2025 TSTBSC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of TSTBSC

Test Token (TSTBSC) is a test token deployed on the BNB blockchain via Four.meme, designed solely for educational purposes. As of December 21, 2025, TSTBSC has achieved a market capitalization of approximately $14.51 million, with a circulating supply of 943.84 million tokens and a current price hovering around $0.01537. Despite its nascent stage and educational focus, the token has demonstrated significant price appreciation, with a one-year gain of 15,812.96% from its initial launch price.

This report will provide a comprehensive analysis of TSTBSC's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment guidance for stakeholders interested in this emerging digital asset.

I. TSTBSC Price History Review and Market Status

TSTBSC Historical Price Movement Trajectory

TSTBSC is a test token deployed on the BNB Chain (BSC) via Four.meme, serving educational purposes. Since its launch on December 18, 2025, the token has experienced significant volatility:

- February 9, 2025: All-time high of $0.5273, representing peak market sentiment and trading activity

- October 10, 2025: All-time low of $0.00378, marking a substantial market correction

- December 21, 2025: Current trading price of $0.01537, reflecting recent market adjustments

TSTBSC Current Market Status

Price Performance: TSTBSC is currently trading at $0.01537, down 6.29% over the last 24 hours and down 1.29% over the past hour. The token has shown modest recovery over the 7-day and 30-day periods, gaining 3.09% and 0.99% respectively. Over its lifetime, TSTBSC has increased approximately 15,812.96% from its launch price of $0.000007939, demonstrating exceptional volatility characteristic of test tokens on decentralized platforms.

Market Capitalization & Supply: With a market capitalization of $14,506,875.06, TSTBSC ranks 991st by market cap globally. The token maintains a 94.38% circulation ratio, with 943,843,530.38 tokens in circulation against a maximum supply of 1,000,000,000 tokens. The fully diluted valuation stands at $14,506,875.06.

Trading Activity: 24-hour trading volume totals $23,603.94, with the token trading within a 24-hour range of $0.01531 to $0.01661. TSTBSC is listed on 21 exchanges and holds a market dominance of 0.00045%. The token currently has 44,762 holders, indicating a distributed user base for an educational test token.

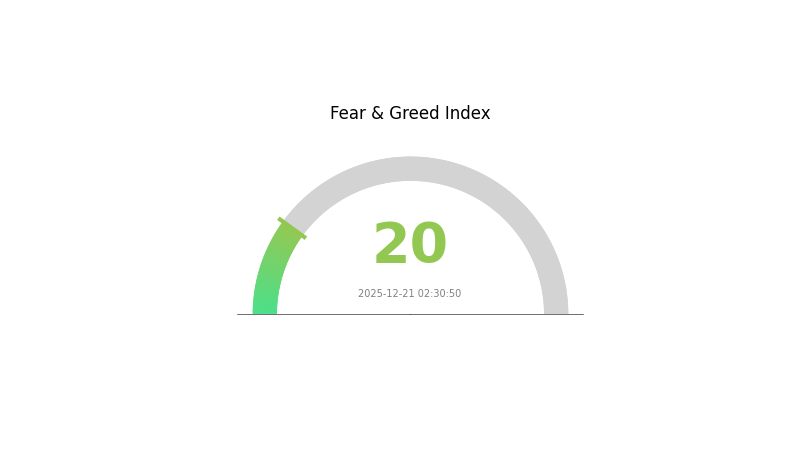

Market Sentiment: Current market sentiment shows extreme fear (VIX: 20), which may be influencing broader cryptocurrency market conditions and TSTBSC's recent price decline.

View the current TSTBSC market price

TSTBSC Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index registering at 20. This indicates heightened market anxiety and risk aversion among investors. When the index reaches such low levels, it typically reflects significant market volatility and negative sentiment. However, extreme fear often presents contrarian opportunities for long-term investors, as panic selling may create potential entry points. Traders should remain cautious and implement proper risk management strategies while monitoring market developments closely on Gate.com.

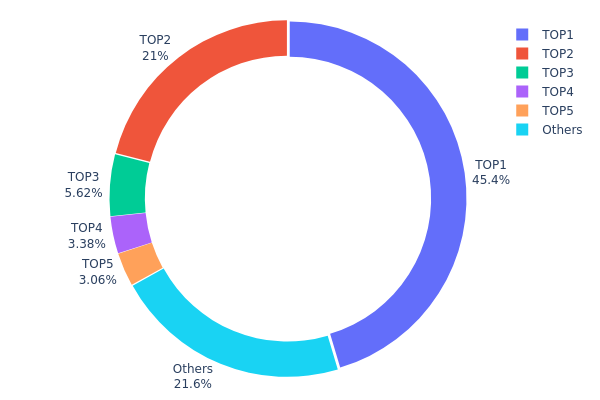

TSTBSC Holdings Distribution

The address holdings distribution chart illustrates the concentration of TSTBSC tokens across blockchain addresses, revealing the degree of token decentralization and potential risks associated with wealth concentration. By analyzing the top holders and their proportional stakes, investors can assess market structure stability and the likelihood of price manipulation or sudden liquidity shifts.

