Prévisions pour le prix de WHITE en 2025 : analyse des tendances du marché et perspectives de valorisation future

Introduction : Positionnement de WHITE sur le marché et valeur d’investissement

WhiteRock (WHITE), en tant que protocole dédié aux « real-world assets », occupe une place de plus en plus stratégique dans la tokenisation des actifs financiers traditionnels depuis sa création. En 2025, WhiteRock affiche une capitalisation boursière de 209,3 millions de dollars, avec une offre en circulation d’environ 650 milliards de tokens, pour un cours se stabilisant autour de 0,000322 dollar. Surnommé « le pont entre la finance traditionnelle et la blockchain », cet actif participe fortement à la transformation de l’accès aux marchés financiers internationaux.

Cette analyse propose une étude approfondie de l’évolution du cours de WhiteRock entre 2025 et 2030, en intégrant les tendances historiques, les dynamiques de l’offre et de la demande, l’évolution de l’écosystème ainsi que les facteurs macroéconomiques, afin d’offrir des prévisions professionnelles et des stratégies d’investissement adaptées aux investisseurs.

I. Historique du cours de WHITE et état du marché

Historique du cours de WHITE

- 2025 : Lancement du protocole WhiteRock, record historique (ATH) à 0,0027701 dollar le 29 mai

- 2025 : Correction du marché, point bas (ATL) à 0,0002197 dollar le 8 août

- 2025 : Phase de rebond, stabilisation autour de 0,000322 dollar au 24 septembre

Situation actuelle du marché WHITE

Au 24 septembre 2025, le token WHITE s’échange à 0,000322 dollar, avec un volume de transactions sur 24 heures de 18 553,90 dollars. La valeur a progressé de 1,67 % sur la dernière journée, illustrant une dynamique haussière à court terme. Toutefois, sur des horizons plus longs, WHITE accuse un recul de 18,52 % sur la semaine et une baisse de 21,27 % sur 30 jours.

La capitalisation boursière actuelle de WHITE atteint 209 300 000 dollars, ce qui le place au 287e rang du marché mondial des cryptomonnaies. Le protocole totalise 650 milliards de tokens en circulation pour une offre totale fixée à 1 trillion, soit un taux de circulation de 65 %.

Malgré la récente tendance baissière, WHITE s’est distingué par une croissance annuelle impressionnante, enregistrant une hausse de 2 147,72 %. Cette performance reflète l’intérêt soutenu des investisseurs pour la tokenisation d’actifs réels proposée par WhiteRock.

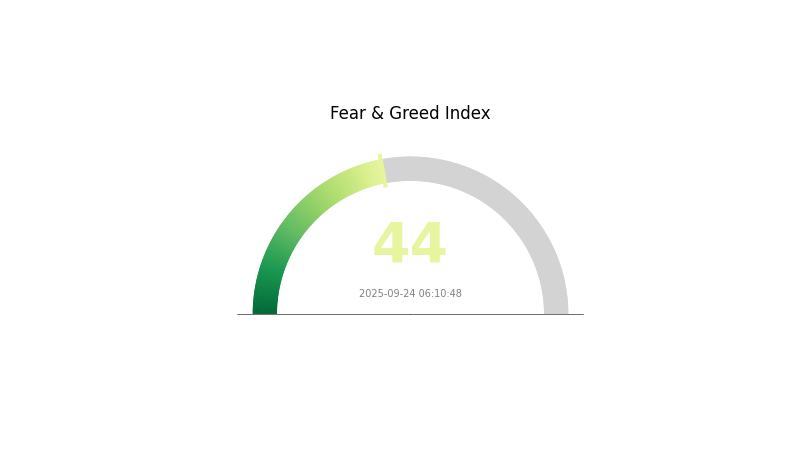

À l’heure actuelle, le sentiment de marché concernant WHITE est en zone « Fear », avec un indice VIX de 44, traduisant une approche prudente des investisseurs face aux dernières corrections et à la conjoncture générale du marché.

Consultez le cours en temps réel de WHITE

Indicateur du sentiment de marché WHITE

24 septembre 2025 : Fear and Greed Index : 44 (« Fear »)

Consultez l’indice Fear & Greed

Le marché crypto traverse une phase d’incertitude, comme en atteste un score de 44 à l’indice Fear and Greed, correspondant à un climat de peur parmi les investisseurs. Ce contexte invite à la prudence ; néanmoins, ces moments d’aversion au risque peuvent offrir des opportunités d’achat pour les investisseurs long terme, certains actifs pouvant se trouver sous-évalués. Il est impératif de réaliser une analyse approfondie et d’évaluer les risques avant toute décision, tout en restant attentif aux tendances du secteur et aux nouveautés du marché.

