Gate Research: Funding Surges 104.8%, Capital Flows Back to Prediction Markets and Stablecoin Infrastructure | October 2025 Web3 Fundraising Overview

This report summarizes the Web3 funding landscape in October 2025. In October, a total of 130 deals were completed, with $5.12 billion raised, representing a 104.8% month-over-month surge, the second-highest level in the past year. Funding was primarily driven by strategic rounds, which accounted for over 70% of the total, fueled by the explosion of the prediction market Polymarket and the accelerated integration of CeFi and TradFi. By sector, DeFi led with $2.15 billion, reflecting concentrated capital flows toward innovative financial applications. In terms of funding structure, projects in the $3M–$10M range accounted for nearly one-third of rounds, while projects under $1M represented only 5.9%, marking a recent low. The report also highlights key funded projects, including Orochi Network, KapKap, Voyage, TBook, and Lava.Summary

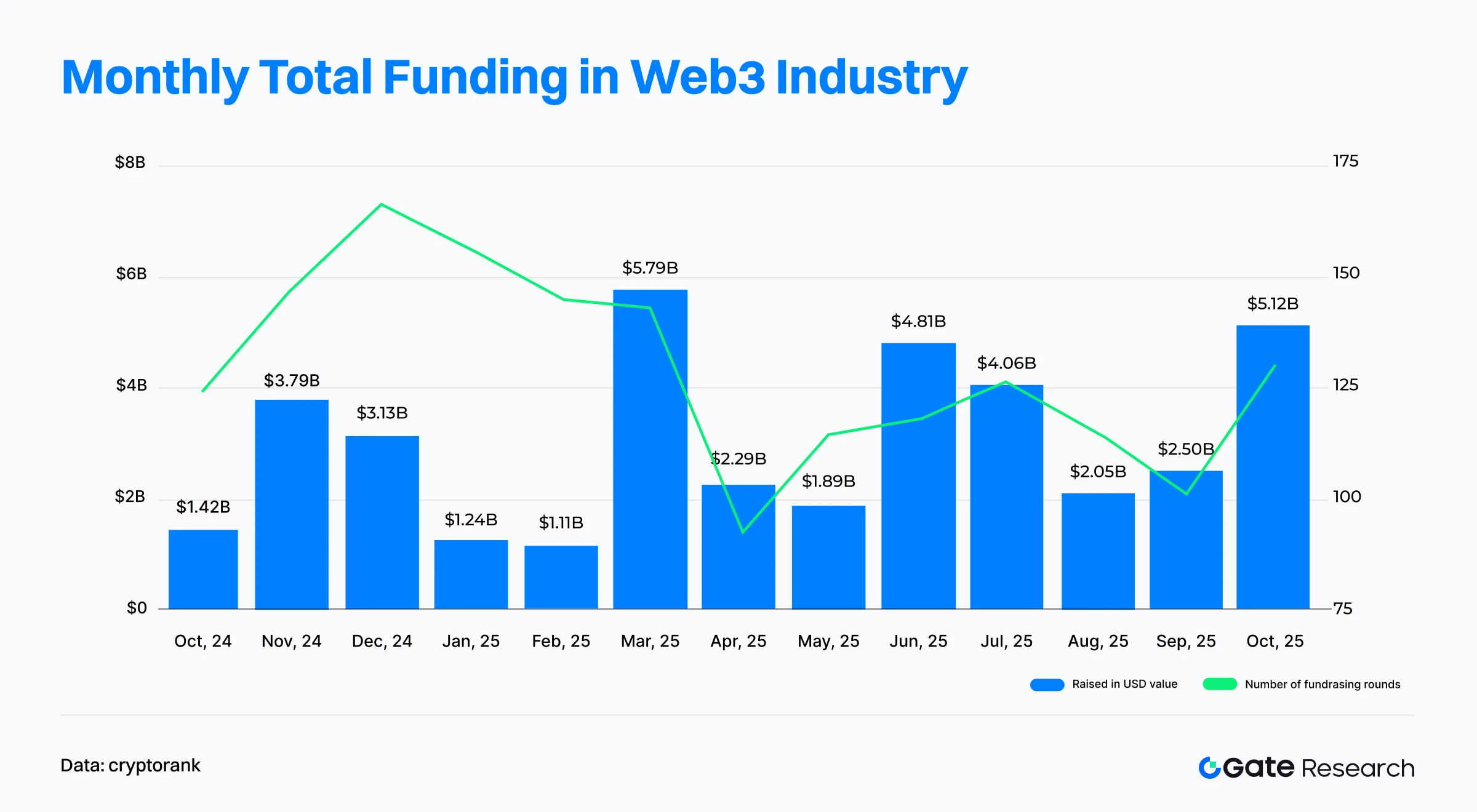

- According to data released by Cryptorank on November 4, 2025, the Web3 industry completed 130 funding rounds in October 2025, with a total financing amount of $5.12 billion; the number of rounds increased 28.43% month-on-month, while the total amount surged 104.8%, marking the second-highest level in nearly a year.

- The top 10 largest financing deals exhibit three key trends: a surge in prediction markets, deep integration of CeFi/TradFi, and accelerated institutionalization and selectivity of capital. Polymarket led with a $2 billion strategic funding, signaling a capital highlight for the prediction market sector; meanwhile, CeFi continues to expand through acquisitions and structured financing, demonstrating significant convergence with the traditional financial system.

