TRON Ecosystem: Setting the Standard for Both Stablecoin Yields and Public Blockchain Token Growth, Ushering in a New Era of Exponential On-Chain Returns

Since October, the crypto market has undergone two rounds of sharp corrections. After reaching new highs, Bitcoin has pulled back, and overall market conditions have entered a phase of wide-ranging volatility. Combined with the Federal Reserve’s pause in its rate hike cycle and a slowdown in institutional capital inflow, market sentiment has shifted from aggressive buying to cautious stability. Investors now show a marked preference for assets that offer steady returns and robust security, with certainty emerging as the key standard for capital allocation.

This bull market is fundamentally different from previous retail-driven rallies, characterized instead by institutional involvement and fundamentals-based momentum. Publicly listed companies are adding Bitcoin to their strategic reserves, while traditional financial institutions like JPMorgan and Fidelity are launching spot Bitcoin and Ethereum ETFs, inviting professional capital into the space. As a result, market control has shifted from retail to institutional hands, and the landscape has moved from across-the-board rallies to a structural bull market.

Investor preferences have evolved accordingly, with less emphasis on broad market windfalls and a greater focus on the certainty of returns. Firstly, after multiple rounds of market turbulence, risk appetite has declined, and the pragmatic need for capital preservation and growth far outweighs the pursuit of excess returns. Secondly, as global macro uncertainties persist, the hedging characteristics and stable yield potential of crypto assets have become vital considerations for capital allocation.

Investment strategies have thus shifted from chasing high risk and high returns to targeting predictable returns. In particular, stablecoins with stable yield and mainstream public chain tokens that combine staking income with appreciation potential have become indispensable components of investment portfolios due to their reliability and defensive qualities.

The TRON ecosystem excels in both asset categories, offering significant yield advantages. Its stablecoins deliver stable returns that outpace those on global public chains like Ethereum, BNB Chain, and Solana. The native public chain token, TRX, is also among the top-performing mainstream crypto assets of the year, demonstrating exceptional resilience and appreciation potential.

This combination of leading stablecoin yields and strong token appreciation has positioned TRON as a core destination for global capital retention and growth. Supported by robust DeFi infrastructure, TRON offers practical, ecosystem-supported solutions that deliver diversified, stable yields throughout market cycles.

TRON Ecosystem: Dual Benchmark for Stablecoin Yield and Public Chain Token Growth

As the crypto market increasingly seeks certain returns, the TRON ecosystem stands out with two main strengths: high, stable yields from stablecoins and substantial appreciation potential and staking rewards from its native token, TRX. Supported by high security and large-scale ecosystem credibility, TRON’s on-chain assets deliver both high yields and stability, making it a core platform for global capital retention and asset growth and a premier choice for steady portfolio expansion in the crypto space.

Currently, investors’ allocation requirements for stablecoins and mainstream public chain tokens focus on distinct priorities:

Stablecoins are widely recognized as safe-haven anchors, allowing users to earn stable returns through staking, lending, and liquidity mining without exposure to token price fluctuations—making them ideal for conservative investors and capital seeking safety.

Mainstream public chain tokens not only offer fixed staking rewards from network participation but also present opportunities for price appreciation as the ecosystem grows (such as increased DeFi activity and user expansion). This creates a dual-engine model of fixed staking returns plus ecosystem-driven price growth, ideally suited to diversified portfolio needs for stable foundation plus growth flexibility.

The TRON ecosystem precisely aligns with investors’ dual requirements for stable returns and growth potential. Its stablecoins provide market-leading stable yields, while its native TRX token demonstrates superior appreciation capabilities, forming an irreplaceable core competitive edge.

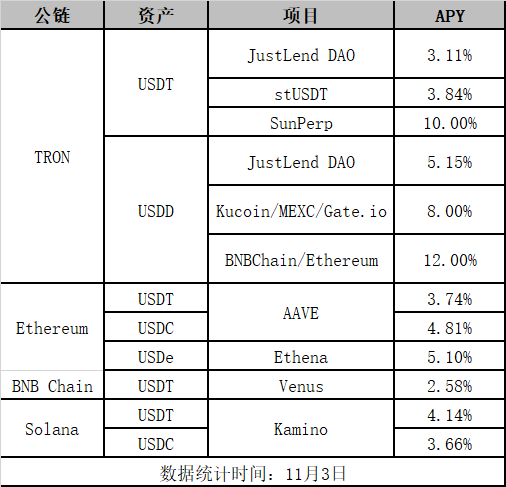

On stablecoin yields, TRON leads the market in stable returns, significantly outperforming other major public chains. As of November 5 (UTC), annualized yields for stablecoins in the TRON ecosystem can exceed 10%, compared to the common 3%–5% annualized returns on Ethereum, BNB Chain, and Solana—making TRON an extremely attractive choice for stablecoin investors seeking stable yield.

