan yang didedikasikan, GameFi mengatasi batasan tradisional dalam TPS dan biaya gas. Permainan Blockchain menjadi salah satu medan pertempuran utama untuk ekosistem Layer 2:

- zkSync memungkinkan game on-chain untuk mencapai pembaruan status dalam waktu kurang dari satu detik.

- Ronin dan Xai adalah contoh utama dari model "rantai khusus game".

- Layer3 sedang menciptakan paradigma baru yang menggabungkan "gaming + finance + identitas."

Solusi L2 yang dapat disesuaikan sedang membuka skala yang belum pernah terjadi sebelumnya dan pengalaman latensi rendah untuk game blockchain.

Tren 3: Integrasi yang Semakin Mendalam Antara Game Blockchain, Kecerdasan Buatan, dan UGC

Peningkatan konten yang dihasilkan oleh kecerdasan buatan (AIGC) dan konten yang dihasilkan oleh pengguna (UGC) sedang menggeser produksi konten dari studio game terpusat:

- AI dapat secara dinamis menghasilkan kerajaan bawah tanah dan perilaku NPC, meningkatkan imersi.

- Pemain dapat membuat aset dan narasi sendiri, lalu mempublikasikannya on-chain sebagai NFT.

- Pencipta konten diberi imbalan dengan token, membentuk roda ekonomi pencipta.

GameFi sedang berkembang menjadi dunia AI-native yang didukung oleh ekonomi yang didorong oleh UGC.

Tantangan Inti 1: Masalah Cold Start dalam Akuisisi Pengguna

Permainan blockchain masih kesulitan mengonversi pemain Web2 menjadi pengguna Web3. Jumlah pengguna aktif harian (DAU) sering tiba-tiba turun karena kurangnya konten atau imbalan. Solusi saat ini termasuk:

- Mengintegrasikan sistem login Web2 dan menjembatani pengalaman on-chain/off-chain

- Membangun gameplay tahap awal seputar model “no-token + aset off-chain”

- Bekerjasama dengan guild game besar (misalnya, YGG, Merit Circle) untuk menanamkan basis pengguna awal

Tantangan Inti 2: Model Token dan Tekanan Likuiditas Aset

Sebagian besar proyek masih menghadapi kesulitan berikut:

- Menjaga keseimbangan dinamis antara insentif dan deflasi.

- Likuiditas NFT rendah dan diskon di luar pasar yang signifikan.

- Gelembung pasar sekunder yang menyebabkan fluktuasi pelanggan yang tinggi terkait dengan ayunan harga.

Solusi yang direkomendasikan:

- Menerapkan model dual-token adaptif.

- Membangun standar aset lintas proyek, seperti EIP-6551 dan ERC-4337.

- Memperkenalkan mekanisme sewa terintegrasi, staking, dan kredit untuk meningkatkan utilitas NFT.

Tantangan Inti 3: Risiko Regulasi yang Meningkat dan Kepatuhan Aset

Seiring dengan pertumbuhan GameFi dalam ukuran pasar dan perilaku keuangan terkait token, pengawasan regulasi semakin intensif:

- Apakah token dianggap sebagai sekuritas?

- Apakah GameFi mirip dengan perjudian atau memerlukan kepatuhan KYC?

- Apakah aset dalam game dikenakan pajak bagi pengguna?

Tim proyek harus melibatkan penasihat kepatuhan secara dini dan mengadopsi mekanisme penerbitan token progresif—seperti Season Pass—sebagai pengganti penjualan awal yang didorong oleh FOMO.

Ringkasan dan Saran Industri: Sebuah Rencana Jalan bagi Pembangun GameFi

Melalui analisis komprehensif dimensi inti GameFi 2.0 dan studi kasus representatif, kita dapat mengekstrak serangkaian rekomendasi praktis yang berorientasi pada tindakan untuk tim proyek, investor, pengembang, dan pencipta konten. Wawasan ini bertujuan untuk membantu pemangku kepentingan menavigasi siklus baru dengan lebih jelas dan lebih sedikit kesalahan.

Rekomendasi untuk Tim Proyek

Rekomendasi untuk Investor dan Institusi

- Hindari investasi yang didorong oleh FOMO dalam aset-aset yang bersifat spekulatif semata; sebaliknya, fokuslah pada model data yang didukung oleh keterlibatan pemain yang berkelanjutan.

- Prioritaskan proyek-proyek yang menunjukkan metrik retensi pengguna yang kuat (misalnya, tingkat retensi 7D/30D di atas 15%) dan memiliki kapasitas untuk pembaruan konten yang konsisten.

- Menilai apakah proyek dibangun di infrastruktur yang tepat, seperti Layer 2s atau AppChains.

- Fokus pada perilaku pengguna on-chain daripada indikator permukaan seperti interaksi Twitter atau aktivitas airdrop; analisis ketahanan aset yang dipegang pemain on-chain.

Rekomendasi untuk Kreator Konten dan Guild

- Transisi dari model "pertanian akun" tradisional ke inkubasi konten dan perdagangan aset dalam game blockchain.

- Gunakan konten video streaming dan panjang untuk menjelaskan monetisasi dalam game blockchain dan membangun alur yang mengubah pemirsa menjadi pemain.

- Memanfaatkan alat kecerdasan buatan untuk meningkatkan pembuatan MOD/UGC, dan mengemas konten ini sebagai NFT untuk diperdagangkan atau dilisensikan.

- Mendirikan sistem pendidikan untuk pemain Web3, membantu pengguna memahami manajemen aset, risiko kontrak pintar, dan lainnya, sehingga meningkatkan nilai komunitas jangka panjang.

Lampiran

Lampiran 1: Kerangka Perbandingan – GameFi 1.0 vs GameFi 2.0

Lampiran 2: Model Siklus Proyek GameFi

Lampiran 3: Glosarium Istilah Umum (Disingkat)

Kesimpulan: Dekade Berikutnya dari Gim Blockchain Dimulai dengan Pengguna

GameFi 1.0 membuktikan, melalui gelembung spekulatif, bahwa aset ter-tokenisasi dapat memberdayakan permainan, tetapi juga berfungsi sebagai sebuah peringatan: blockchain bukanlah tongkat ajaib, dan sebuah permainan tetap harus menjadi sebuah permainan. Munculnya GameFi 2.0 menandai koreksi arah bagi industri ini, menggeser fokus dari hiruk-pikuk keuangan kembali ke pengalaman pengguna.

Sebuah permainan blockchain yang benar-benar hidup bukan hanya tempat di mana orang dapat menghasilkan—ini adalah:

- Sebuah gaya hidup digital baru (Miliki-untuk-Bermain);

- Sebuah dunia virtual di mana pemain memiliki nilai yang mereka ciptakan;

- Sebuah medium budaya yang menyatukan kode, kreativitas, dan komunitas.

Pertanyaan inti dari GameFi 2.0 bukan lagi “Bagaimana cara kita membantu pengguna menghasilkan uang?” melainkan “Bagaimana cara kita membuat pengguna ingin tinggal dan berkolaborasi?”

Di dekade mendatang, game blockchain tidak akan menggantikan game tradisional, tetapi mereka akan menjadi cara kunci untuk adopsi massal teknologi blockchain. Siapa pun yang berhasil membangun ekosistem game blockchain yang benar-benar mempertahankan pengguna akan memiliki kesempatan untuk menjadi Roblox, Steam, atau Nintendo berikutnya.

Artikel Terkait

Apa yang Dimaksud dengan Analisis Fundamental?

Apa itu Altcoin?

Apa itu Axie Infinity?

Apa itu Dompet HOT di Telegram?