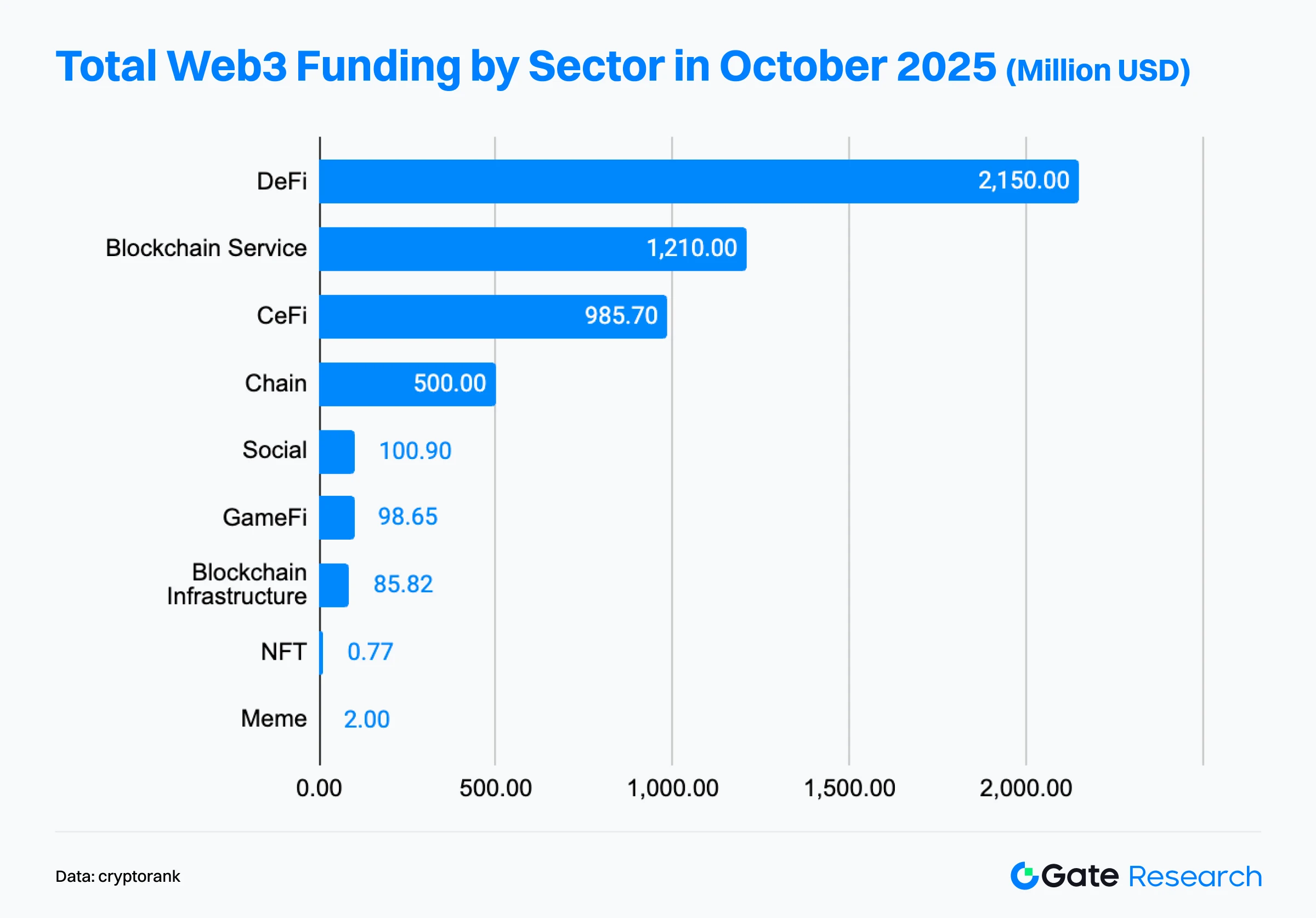

- In terms of sector distribution, capital is clearly concentrated in the dual core areas of innovative finance and underlying infrastructure. DeFi ranked first with $2.15 billion raised, surpassing blockchain services ($1.21 billion) and CeFi ($986 million), making it the most capital-attractive sector in October. Capital largely flowed into financial applications and core technologies, while consumer-facing application-layer projects cooled noticeably.