Specifically, TRON has developed multiple yield mechanisms for leading stablecoin USDT and its native decentralized stablecoin USDD:

- USDT, the ecosystem’s principal circulating asset, offers diverse yield pathways: 1. Interest-bearing deposits—store USDT in the lending center on JustLend DAO, with a real-time supply interest rate around 3.11% (as of November 3), supporting instant deposits and withdrawals;

RWA yield: By locking USDT via the stUSDT RWA product, investors can indirectly access returns from traditional financial markets, such as U.S. Treasuries, with an annualized yield of 3.84% (as of November 3).

Contract platform lock-up yield: Lock USDT on the decentralized contract platform SunPerp, with yields up to 10%.

- USDD, TRON’s native decentralized stablecoin, supports flexible cross-chain appreciation and is now deployed on Ethereum and BNB Chain, each offering distinct yield opportunities:

1. On TRON, USDD yields are split between direct deposits in JustLend DAO (base annualized yield of 5.2%) and participation in USDD staking campaigns on exchanges like KuCoin and MEXC (annualized yields up to 8%);

2. Across multi-chain ecosystems (Ethereum/BNB Chain), locking USDD mints interest-bearing sUSDD tokens, with annualized yields up to 12%.

Importantly, TRON’s DEX Sun.io offers the PSM stablecoin exchange tool, supporting 1:1, zero-slippage, fee-free swaps between USDD and USDT. This allows USDT holders to seamlessly exchange for USDD and capture higher yields with zero risk.

For native public chain token growth, TRX is outstanding in both price performance and staking yield. It offers compelling appreciation potential and steady, reliable staking returns, and benefits from the synergy of TRON’s DeFi applications to further amplify investment returns—making it a top-tier asset for both offense and defense.

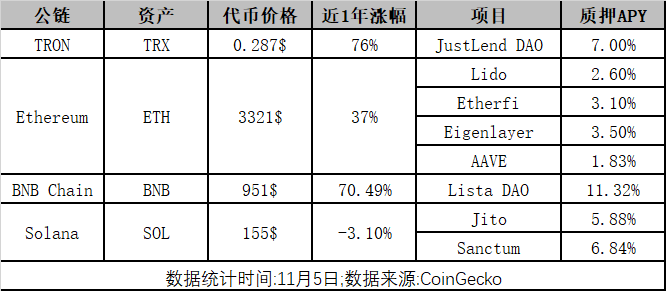

Despite recent market turbulence, as of November 5 (UTC), TRX has achieved a 76% price increase over the past year, demonstrating notable resilience and growth. In comparison, ETH gained 37%, BNB rose 70.49%, while SOL declined by 3.1% over the same period—clearly highlighting TRX’s leading position in resilience and appreciation among mainstream public chains.

Beyond price appreciation, TRX is competitive in staking yields as well. Currently, TRX’s base staking yield on JustLend DAO is 7%. By contrast, other major public chains offer: ETH (via Lido staking) at 2.6%, SOL (via Jito staking) at 5.88%, and BNB (via ListaDAO) at just 0.99% base yield, with Binance Launchpool incentives raising BNB’s yield to 11.32%. Notably, TRX rewards require no extra incentives—basic staking delivers attractive, stable returns that are especially appealing and accessible to regular investors.

Leveraging TRON’s advanced DeFi ecosystem, users can further amplify TRX staking returns via combined strategies. For example, sTRX liquid staking tokens can be stored directly in JustLend DAO for yields up to 7.1% annualized; sTRX can also be used as collateral to mint USDD, which can then be deposited in JustLend DAO—through a staking, lending, and reinvestment loop, yields denominated in tokens can potentially exceed 15%.

This stable staking plus high price appreciation flexibility makes TRX a premium asset catering to both conservative investors seeking fixed income and aggressive investors pursuing growth, thus making it a core holding for all portfolio types.

With industry-leading stablecoin yields above 10%, TRX’s comprehensive return advantage, and flexible mechanisms for shifting and amplifying yield, TRON firmly stands as the dual benchmark of stablecoin yield plus public chain token growth—an irreplaceable anchor of certainty in the crypto market.

DeFi Infrastructure: Building a Long-Term, Stable Yield Base—TRON Constructs a Cycle-Resilient Value Ecosystem

As the crypto market shifts from universal rally exuberance to value investing, the TRON ecosystem leverages its risk-free, high-yield stablecoins and high-growth native TRX token to build a yield system that enables steady asset appreciation throughout market cycles. Its core edge lies not just in leading annualized yields (APY), but in deeply integrating asset returns and growth with ecosystem development, all backed by mature DeFi infrastructure to deliver stable and sustainable returns for investors.