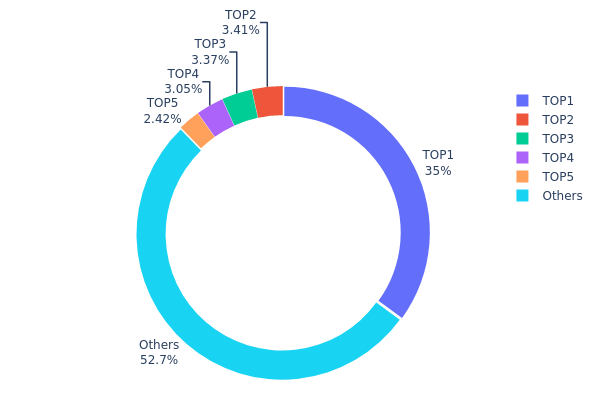

Répartition des détentions de WHITE

L’analyse de la distribution des adresses WHITE révèle une forte concentration de tokens entre quelques détenteurs majeurs. L’adresse principale concentre 35 % de l’offre totale, soit une part conséquente pour un acteur unique. Les quatre autres plus importants détenteurs cumulent 12,24 % supplémentaires. Ce niveau de concentration traduit une distribution assez centralisée du token.

Cette concentration peut affecter la dynamique de marché : la présence de « whales » peut générer un surcroît de volatilité et impacter la liquidité. Des mouvements importants de ces adresses majeures risquent de provoquer des fluctuations notables, et leur influence soulève des questions quant à la stabilité et à la possibilité de manipulation du cours et des volumes.

Sur le plan structurel, la répartition actuelle suggère une faible décentralisation du token WHITE. Si 52,76 % des tokens sont disséminés sur d’autres adresses, la prépondérance de quelques grands porteurs rend la structure on-chain plus vulnérable à des phénomènes soudains en cas de changement de stratégie de leur part.

Consultez la répartition des détenteurs WHITE

| Top | Adresse | Quantité détenue | Pourcentage |

|---|---|---|---|

| 1 | 0x7c6c...37d4e0 | 350 000 000,00K | 35,00 % |

| 2 | 0x8bcc...3f585a | 34 084 266,27K | 3,40 % |

| 3 | 0xe9c3...8decdd | 33 730 150,06K | 3,37 % |

| 4 | 0x5fb7...aab294 | 30 534 826,30K | 3,05 % |

| 5 | 0xc4d2...152f43 | 24 219 845,65K | 2,42 % |

| - | Autres | 527 430 911,73K | 52,76 % |

II. Facteurs essentiels déterminant l’évolution future du cours de WHITE

Environnement macroéconomique

- Influence des politiques monétaires : Les principales banques centrales devraient maintenir une politique accommodante pour soutenir la reprise mondiale.

- Rôle de couverture contre l’inflation : WHITE montre un potentiel comme valeur refuge dans le contexte d’une inflation mondiale persistante.

- Risques géopolitiques : Les tensions internationales et disputes commerciales affectent toujours l’évolution du token.

Développement technologique et construction de l’écosystème

- Améliorations blockchain : Toute avancée sur la technologie sous-jacente de WHITE pourrait renforcer sa scalabilité et enrichir ses fonctionnalités.

- Applications et adoption : Le déploiement de DApps et de nouveaux projets au sein de l’écosystème WHITE jouera un rôle clé dans l’adoption et la valorisation du token.

III. Prévisions de cours de WHITE pour 2025-2030

Scénario 2025

- Prévision prudente : 0,00022 – 0,00028 dollar

- Prévision neutre : 0,00028 – 0,00036 dollar

- Prévision optimiste : 0,00036 – 0,00046 dollar (sous réserve d’une adoption forte du marché)

Scénario 2026 à 2028

- Phase de marché attendue : croissance progressive et adoption élargie

- Prévisions de cours :

- 2026 : 0,00028 – 0,00048 dollar

- 2027 : 0,00040 – 0,00051 dollar

- 2028 : 0,00038 – 0,00066 dollar

- Facteurs moteurs : avancées technologiques, nouveaux partenariats et dynamique globale du marché crypto

Scénario long terme 2029-2030

- Cas de base : 0,00052 – 0,00076 dollar (hypothèse de croissance régulière du marché)

- Scénario optimiste : 0,00076 – 0,00098 dollar (en cas d’adoption massive et contexte très favorable)

- Scénario transformationnel : 0,00098 dollar et plus (si le secteur crypto connaît des avancées majeures)

- 31 décembre 2030 : estimation du prix moyen WHITE à 0,00066 dollar selon les projections actuelles

| Année | Prix max prévu | Prix moyen prévu | Prix min prévu | Variation (%) |

|---|---|---|---|---|

| 2025 | 0,00046 | 0,00032 | 0,00022 | 0 |

| 2026 | 0,00048 | 0,00039 | 0,00028 | 21 |

| 2027 | 0,00051 | 0,00044 | 0,00040 | 35 |

| 2028 | 0,00066 | 0,00047 | 0,00038 | 46 |

| 2029 | 0,00076 | 0,00057 | 0,00053 | 75 |

| 2030 | 0,00098 | 0,00066 | 0,00052 | 106 |

IV. Stratégies d’investissement et gestion des risques pour WHITE

Méthodes d’investissement WHITE

(1) Stratégie de détention à long terme

- Profil conseillé : Investisseurs souhaitant s’exposer aux actifs réels tokenisés