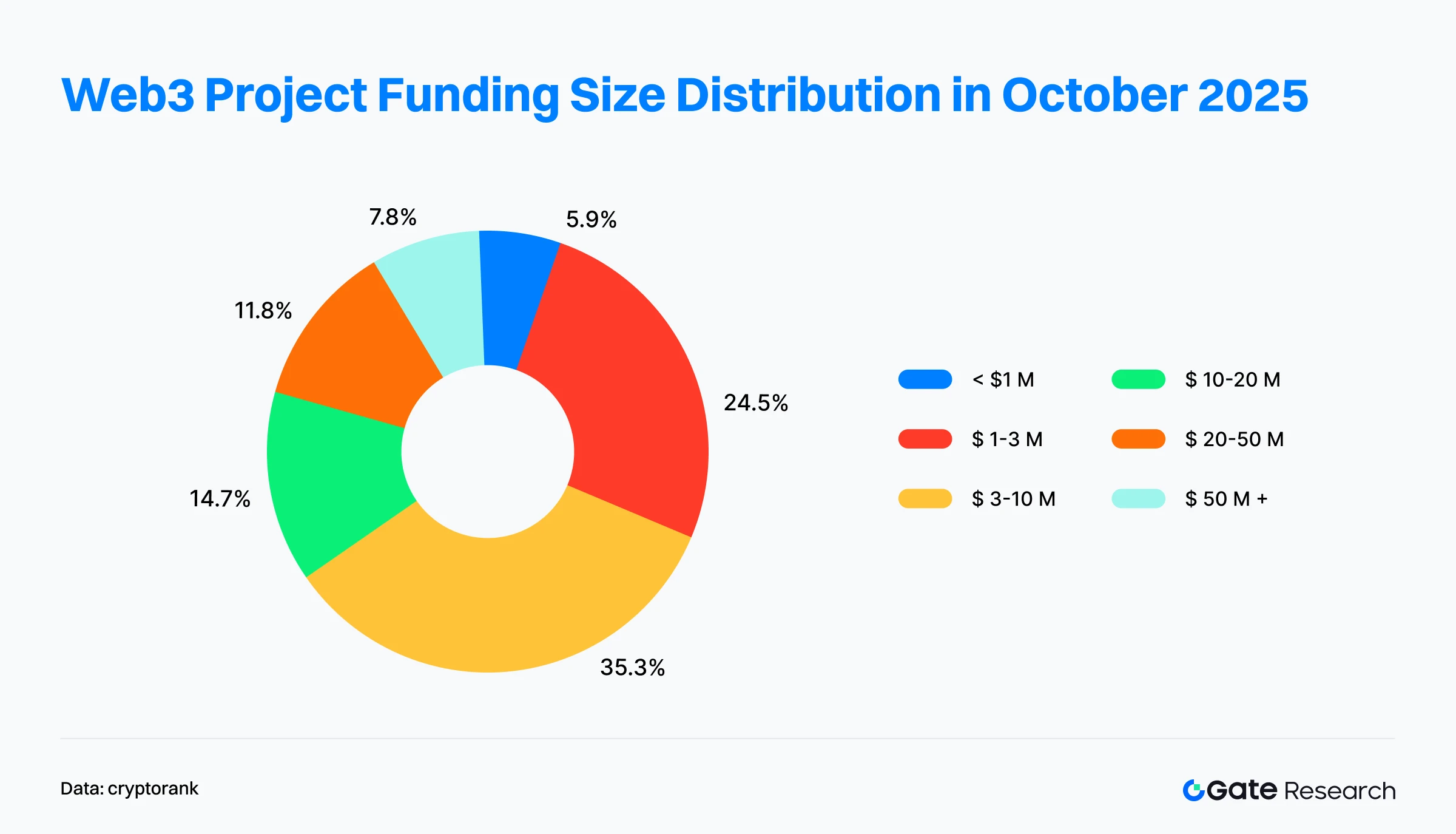

- Regarding financing structure, the market still shows a pattern of dominance by mid-tier projects with increasing concentration at the top. Projects raising $3–10 million accounted for more than one-third of total rounds, forming the most active segment; projects under $1 million represented only 5.9%, hitting a recent low.

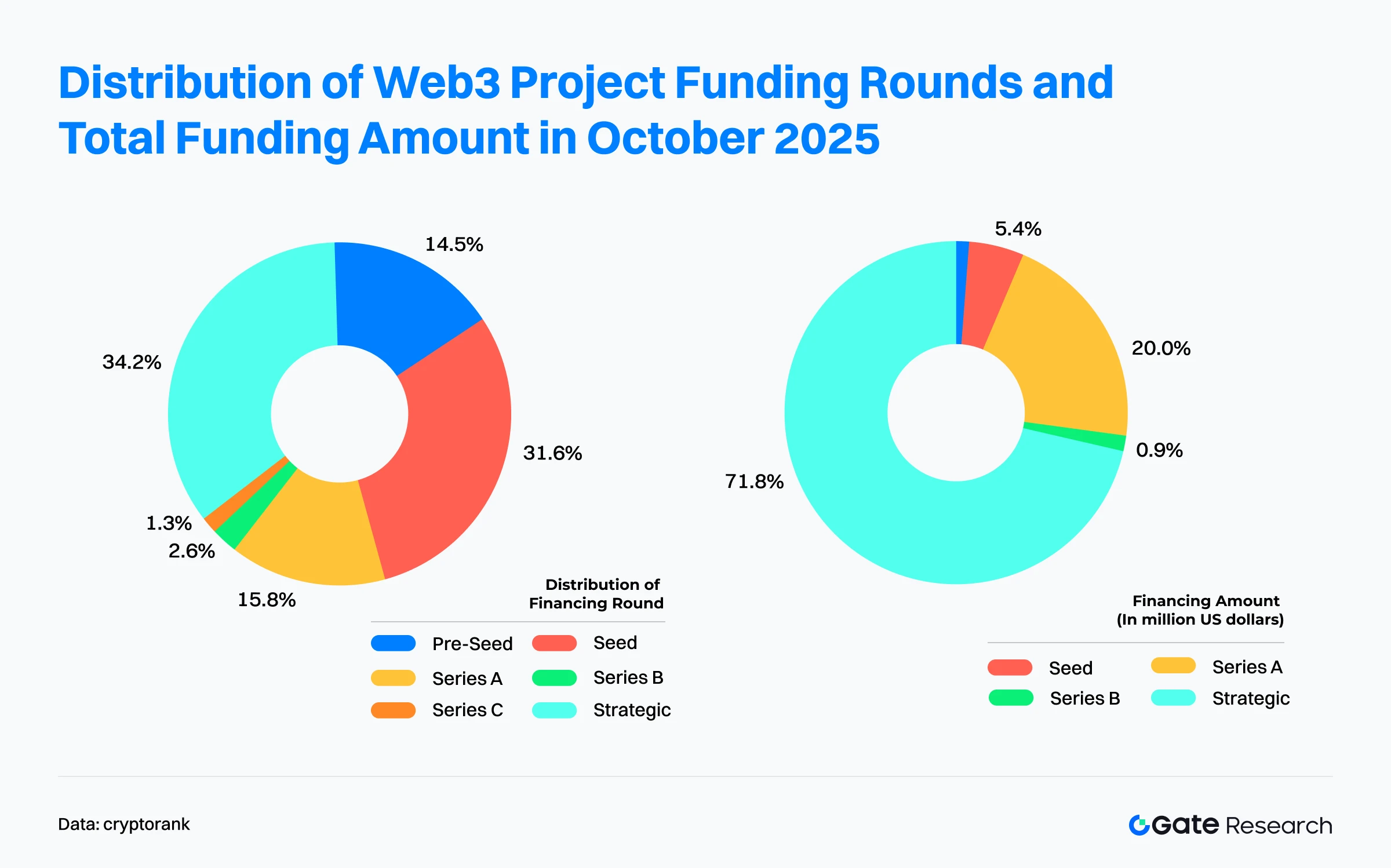

- By round type, strategic rounds were the absolute dominant force, accounting for 34.2% of funded projects and over 70% of total financing, indicating that top-tier investors are accelerating ecosystem positioning through strategic entry. Early-stage projects remained active but with limited capital; mid-stage rounds (A, B, C) showed a clear gap, reflecting a market entering a structured and selective cycle.