Today’s crypto investors focus less on headline APYs and more on transparency, sustainability, actual ecosystem profitability, protocol security, maturity, and risk in their asset yield strategies.

TRON, a veteran public chain hardened by multiple market cycles, has carved out significant differentiation on these critical fronts, perfectly matching evolving market demands. It commands leadership in security and ecosystem scale, while its on-chain assets deliver high, stable yields. Genuine ecosystem cash flow and sustainable yield make TRON a global anchor for capital retention and growth.

With recent security incidents such as the Balancer hack and xUSD depegging, asset safety is now investors’ top priority. TRON and its core DeFi protocols (JustLend DAO, Sun.io, etc.) have operated stably for years, weathering extreme market conditions with no major security breaches, providing a solid foundation for asset security.

In terms of ecosystem scale, TRON is backed by a hundred-billion-dollar ecosystem, with enormous user volume and capital reserves sustaining long-term yield stability. Specifically, TRON’s stablecoin market cap consistently holds at $80 billion, ecosystem TVL at $28.8 billion, and abundant liquidity powers yield scenarios. The chain’s user base exceeds 342 million, with daily active accounts above 5 million, sustaining vibrant ecosystem growth. According to Messari’s latest Q3 report, TRON’s Q3 revenue reached $1.2 billion (USD), up 30.5% quarter-over-quarter and setting a new all-time high, further validating the ecosystem’s quality growth.

More than just scale and capital, TRON’s core strength lies in stablecoin yield and TRX appreciation logic rooted in genuine DeFi business activity. TRON’s ecosystem has built end-to-end DeFi infrastructure encompassing asset issuance, trading and exchange, yield generation, and cross-chain circulation, supporting efficient asset flows and providing solid business foundations for both core asset classes.

Key infrastructure features are complementary and cover all scenarios: Sun.io, the one-stop DEX, integrates SunSwap decentralized trading, SunCurve and PSM stablecoin exchange tools, SunPump meme issuance, and the newly launched SunPerp contract trading product—covering the entire process from asset issuance and exchange to derivatives trading. JustLend DAO supports lending, interest-bearing deposits, TRX staking, energy rental, and more. The stUSDT RWA product creates cross-sector yield channels; native stablecoin USDD builds high-yield systems across multiple chains. The BTTC cross-chain protocol links TRON to Ethereum, BNB Chain, and other EVM-compatible chains, ensuring seamless cross-chain liquidity. The AINFT brand expands to AI and NFT innovation, continuously enriching ecosystem business lines.

These DeFi and ecosystem products create end-to-end yield scenarios for TRON assets, ensuring every step from ecosystem entry to multi-dimensional appreciation is supported by mature applications, delivering stable, sustainable yields while reducing reliance on short-term incentives.

For stablecoins, TRON delivers stable yields of 10%+ thanks to a comprehensive product suite and integrated DeFi scenarios. JustLend DAO’s base deposit, SunPerp’s contract lock-up, USDD’s cross-chain appreciation, PSM’s risk-free swaps, and stUSDT’s connection to traditional finance each provide substantive, application-driven yield opportunities—not short-lived policy subsidies.

TRX’s above-market returns also rely on deep DeFi infrastructure. Beyond basic network staking, derivative scenarios via JustLend DAO and other platforms (e.g., staking certificates for reinvestment, cyclic lending) further amplify returns, forming a multi-layered base yield plus derivative growth model for higher yield potential.

Additionally, TRON benefits from compliant infrastructure that welcomes sustained capital inflow. Through U.S.-listed Tron entities and regulatory pathways, TRON continually attracts traditional financial and institutional capital, injecting long-term liquidity and supporting stable yields. In June (UTC), a listed Tron company staked 365 million TRX on JustLend DAO; in September, Tron secured $110 million in new investment, adding 312.5 million TRX to its treasury. As of November 5 (UTC), listed Tron companies hold over 670 million TRX. This long-term lock-up plus infrastructure staking capital not only strengthens TRX price stability but also provides ample liquidity for core yield platforms like JustLend DAO.

With comprehensive DeFi infrastructure and external ecosystem expansion, TRON has built a multi-dimensional, multi-tiered asset yield system spanning basic appreciation to cross-sector investment, meeting both conservative users’ demand for safety and stability and aggressive users’ pursuit of high returns.

Whether you’re a cautious investor seeking capital preservation and steady growth (via USDT/USDD deposit and staking), a growth-oriented investor prioritizing fixed returns plus price flexibility (allocating TRX for overall yield), or an institution requiring compliance (selecting stUSDT), TRON’s ecosystem provides clear, tailored allocation paths.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [TechFlow]. For any concerns regarding republication, please contact the Gate Learn team, which will promptly address your concerns following established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions have been translated by the Gate Learn team. Unless specifically referenced by Gate, reproduction, distribution, or plagiarism of these translations is strictly prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?