- Recommandations :

- Accumuler des tokens WHITE lors des phases de baisse

- Conserver sur une durée minimale de 1 à 2 ans pour maximiser la croissance potentielle de la valeur

- Stockage sécurisé via portefeuille matériel

(2) Stratégie de trading actif

- Outils d’analyse technique :

- Moyennes mobiles : surveiller les moyennes mobiles à 50 et 200 jours pour identifier les tendances

- RSI : exploiter les seuils de surachat/survente pour définir les points d’entrée et de sortie

- Points clés pour le swing trading :

- Définir strictement les seuils de stop-loss et de prise de profit

- Surveiller l’actualité du projet et les annonces de nouveaux partenariats

Cadre de gestion des risques WHITE

(1) Principes d’allocation d’actifs

- Investisseurs prudents : 1 à 3 % du portefeuille crypto

- Investisseurs dynamiques : 5 à 10 % du portefeuille crypto

- Investisseurs professionnels : jusqu’à 15 % du portefeuille crypto

(2) Outils de couverture des risques

- Diversification : investir sur différents projets tokenisant les actifs réels

- Ordres stop-loss : mise en place pour limiter les pertes potentielles

(3) Solutions de stockage sécurisé

- Portefeuille matériel recommandé : Gate Web3 Wallet

- Stockage à froid : portefeuille papier pour une détention longue durée

- Conseils de sécurité : activer la vérification à deux facteurs et choisir des mots de passe robustes

V. Risques et défis majeurs pour WHITE

Risques de marché pour WHITE

- Volatilité : fluctuations importantes des cours, fréquentes dans le secteur crypto

- Liquidité : obstacles potentiels pour les transactions de gros volumes

- Concurrence : émergence possible de nouvelles plateformes d’actifs tokenisés

Risques réglementaires WHITE

- Instabilité réglementaire : évolution permanente des règles internationales sur les actifs tokenisés

- Contraintes de conformité : nécessité de respecter les législations spécifiques à chaque juridiction

- Restrictions futures : limitations potentielles sur la détention ou l’échange d’actifs tokenisés

Risques techniques WHITE

- Failles des smart contracts : possibilité d’exploits ou de bugs

- Problèmes de scalabilité : risques de congestion lors d’augmentations de volume

- Complexité d’intégration : difficultés d’interfaçage avec les infrastructures financières traditionnelles

VI. Conclusion et recommandations opérationnelles

Évaluation de la valeur d’investissement de WHITE

WHITE constitue une solution pertinente à long terme pour relier la finance traditionnelle à la technologie blockchain. Il subsiste toutefois des risques de court terme, en particulier liés à l’incertitude réglementaire et à la volatilité du marché.

Recommandations pour l’investissement sur WHITE

✅ Débutants : privilégier les petits montants et s’informer sur la tokenisation des actifs

✅ Investisseurs expérimentés : envisager une allocation modérée, suivre de près les avancées du projet

✅ Investisseurs institutionnels : explorer les opportunités de partenariat et d’intégration aux systèmes financiers existants

Modalités de participation au marché WHITE

- Trading au comptant : acheter et conserver des tokens WHITE sur Gate.com

- Staking : participer aux programmes de staking proposés par le projet

- Intégration DeFi : explorer les protocoles DeFi compatibles avec le token WHITE

L’investissement en cryptomonnaies comporte un niveau de risque très élevé ; le présent article ne constitue en aucun cas un conseil financier. Les investisseurs doivent agir selon leur propre profil de risque et solliciter l’avis de conseillers professionnels. N’engagez jamais plus que ce que vous êtes prêt à perdre.

FAQ

Quelle est la prévision de cours pour l’action Whitecap ?

L’action Whitecap pourrait atteindre un prix moyen de 4,27 dollars en 2025, avec des sommets à 6,21 dollars et des planchers à 2,32 dollars.

Quelle cryptomonnaie affiche la plus forte prévision de cours ?

Bitcoin (BTC) reste la cryptomonnaie avec le potentiel de hausse le plus élevé pour 2025, suivi par Ethereum (ETH), selon les analyses de marché et les prévisions d’experts.

Quelles sont les prévisions de cours pour XRP en 2030 ?

Le cours du XRP pourrait osciller entre 4,67 dollars et 26,97 dollars en 2030, en fonction de l’adoption institutionnelle et du contexte réglementaire. Un niveau de 10 dollars demeure accessible en cas de conditions favorables et de forte demande institutionnelle.

Quelle est la prévision de cours pour l’action WC8 en 2025 ?

Le cours de l’action WC8 pour 2025 est estimé à 0,194 dollar en moyenne, avec une fourchette comprise entre 0,0653 dollar et 0,320 dollar.

Partager

Contenu