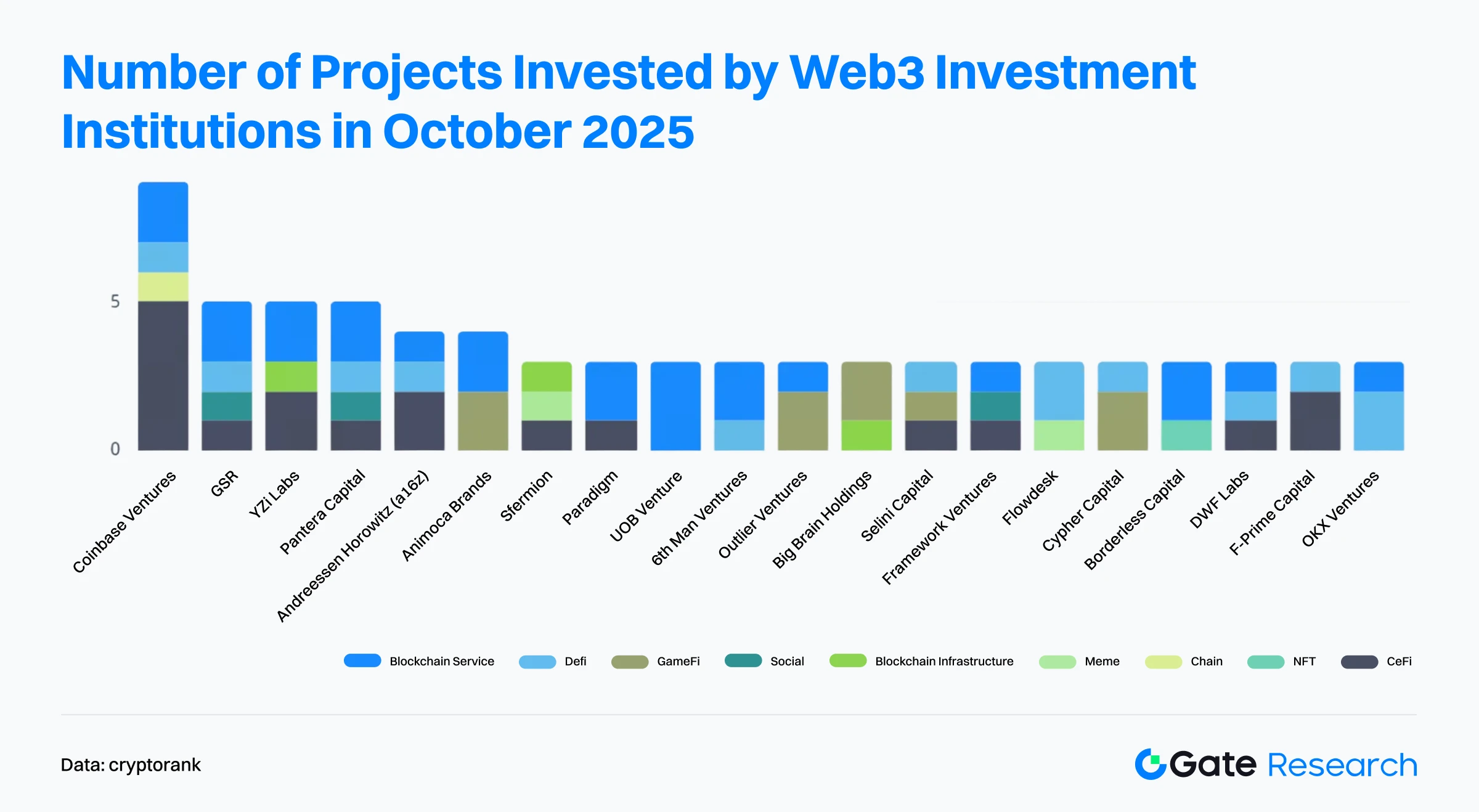

- At the institutional level, Coinbase Ventures led with 9 investments, spanning multiple sectors including CeFi, DeFi, blockchain services, and chain infrastructure.

Financing Overview

According to data released by the Cryptorank Dashboard on November 4, 2025, the Web3 industry completed 130 funding rounds in October 2025, with a total financing amount of $5.12 billion【1】. It should be noted that due to differences in statistical methodology, this figure differs from the sum of individual deals (approximately $6.995 billion), which may be attributable to certain crypto strategic reserves, private placements, or IPO-type financings not being included in the statistics. To maintain consistency, this analysis adopts the original Cryptorank Dashboard data.

Compared with 101 rounds totaling $2.5 billion in September, October saw a 28.43% month-on-month increase in the number of rounds and a 104.8% surge in total financing, effectively doubling, marking the second-highest level in nearly a year, only behind the March 2025 peak of $5.79 billion. This month’s financing was largely driven by a few mega-deals: prediction market Polymarket completed a $2 billion strategic round, Ripple acquired GTreasury for $1 billion to enter enterprise treasury management, the stablecoin blockchain Tempo (backed by Stripe) raised $500 million in Series A, and prediction market Kalshi secured $300 million in Series D. These four deals together accounted for over 74% of the month’s total financing, illustrating a strong capital concentration effect.

