10 Observations sur DeFi En Marge des Règles des Courtiers Abrogées et des Attaques à la Gouvernance de CAKE

DeFi se relâche—règle du courtier abrogée, la gouvernance de CAKE attaquée, sUSD continue de se délier. Voici les réflexions récentes sur DeFi :

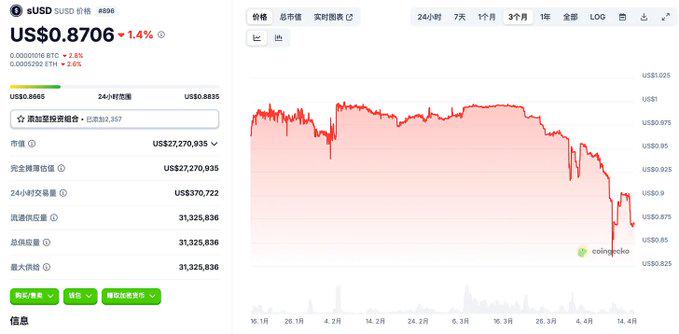

1/ sUSD Continue à se Déconnecter : Pourquoi Pas Encore de Correction ?

Depuis le début de l'année et l'adoption de la proposition SIP-420, le sUSD a connu un désarrimage, chutant récemment en dessous de 0,9 $ dans une divergence sévère. La proposition a introduit un changement clé, le "Pool Délégué". Ce mécanisme encourage les utilisateurs à émettre du sUSD via ce nouveau design, offrant des avantages tels que :

- Ratio de garantie de 200% (initialement conçu à 500%+)

- La dette peut être transférée linéairement au protocole

- Une fois entièrement transférés, les utilisateurs sont exemptés de remboursement

- Le protocole atténue la dette grâce aux bénéfices et à l'appréciation du $SNX

Les avantages sont clairs - amélioration de l'efficacité de frappe pour SNX et élimination du risque de liquidation pour les emprunteurs. Si le marché a une forte confiance en SNX, cela pourrait créer un cycle positif.

Cependant, des problèmes sont rapidement apparus :

- Le marché a toujours un état de stress post-traumatique autour des systèmes de collatéral endogène comme SNX - sUSD

- L'efficacité accrue du minage a conduit à un excès de sUSD entrant sur le marché, provoquant un déséquilibre grave du pool de courbes

- En raison de la conception déléguée, les utilisateurs ne gèrent plus activement leur dette, ils ne peuvent donc pas arbitrer en achetant des sUSD à prix réduit pour rembourser

La principale préoccupation est de savoir si le peg peut être restauré. Cela dépend largement de l'équipe du projet, qui doit stimuler la demande de sUSD ou créer de nouveaux incitatifs.@synthetix_ioest bien conscient de cela, mais il est inconnu si le marché acceptera un stablecoin algorithmique adossé à un collatéral endogène. Le traumatisme de LUNA est encore profondément enraciné. Cependant, d'un point de vue de la conception, le modèle de Synthetix reste avancé - il aurait pu prospérer dans la phase antérieure de "far west" des stablecoins.

(Note: Ceci n'est pas un conseil financier. Il s'agit d'une analyse factuelle destinée à la recherche et à l'apprentissage.)

Attaque de gouvernance veCAKE 2/, Cakepie fait face à l'expulsion

Ironiquement, le modèle ve a été créé pour prévenir les attaques de gouvernance - pourtant veCAKE a été fermé via des sanctions centralisées.

En sautant la chronologie détaillée, le principal litige réside dans l'accusation de PancakeSwap selon laquelle @Cakepiexyz_ioa utilisé son pouvoir de gouvernance avec effet de levier pour diriger les émissions de CAKE vers des pools de liquidité inefficaces, un comportement "parasite" jugé préjudiciable à PancakeSwap.

Cependant, ce résultat ne viole pas la conception du mécanisme ve. Les émissions de CAKE ont été dirigées par vlCKP, le jeton de gouvernance de Cakepie, qui représente le pouvoir de gouvernance et permet un marché de corruption. C'est le but même des protocoles comme Cakepie et Convex.

Le dynamisme Pancake - Cakepie reflète la courbe - Convexe. Frax et Convex ont bénéficié de l'accumulation des votes veCRV. Le modèle ve ne lie pas directement les frais et les émissions. Le problème soulevé contre Cakepie - le ciblage inefficace des émissions - est en réalité un symptôme d'une faible concurrence pour le pouvoir de gouvernance. En général, cela serait résolu en favorisant un marché plus compétitif. Si une intervention est nécessaire, il existe de meilleures alternatives réglementaires, comme fixer des plafonds d'émission par pool ou encourager une concurrence plus large pour les votes veCAKE.

3/ Suivi de l’attaque veCAKE : la méthode quantitative du fondateur de Curve, @newmichwill

- Mesurer la quantité de CAKE verrouillée dans veCAKE via Cakepie (ce CAKE est verrouillé de manière permanente)

- En comparaison avec un scénario hypothétique où les mêmes votes veCAKE soutenaient des "pools de haute qualité" et où tout le rendement était utilisé pour acheter et brûler du CAKE, combien de CAKE serait brûlé ?

