Paparan terhadap PROMPT: Perhitungan yang Diperbarui

Refleksi tentang Perhitungan Hasil $PROMPT

Selama setahun saya telah membagikan angka estimasi hasil untuk staking $PRIMEdan menerima$PROMPTyang sering disebutkan dalam komunitas. Menilai hal ini setelah TGE, saya senang bahwa perkiraan itu cukup akurat:

Model ini memperkirakan jumlah total 'PROMPT points' = PRIME TerkunciDurasiPengganda. Pencari menerima sejumlah proporsional dari total poin berdasarkan jumlah taruhan mereka.

Membandingkan model dengan 3 dompet berbeda termasuk milik saya sendiri, model tersebut memperkirakan PROMPT yang diterima lebih tinggi sekitar 20%. Saya mengaitkan hal ini dengan 2 alasan:

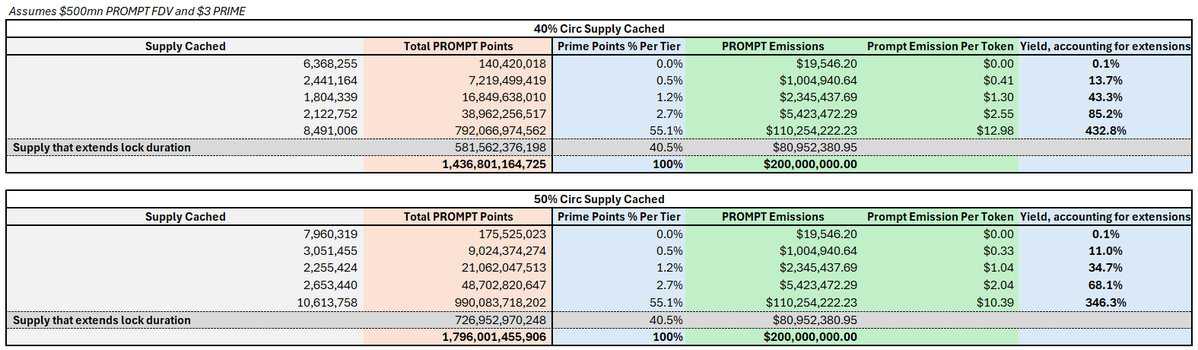

- Saya mengira 40% dari PRIME yang beredar akan di-cache, sedangkan kita mencapai 45%, artinya total jumlah poin lebih tinggi dan akibatnya lebih banyak dilusi.

- Jumlah total point PROMPT masih tidak pasti, mengingat beberapa cachers mungkin akan menghapus cache mereka atau memperpanjangnya, yang akan mengurangi/meningkatkan jumlah total point secara berturut-turut.

Di luar itu, perkiraan hasil sangat bergantung pada keduanya$PRIMEdan $PROMPTharga - sebagai $PRIMEsaat harga turun, Anda didorong untuk membeli lebih banyak token dan menyimpannya karena imbal hasilnya lebih tinggi. Tentu saja, pada akhirnya imbal hasil bergantung pada penilaian terminal dari $PROMPT.

Dengan informasi lebih banyak yang tersedia setelah TGE, saya percaya tabel berikut mungkin merupakan representasi hasil yang paling akurat untuk caching$PRIMESaya telah memperbarui ini untuk memperhitungkan lebih banyak PRIME dipertaruhkan (melalui lebih banyak poin PROMPT yang dihasilkan), dan tetap pada $500 juta FDV. Selain itu, saya telah menambahkan kolom baru untuk tidak termasuk proporsi 28% ke komunitas yang di-drop di TGE:

TLDR: Memaksimalkan penyimpanan PRIME sekarang akan menghasilkan 106% selama 797 hari ke depan dalam PROMPT yang diterima.

Melihat hal di atas, jelas bahwa peluang pertanian hasil telah berkurang secara signifikan sejak Juni 2024. Hal ini terlihat saat penggandaan menurun, dan jumlah poin PROMPT meningkat seiring waktu – semakin lama Anda memasuki permainan, semakin sedikit proporsi poin yang tersedia untuk Anda hasilkan. Hal ini bahkan lebih benar setelah TGE karena 28% dari total pasokan telah dikeluarkan, dan kita akan melihat pasokan baru tersedia untuk diklaim secara mingguan.

Mengambil PRIME vs. Membeli PROMPT: Analisis Skenario

Analisis di bawah ini membandingkan dua opsi yang dimiliki partisipan pasar opsi sekarang - apakah harus membeli PROMPT di pasar terbuka, atau membeli PRIME dan cache, menerima PROMPT sepanjang jalan. Untuk tujuan ini, kami akan mengasumsikan bahwa PRIME akan di-cache maksimal pada multiplier 49,8x selama 797 hari yang dikutip di atas.

Membeli $1k PRIME hari ini akan memberi Anda sekitar 333 PRIME. Berdasarkan tabel di atas, melakukan staking maksimum ini akan menghasilkan 333*39.690 poin, yaitu 13,2 juta poin.