From a macro perspective, there is a notable divergence between the number of rounds and total financing. On one hand, the number of rounds has steadily declined from a peak of ~166 rounds in December 2024, stabilizing between 110–126 rounds in the second half of 2025. On the other hand, total financing exhibits pronounced “spike-like” volatility, with massive inflows in March 2025 ($5.79B), June 2025 ($4.81B), and October 2025 ($5.11B). This “fewer deals, higher amounts” pattern clearly indicates a market phase of capital consolidation and concentration on high-quality projects, where funds are flowing from early-stage high-risk ventures to projects with mature business models, compliance potential, and long-term ecosystem value.

Overall, following relatively stable months in August ($2.05B) and September ($2.5B), October’s strong rebound to $5.11B not only marks a half-year high, but also signals that Web3 venture capital confidence is returning toward the year-end, and the industry is entering a high-activity financing cycle again.

According to Cryptorank data, the Top 10 Web3 financing projects in October 2025 were dominated by multiple mega-deals, with prediction markets and CeFi emerging as the core drivers of capital inflow, highlighting that funds are increasingly focusing on mature business models and compliant financial architectures【2】.

- Prediction market sector achieved a full-scale surge. Polymarket and Kalshi together raised over $2.3 billion, dominating October’s total financing. Polymarket led with a $2 billion strategic round backed by Intercontinental Exchange (ICE), marking the largest prediction market financing in Web3 history and signaling significant traditional financial capital entry into decentralized derivatives and event trading markets. Similarly, regulated prediction market Kalshi raised $300 million in Series D, reflecting long-term investor confidence in this sector.

- CeFi sector continues to expand through acquisitions and traditional financial instruments. Structured financing formats such as M&A, PIPE (private investment in public equity), and post-IPO debt accounted for a growing proportion of capital. Ripple’s $1 billion acquisition of GTreasury ranked second only to Polymarket, consolidating its presence in enterprise payments and liquidity management. Coinbase Ventures’ acquisition of Echo ($375M) and Kraken’s acquisition of The Small Exchange ($100M) demonstrate CeFi leaders strengthening their services via vertical integration, accelerating Web3–TradFi convergence. Meanwhile, IREN ($875M convertible bonds) and Zeta Network Group ($230M post-IPO private placement) obtained institutional funding, showing that listed and pre-IPO companies are integrating crypto assets into financial strategy and reserves. Greenlane Holdings ($110M PIPE) established the Berachain digital asset treasury, exemplifying the deepening of on-chain treasury models as a new normal for traditional enterprises entering Web3.

- Stablecoin sector regained capital attention. Infrastructure project Tempo completed a $500 million Series A, led by Sequoia Capital and Thrive Capital, underscoring the strategic importance of stablecoins and payment networks in the new capital cycle.

In summary, the Web3 financing landscape in October 2025 is characterized by three major trends: prediction markets entering a capital spotlight, CeFi and TradFi integration accelerating, and mergers & structured financing becoming the mainstream path, driving the market into a phase of selective investment and consolidation

According to Cryptorank Dashboard data, the Web3 financing structure in October 2025 underwent a significant structural reshaping. Compared with September, capital flows showed a clear pattern of “innovation-driven finance supported by infrastructure services”, with funds heavily concentrated in financial applications and underlying technologies, while consumer-facing application layer projects cooled noticeably.

DeFi emerged as the dominant sector. Decentralized finance (DeFi) raised $2.15 billion, surpassing blockchain services and CeFi, making it the largest capital-attracting sector in October. This surge was primarily driven by innovative derivatives and prediction market projects, notably Polymarket’s $2 billion financing, which propelled the overall DeFi sector upward. Compared with September, capital focus shifted from “service and CeFi-led” to “high-yield financial innovation bets”, reflecting strong market attention toward Web3 derivatives ecosystems with traditional financial attributes.

Blockchain services and CeFi continued as stable capital pillars. Blockchain services raised $1.21 billion, steadily growing from September and reinforcing its position as a core Web3 infrastructure sector. CeFi ranked third with $986 million, driven by multiple high-value M&A deals led by Ripple, Kraken, and other major players, highlighting continued capital demand for compliant expansion and market consolidation in CeFi.

Public chains and stablecoin infrastructure experienced a breakout. The Chain sector raised $500 million, nearly 15 times higher than September, primarily due to Tempo’s $500 million Series A. This underscores top-tier capital recognition of stablecoins and payment networks as strategically vital in the Web3 financial landscape and signals that stablecoin infrastructure may become the next major focus of investment.

Application layer projects cooled across the board. Social and GameFi raised $101 million and $98.65 million, respectively—still active, but only about 1/20th the size of financial and infrastructure sectors. NFT and Meme sectors further contracted, raising $12 million and $2 million, respectively, indicating a market shift from speculative and cultural narratives back to rational investment.

Overall, October’s Web3 financing exhibited a highly concentrated structure: DeFi, blockchain services, and CeFi together accounted for over 80% of total financing. This demonstrates that institutional capital is returning from consumer narratives to the “finance and infrastructure mainline”, accelerating the development of the underlying Web3 market and financial operational systems, and laying a solid foundation for the next DeFi- and stablecoin-driven innovation cycle.

Based on 102 Web3 project financings disclosed in October 2025, the month’s financing structure continued to display the typical pattern of “mid-tier dominance with increasing concentration at the top”, highlighting a notable divergence in market activity and capital concentration.

Early-stage and growth-stage projects formed the market foundation. The majority of financing rounds came from mid- and lower-tier projects, forming the core of market activity. Projects in the $3–10 million range were the most numerous, accounting for over one-third of total rounds, making them the market’s primary active layer. Following this, projects in the $1–3 million range accounted for approximately 24.5%. Together, these mid- and lower-tier segments contributed nearly 60% of total rounds, indicating that venture capital firms continue to broadly deploy funds into early- and growth-stage projects with preliminary validation and clear commercialization pathways, capturing high-growth potential.