- Cette comparaison évalue si le comportement de Cakepie est plus efficace qu'une combustion directe

Selon l'expérience de Michael, sur Curve, le modèle de jeton veToken réduit la circulation des jetons environ 3 fois plus efficacement que les brûlures directes.

4/ La croissance de BUIDL se poursuit, en hausse de 24% en 7 jours

(1) La dernière fois, nous nous sommes concentrés sur franchir les 2 milliards, nous sommes maintenant proches de franchir les 2,5 milliards.

(2) La dernière augmentation de 500 millions de dollars n'est pas venue d'Ethena

(3) Peut attirer de nouveaux groupes d'investisseurs

(4) Les traces sur la chaîne peuvent provenir de Spark, un protocole de prêt détenu par Sky (MakerDAO)

Le secteur des actifs du monde réel (RWA) continue de croître mais ne s'est pas bien intégré dans le courant dominant de la finance décentralisée. Actuellement, il se sent déconnecté du marché plus large et des utilisateurs de détail.

5/ Les États-Unis abrogent la règle du courtier DeFi de l'IRS

Le 11 avril, le président Trump a signé une loi abrogeant officiellement les règles de courtier DeFi de l'IRS.

Le marché DeFi a enregistré des gains modérés - pas spectaculaires. Pourtant, je crois que cela représente un changement positif majeur. Les régulateurs desserrent leur emprise sur le DeFi, ouvrant potentiellement la voie à plus d'innovation et d'applications.

6/ Unichain lance l'exploitation minière de liquidité : 5 millions de récompenses en UNI répartis sur 12 pools

Jetons impliqués : USDC, ETH, COMP, USDT0, WBTC, UNI, wstETH, weETH, rsETH, ezETH

Le dernier événement de minage de liquidité d’Uniswap remonte à cinq ans, coïncidant avec le lancement du jeton UNI en 2020. Cette fois, l’objectif est de canaliser les liquidités vers Unichain. Attendez-vous à ce qu’un grand nombre d’entre eux vous rejoignent : c’est une occasion peu coûteuse de gagner des UNI.

7/ Euler s'étend à Avalanche, entre dans le top 10 des protocoles de prêt par TVL

(1) La TVL a augmenté de 50% en un mois

(2) La plupart de la croissance est incitative, principalement de Sonic, Avalanche et EUL

8/ Cosmos IBC Eureka Officially Launches

(1) Construit sur IBC v2

(2) Chaque transaction brûle $ATOM comme gaz

(3) Permet la cross-chain entre Cosmos et EVM

(4) Prend actuellement en charge le réseau principal Ethereum et les principaux actifs de Cosmos; n'est pas encore étendu aux L2s

(5) Au cours de la semaine dernière, Cosmos Hub a vu 1,1 milliard de dollars d'entrées inter-chaînes

Cela confère une forte utilité à $ATOM. Toute chaîne au sein de Cosmos qui attire un capital significatif peut désormais stimuler la valeur de l'ATOM, évitant potentiellement la rupture observée lors du boom de LUNA.

Malgré les entrées récentes, le changement fondamental à long terme pour ATOM dépend de la durabilité.

9/ Rachats

(1) AaveDAO a commencé des rachats de jetons formels

(2) Pendle a proposé d'inscrire les jetons PT sur Aave

10/ Ferme Berachain

(1) Règles de répartition mises à jour des récompenses POL (Liquidité détenue par le protocole) - plafond de 30% par coffre de récompenses

(2) La mise à jour de la gouvernance introduit un nouveau Conseil des gardiens chargé d’examiner et d’approuver les RFRV

(3) OlympusDAO prévoit de déplacer une partie de ses POL pour s'adapter aux nouvelles règles et maintenir des incitations élevées en $OHM

(4) Yearn’s $yBGT est maintenant disponible sur Berachain

Après un mois de mars doré, le prix et le TVL de Berachain ont connu une correction. L'équipe a abordé les mauvaises allocations d'incitations avec de nouvelles restrictions. Malgré des sorties de TVL importantes ces dernières semaines, il reste l'une des chaînes les plus nativement DeFi. Continuez à surveiller plus d'intégrations de protocoles et de tendances TVL.

Clause de non-responsabilité :

Cet article est reproduit à partir de [PANews]. Le droit d'auteur appartient à l'auteur original [Chen Mo cmDeFi]. Si vous avez des objections à la réimpression, veuillez contacter Porte Apprendrel'équipe, l'équipe le traitera dès que possible selon les procédures pertinentes.

Avertissement : Les points de vue et opinions exprimés dans cet article ne représentent que les points de vue personnels de l'auteur et ne constituent pas un conseil en investissement.

Les autres versions linguistiques de l'article sont traduites par l'équipe Gate Learn. L'article traduit ne peut être copié, distribué ou plagié sans mentionner Gate.com.

Articles Connexes

Qu'est-ce que le dYdX ? Tout ce que vous devez savoir sur DYDX

Explication approfondie de Yala: Construction d'un agrégateur de rendement DeFi modulaire avec la stablecoin $YU comme moyen.

Qu'est-ce qu'Akash (AKT) : L'informatique en nuage décentralisée

Vitalik Buterin : Comment la technologie zk-SNARK protège-t-elle la vie privée ?

Tout ce que vous devez savoir sur Helio