Mengingat 400mn token PROMPT akan didistribusikan ke semua penangkap berdasarkan total 1.8tn poin yang dihasilkan, 13.2mn token seharusnya menghasilkan sekitar 2.944 token PROMPT. Mengingat 28% dari PROMPT telah didistribusikan sejauh ini, kita akan mengurangi ini secara proporsional, yaitu poin seharusnya menghasilkan sekitar 2.119 PROMPT. Perlu diingat, saya menerima bahwa perhitungan ini tidak tepat - karena distribusi PROMPT didasarkan pada berapa banyak poin yang diperoleh pada suatu hari tertentu. Namun di atas adalah cara yang sederhana dan intuitif untuk memikirkan hasil dan secara kasar benar.

Tabel di bawah ini mengaplikasikan angka ini ke skenario valuasi untuk PRIME dan PROMPT pada akhir periode penjatahan:

Di sisi lain, matematika bagi seseorang yang hanya membeli PROMPT lebih sederhana. Pada akhirnya, dengan asumsi harga PROMPT $0,5, Anda akan memiliki 2.000 token PROMPT dengan investasi $1k, yang lebih sedikit dari apa yang akan Anda dapatkan dengan membeli PRIME dan max caching.

Tentu saja, manfaat dari hanya membeli PROMPT di pasar terbuka saat ini adalah Anda memiliki fleksibilitas untuk mengambil keuntungan dari PROMPT setiap kali puncak lokal muncul.

Anggaplah bahwa Penilaian PROMPT di akhir kampanye pengeksposan adalah $1miliar dan harga PRIME tetap stabil, nilai token di akhir periode pengeksposan akan sama dengan $3.118 seperti di atas.

Namun, pertimbangkan volatilitas crypto - kemungkinan PROMPT mencapai rekor tertinggi dalam 2 tahun mendatang, katakanlah pada FDV $4 miliar (serupa dengan FDV yang dicapai oleh VIRTUAL selama mania agen AI puncak), sebelum kembali ke FDV yang lebih wajar yaitu $1 miliar.

Membeli $1k PROM di pasar terbuka hari ini dan menjualnya di puncak lokal ini akan menghasilkan $8.000, lebih dari 2x nilai untuk menyimpan PRIME.

Kesimpulan

Mereka yang ingin mendapatkan eksposur terhadap PROMPT, baik melalui penyetoran maksimal PRIME atau hanya melalui pembelian di pasar terbuka, sebaiknya mempertimbangkan faktor-faktor berikut:

- Apa menurutmu nilai terminal dari PRIME dan PROMPT pada akhir periode kaching 2 tahun?

- Menurutmu, berapa harga tertinggi sepanjang masa dari PROMPT akan mencapai selama 2 tahun ke depan, dan yang penting, apakah kamu akan bisa menjualnya di puncak tersebut?

Pada akhirnya, hal ini sangat bergantung pada individu. Ini adalah fakta bahwa kebanyakan investor tidak mampu menjual puncak pasar. Pada saat yang sama, seperti yang dialami oleh banyak PRIME cachers, mengunci token Anda selama lebih dari 2 tahun dan melihatnya turun 90% adalah perasaan yang memilukan. Tentu saja, saya kesulitan membayangkan bahwa PRIME jatuh lebih dari 50% dari posisi saat ini, mengingat bahwa itu adalah pemimpin dalam ruang permainan web3 dan memiliki beberapa katalisator ke depan - termasuk rilis permainan Colony dan Sanctuary yang diharapkan terjadi tahun ini.

Selain itu, tim sudah memikirkan tentang menciptakan tuas tokenomik baru untuk menciptakan$PRIMEdeflasi dan kenaikan nilai, memberi saya keyakinan bahwa potensi penurunan untuk token gaming ini terbatas dari sini:

Saya akan mengakhiri dengan menyatakan bahwa tidak ada yang disebutkan di atas adalah nasihat keuangan, dan saya tidak bertanggung jawab jika perhitungan di atas ada yang salah. Saya bertujuan untuk seransparent mungkin dalam perhitungan saya, selalu menyatakan asumsi saya, tetapi saya mohon Anda melakukan riset sendiri dan menguji asumsi-asumsi ini sendiri. Semoga ini membantu peserta pasar membuat keputusan yang lebih terinformasi tentang cara mendapatkan paparan ke Wayfinder.

DMD.

Disclaimer:

Artikel ini diambil dari [X]. Semua hak cipta milik penulis asli [@Daveeemor]. Jika ada keberatan terhadap cetak ulang ini, silakan hubungi Belajar Gatetim, dan mereka akan menanganinya segera.

Penolakan Tanggung Jawab: Pandangan dan opini yang terdapat dalam artikel ini semata-mata milik penulis dan tidak merupakan saran investasi apa pun.

Terjemahan artikel ke dalam bahasa lain dilakukan oleh tim Gate Learn. Kecuali disebutkan, menyalin, mendistribusikan, atau menjiplak artikel yang diterjemahkan dilarang.

Artikel Terkait

Bagaimana Melakukan Penelitian Anda Sendiri (DYOR)?

Analisis Teknis adalah apa?

Apa yang Dimaksud dengan Analisis Fundamental?

Top 10 Platform Perdagangan Koin Meme

Apa itu Altcoin?