High-value financing projects increased, strengthening capital concentration. Mega-deals above $50 million accounted for 7.8% of projects; although few in number, they contributed the majority of the month’s total financing, reflecting the strong capital-attracting ability of top-tier projects and a market preference for mature business models. Projects in the $10–50 million range accounted for 19.6%, showing that capital remains focused on “near-unicorn” projects with scalability and stable revenue models.

Small-scale financing declined sharply. Projects under $1 million accounted for only 5.9%, a recent low, indicating that early-stage teams face increasing difficulty securing funding, while investors place greater emphasis on product maturity and market validation, applying stricter criteria to purely conceptual projects.

In summary, October’s financing pattern shows a bipolar capital strategy: on one end, frequent deployments into the ecosystem base (<$10 million) maintain innovation momentum; on the other, precise and concentrated investments target a few mature or strategically significant mega-deals (e.g., M&A).

Based on 76 Web3 project financings disclosed in October 2025, the capital structure across funding rounds displayed a bipolar pattern of “strategic capital dominance with early-stage innovation activity”, indicating that after several months of contraction, market funds are accelerating toward top-tier projects and core infrastructure.

Strategic rounds emerged as the absolute leader. Strategic round projects accounted for approximately 34.2% of total financing rounds, with their financing amount exceeding 70% of total capital. This trend was primarily driven by mega-deals such as Polymarket ($2 billion), reflecting the increasing role of traditional finance and large institutional capital in steering Web3 investment rhythms. The surge in strategic financing indicates that capital is shifting from “early-stage bets” to “industry collaboration and ecosystem deployment”, marking a new stage in Web3 dominated by financial institutions and leading enterprises.

Early-stage rounds remain active but with limited capital. Seed-stage projects ranked second by number, accounting for about 31.6% of rounds but only 5.4% of total financing, showing that innovative projects remain attractive while individual deal sizes remain relatively small. Pre-Seed projects represented approximately 14.5% by number but less than 1% by capital, highlighting a cautious early-stage environment where investors focus on teams with initial product validation and market potential. Overall, early-stage rounds accounted for nearly 35% of total deals, sustaining ecosystem innovation, but capital allocation is increasingly rational and concentrated.

Growth-stage rounds (Series A, B, C) showed a clear gap. Series A financing accounted for 20.9% of total capital but only 15.8% by project count, with funds concentrated in a few infrastructure-related projects (e.g., Tempo, stablecoins, payment networks), indicating a preference for teams with mature business models and clear revenue paths. Series B and C rounds were scarce, representing only 2.6% and 1.3% of rounds, respectively, with Series B financing under 1% of total capital and Series C amounts undisclosed. This highlights a financing vacuum in the transition from growth to scale, where investors are increasingly selective and cautious regarding mature projects.

In summary, October’s Web3 financing structure exhibited dual characteristics:

- Strategic rounds drove capital flows, promoting industry consolidation and ecosystem deployment.

- Early-stage rounds maintained innovative activity, supplying foundational momentum for new narratives and technological breakthroughs.

The mid- and late-stage financing gap indicates that the market is entering a structurally selective phase, with capital flowing toward projects that demonstrate long-term competitiveness and clear commercialization potential.

According to Cryptorank data released on November 4, 2025, in terms of institutional activity, Coinbase Ventures led significantly with 9 investments, far exceeding other institutions in project count. Its investments spanned CeFi, DeFi, Chain, and Blockchain Service sectors, reflecting a strategic focus on deepening the crypto ecosystem. Following Coinbase Ventures were established institutions such as GSR, YZi Labs, Pantera Capital, and a16z (Andreessen Horowitz), which remained active in DeFi, GameFi, and Social projects, demonstrating a long-term focus on innovative applications and potential user growth.

By sector distribution, Blockchain Service and CeFi emerged as the primary investment hotspots and the main focus of most leading institutions, reflecting the market’s long-term strategic confidence in financial services and infrastructure sectors. DeFi and GameFi followed, indicating that liquidity management, on-chain yield, and user entertainment interactions continue to attract investment. In contrast, NFT, Social, and Meme sectors received relatively less attention, suggesting that capital is increasingly returning to areas with sustainable business models and stable cash flows.

Overall, the investment landscape in October 2025 demonstrated structural capital reflow and strategic rebalancing: institutional investors are no longer blindly chasing hype narratives, but are increasingly emphasizing long-term ecosystem deployment and commercial execution capabilities.

Highlighted Project of the Month

Orochi Network

Overview: Orochi Network is a verifiable data infrastructure that leverages zero-knowledge proofs (ZKP) and multi-party computation (MPC) to provide high-performance data pipelines for AI/ML, zkApps, and dApps, balancing privacy with verifiability. The network is specifically designed for applications such as RWA tokenization, stablecoins, Web3, artificial intelligence, and decentralized physical infrastructure networks.【3】

On October 17, 2025, Orochi Network announced the completion of an $8 million funding round, with participation from the Ethereum Foundation. The funds will be used to further develop a verifiable data infrastructure focused on RWA tokenization.【4】

Investors / Angel Backers: Ethereum Foundation, Plutus VC, Bolts Capital, Ant Labs, MEXC Ventures, among others.

Highlights:

- Orochi Network transforms real-world data into verifiable data, enabling smart contracts to perform data verification without third-party intermediaries, fundamentally reducing trust and security risks. Currently, Orochi Network has over 300,000 daily active users and 1.5 million monthly active users, has processed over 160 million transactions, and provides high-performance data support for more than 40 dApps and blockchain projects. Its global community has grown to over 500,000 members, demonstrating strong ecosystem expansion and developer appeal.

- Core products include zkDatabase, Orocle, Orand, and zkMemory, which integrate ZK-data rollups, verifiable data pipelines, and hybrid aBFT consensus mechanisms, offering high security and transparency. Orochi supports multiple ZKP systems (e.g., Plonky3, Halo2, Nova) and is blockchain-agnostic, enabling seamless cross-chain interaction and flexible deployment for developers.

- The zkDatabase mainnet has officially launched, with over 10,000 downloads and more than 700 million ZKP requests processed. Orochi has formed the zkDatabase Alliance with 120 enterprises including Plume, Lumia, and Nexus. The system provides audit-level data verification for RWA, AI, and Web3 use cases, reducing Ethereum data costs from ~$25 per KB to $0.002 per KB.

KapKap

Overview: KapKap is an AI-native Web3 platform focused on transforming gaming, content creation, and social interaction into measurable and tradable digital value. Its core mechanism, the Key Attention Pricing System (KAPS), quantifies user behavior and reputation into attention-based assets, enabling fairer incentive distribution, game publishing opportunities, and creator revenue mechanisms within the Web3 ecosystem.【5】

On October 30, 2025, KapKap announced the completion of a $10 million seed round, led by Animoca Brands. The funds will be used to expand the KAPS reputation system and deepen collaboration with game developers to accelerate platform ecosystem growth and application adoption.【6】

Investors: Animoca Brands, Shima Capital, Mechanism Capital, Klaytn Foundation, Big Brain Holdings, among others.

Highlights:

- KapKap’s core strategy is “AI × Web3”. Its proprietary KAPS (Key Attention Pricing System) converts user attention, engagement, and reputation into measurable assets, creating an “attention-as-value” incentive mechanism. KAPS tracks user behavior in gaming, social, and creative activities to generate k-score values, enabling cross-platform reputation assessment and reward distribution. By combining AI algorithms with reputation-based pricing, KapKap is building a new Web3 economy centered on attention-as-value.

- KapKap has formed strategic partnerships with globally recognized IPs and communities, including BAYC, ApeCoin DAO, and SNK, integrating their brand content and characters into the ecosystem to bridge Web3 with mainstream culture.

- KapKap currently has over 1.7 million monthly active users and 25,000 daily active users. It has partnered with popular games such as The King of Fighters and Idle Knights, demonstrating strong user retention and growth potential.

Voyage

Overview: Voyage is a decentralized network focused on Generative Engine Optimization (GEO), designed to provide high-quality data support for AI systems during search and information discovery. Its core infrastructure collects, structures, and distributes AI-usable data, while incorporating an incentive mechanism that tracks contributions and rewards participants who provide valuable content or expertise.【7】

On October 16, 2025, Voyage announced the completion of a $3 million Pre-Seed round, with funds aimed at accelerating the development and ecosystem growth of the GEOFi network.【8】

Investors: a16z Speedrun, Alliance DAO, Solana Ventures, LECCA Ventures, IOSG VC, Big Brain VC, MH Ventures, GAM3GIRL VC, Y2Z Ventures, among others.

Highlights:

- Voyage aims to build the world’s first “GEOFi (Generative Engine Optimization Finance)” network, establishing a fair knowledge citation and value distribution layer for AI-generated content, ensuring that genuine knowledge contributors are appropriately rewarded. The project structures human knowledge via AI-guided dialogue for use in generative models, creating a virtuous cycle of “more citations → more contributions → more trust”, with the goal of becoming an AI-referable human knowledge platform.

- As an AI-native data protocol, Voyage serves as the “discovery and trust infrastructure” for the AI era. Its Proof-of-Index mechanism incentivizes users to contribute, index, and verify web data, turning data crawling into a decentralized “AI mining (earn the crawl)” process. This approach reshapes the underlying logic of AI search and establishes a sustainable incentive ecosystem for human knowledge creators.

- Voyage has secured support from top-tier institutions and ecosystem funds with deep expertise in AI, crypto, and search technologies. This capital and resource network will help accelerate the development and global adoption of the GEOFi network, strengthening Voyage’s first-mover advantage in the “AI × Web3” intersection.

TBook

Overview: TBook is a platform focused on incentivizing and rewarding user and developer contributions within the Web3 ecosystem, building a network centered on identity and reputation. It provides tools to create reward programs based on Soulbound Tokens (SBTs), recording users’ unique achievements and contributions within the ecosystem.【9】

On October 21, 2025, TBook announced the completion of a $5 million strategic funding round, intended to accelerate the construction and promotion of its core infrastructure, including an instant stablecoin payment system, identity-bound settlement channels, and an RWA revenue distribution vault.【10】

Investors / Angel Backers: Sui Foundation, Vista Labs, Bonfire Union, HT Capital, among others.

Highlights:

- TBook was officially recognized by Telegram as a “hot app” and added to the official recommendation list, reflecting broad recognition at the social entry and mainstream user level. Its modular design supports multi-scenario expansion, serving both grassroots communities and large enterprises, providing “Incentive-as-a-Service” infrastructure for the crypto ecosystem. To date, TBook has built an asset distribution network on the TON and Sui platforms, with over 4 million users creating TBook reward passes and claiming more than 9.8 million assets through TBook Vault.

- At the mechanism level, TBook centers on SBTs, creating an incentive matrix that balances trustworthiness and loyalty. SBTs are non-transferable and non-tradable, ensuring authenticity and immutability of identity credentials. TBook also introduces the WISE scoring system, which quantifies users’ multi-dimensional contributions (engagement, influence, loyalty, etc.) to provide projects with precise community insights and optimize incentive allocation. Each user is issued a unique incentive passport, recording and managing personal incentive activity and assets, connected via on-chain identity verification. Additionally, the SBT data insight module provides detailed community analytics and incentive optimization tools to enhance distribution accuracy and sustainable growth.

- To better assess user contributions across multiple chains, TBook Labs launched the Omni-Chain Airdrop Scoring System. This system aggregates on-chain behavioral data to evaluate users’ activity, interaction frequency, and influence, generating a quantifiable contribution index. It helps users identify potential ecosystem rewards and enables projects to precisely target core contributors, ensuring fairer and more efficient incentive distribution.

Lava

Overview: Lava is a service platform focused on the financialization of crypto assets, providing Bitcoin-collateralized loans, USD-denominated yield products, and secure self-custody solutions to enhance users’ financial freedom while mitigating risks associated with centralized finance.【11】

On October 1, 2025, Lava announced the completion of a $17.5 million Series A extension, backed by multiple prominent angel investors.【12】

Angel Investors: Peter Jurdjevic, Bijan Tehrani (Stake), Zach White (8VC), Saurabh Gupta (DST Global), former Visa executive Terry Angelos, former Block executive Aaron Suplizo, among others.

Highlights:

- Lava introduced the Bitcoin-Backed Line of Credit (BLOC), enabling users to “save in BTC, spend in USD”. Users can borrow USD securely without selling their Bitcoin, with interest rates starting as low as 5%. This mechanism allows users to maintain long-term BTC value while meeting liquidity needs, marking a step toward the global expansion of crypto-collateralized lending.

- Lava’s USD yield products allow users to provide USD liquidity to support BTC-backed loans on the platform, earning yields of up to 7.5% APY. All loans are backed exclusively by BTC with over 200% collateralization, ensuring borrower security. This setup promotes stable USD asset growth while improving internal capital efficiency and BTC utilization.

- Lava has built an integrated “collateral → lending → spending” lifecycle. Users can purchase BTC on Lava Exchange with zero fees, earn USD via BTC-collateralized loans, and receive up to 5% BTC cashback using the Lava Card. Additionally, Lava Free Pay enables instant, free, cross-chain payments, allowing on-chain transactions without holding gas tokens.

- Lava’s smart key system provides institutional-grade asset protection via a 2-of-2 encrypted backup architecture, balancing security and recoverability while mitigating traditional mnemonic loss risks. It also offers APIs for enterprises and developers to integrate core functions such as Lava Loans, Free Pay, and Exchange, building a scalable Web3 financial infrastructure.

Conclusion

In October 2025, the Web3 funding market rebounded strongly, completing 130 deals totaling $5.12 billion, up 104.8% month-over-month, marking the second-highest level in the past year and signaling that the industry has re-entered a high-energy cycle. The core driver of this month’s funding structure was strategic round financing, which accounted for over 70% of the total capital. This surge was primarily driven by the explosion in prediction markets (e.g., Polymarket’s $2B raise) and the deep integration of CeFi and TradFi (e.g., Ripple’s acquisition of GTreasury).

At the sector level, DeFi led with $2.15 billion, highlighting concentrated capital bets on innovative financial applications. Meanwhile, the rise of stablecoin infrastructure projects (e.g., Tempo’s $500M Series A) further reinforced their strategic importance within the Web3 financial ecosystem.

In terms of funding size distribution, the market showed a “mid-tier dominated, increasingly polarized” pattern:

- Projects raising $3M–$10M were the most numerous, accounting for nearly one-third of total rounds.

- Projects under $1M fell to only 5.9%, the lowest in recent months, indicating that capital is applying stricter screening criteria for purely conceptual projects, while accelerating the flow toward mature teams and deployable solutions with long-term competitiveness.

Key innovation focuses among funded projects were concentrated in three areas:

- AI-powered data verifiability and value allocation — Orochi Network builds verifiable data infrastructure via ZKP; Voyage leverages a Proof-of-Index mechanism to enable fair knowledge value distribution in its GEOFi network; KapKap quantifies user attention and reputation through AI algorithms, driving coordinated evolution of the data trust layer and value allocation layer.

- Identity- and reputation-driven incentive networks — TBook uses Soulbound Tokens (SBTs) to establish an identity and reputation system, officially recognized by Telegram, providing a novel incentive model for user contributions and behavioral credibility.

- Practical financialization of crypto assets — Lava focuses on BTC-backed credit lines (BLOC) and self-custody savings services, offering bridge-like financial services that allow users to save in BTC and spend in USD, reflecting the accelerated convergence of Web3 and real-world finance.

Overall, the Web3 funding landscape in October 2025 displayed three key characteristics: capital return, structural reshaping, and confidence recovery. The rise of prediction markets, deep CeFi-TradFi integration, and capital concentration in stablecoin and infrastructure sectors collectively drove the resurgence of funding to high-energy levels. Web3 capital is shifting from narrative-driven speculation to structural upgrading, ushering the industry into a new cycle oriented toward sustainable growth and real value creation.

Reference:

- Cryptorank , https://cryptorank.io/funding-analytics

- Cryptorank, https://cryptorank.io/funding-rounds

- Orochi Network, https://orochi.network/

- Orochi Network, https://orochi.network/blog/orochi-network-secures-additional-8-m-bringing-total-funding-to-20-m-to-power-verifiable-data-infrastructure-for-rwa

- KapKap, https://www.kapkap.io/

- X, https://x.com/BlocksterCom/status/1983911254008709345

- Voyage, https://onvoyage.ai/

- X, https://x.com/onvoyage_ai/status/1978803530086658294

- TBook, https://www.tbook.com/

- chainwire, https://chainwire.org/2025/10/21/tbook-has-raised-5m-to-power-stablecoin-payouts-and-rwa-distribution/?mfk=jYDZLv73CAl2LD2%2BD9vCjUDc1iW7JEoWwkMGBTwsJoSBntEjBUN9Z2Bqe%2BP6JzaGdAKRHIU%2FjnxtNgea00qF148a89N3laJcykcQ9aFNzvPr

- Titan, https://www.lava.xyz/

- The Block, https://www.theblock.co/post/373096/bitcoin-lending-platform-lava-funding-new-yield-product

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"