TSTBSC exhibits pronounced concentration characteristics, with the top five addresses controlling approximately 78.4% of the total token supply. The leading address (0x5a52...70efcb) alone accounts for 45.39% of holdings, representing an exceptionally high concentration level that warrants careful consideration. The second-largest holder (0xf977...41acec) maintains a 20.98% stake, while the remaining top three addresses collectively hold 11.03%. This distribution pattern suggests significant centralization risk, as a small number of stakeholders possess disproportionate influence over the token's circulating supply and potential price movements.

The remaining 21.6% of tokens distributed among other addresses indicates limited decentralization at the holder level. The substantial holdings by the top two addresses combined (66.37%) create notable potential for coordinated actions or unilateral decisions that could significantly impact market dynamics. This concentration structure typically correlates with higher price volatility and increased susceptibility to market manipulation, as major holders possess the capacity to trigger substantial liquidity events.

Click to view current TSTBSC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5a52...70efcb | 453919.49K | 45.39% |

| 2 | 0xf977...41acec | 209898.94K | 20.98% |

| 3 | 0x0000...00dead | 56156.47K | 5.61% |

| 4 | 0x4368...26f042 | 33795.46K | 3.37% |

| 5 | 0x1696...26b42b | 30588.45K | 3.05% |

| - | Others | 215641.19K | 21.6% |

II. Core Factors Influencing TSTBSC's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Interest rates and US dollar index movements have significant effects on price movements. Central bank policy expectations play a crucial role in market direction.

-

Inflation Hedge Characteristics: TSTBSC exhibits notable volatility during high inflation periods, reflecting its sensitivity to macroeconomic conditions and inflation cycles.

-

Geopolitical Factors: Cross-border transaction demand and international relations influence market dynamics and price trajectories.

Market Maturity and Adoption

-

Adoption Growth: Market maturity is expected to improve as adoption rates continue to climb, supporting long-term price appreciation potential through 2025-2030.

-

Market Sentiment: Trading sentiment plays a crucial role in price movements. Recent market sentiment remains subdued, which may present both challenges and opportunities for price recovery during year-end periods.

-

Investor Perception: Industry positioning is recognized by 31% of investors as an important influencing factor on TSTBSC's price performance.

III. 2025-2030 TSTBSC Price Forecast

2025 Outlook

- Conservative Prediction: $0.0104 - $0.01529

- Neutral Prediction: $0.01529

- Optimistic Prediction: $0.01881 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental adoption growth

- Price Range Predictions:

- 2026: $0.01568 - $0.02284 (10% upside potential)

- 2027: $0.01057 - $0.02972 (29% upside potential)

- Key Catalysts: Enhanced protocol functionality, increased institutional interest, ecosystem partnership announcements, and improved market liquidity on platforms such as Gate.com

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01267 - $0.02856 (61% appreciation by 2028, assuming stable market conditions and moderate adoption acceleration)

- Optimistic Scenario: $0.02189 - $0.03924 (73-114% appreciation by 2029-2030, assuming significant technological breakthroughs and mainstream adoption)

- Transformational Scenario: $0.03297 - $0.03528 (114% cumulative gain by 2030, contingent upon revolutionary use case adoption, regulatory clarity, and substantial capital inflows into the asset class)

Note: These forecasts represent analytical projections based on available data and should not be considered as investment advice. Market conditions, technological developments, and macroeconomic factors may significantly alter price trajectories.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01881 | 0.01529 | 0.0104 | 0 |

| 2026 | 0.02284 | 0.01705 | 0.01568 | 10 |

| 2027 | 0.02972 | 0.01995 | 0.01057 | 29 |

| 2028 | 0.02856 | 0.02483 | 0.01267 | 61 |

| 2029 | 0.03924 | 0.0267 | 0.02189 | 73 |

| 2030 | 0.03528 | 0.03297 | 0.02209 | 114 |

TSTBSC Professional Investment Strategy and Risk Management Report

IV. TSTBSC Professional Investment Strategy and Risk Management

TSTBSC Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Educational participants and risk-averse investors seeking exposure to emerging blockchain tokens

- Operational Suggestions:

- Establish a fixed dollar-cost averaging (DCA) entry strategy over multiple tranches to mitigate volatility risk

- Monitor the project's development milestones and community engagement on social channels (Twitter: @TestonBSC)

- Maintain a holding period of 12+ months to capture long-term price appreciation potential given the 15,812.96% annual gains

- Periodically rebalance portfolio allocation to maintain target exposure levels

(2) Active Trading Strategy

- Technical Analysis Tools:

- Candlestick Charting: Monitor 1-hour, 4-hour, and daily timeframes to identify breakout and reversal patterns

- Volume Analysis: Track the 24-hour trading volume of 23,603.94 TSTBSC to confirm price movements and market participation

- Swing Trading Key Points:

- Execute buy signals when price approaches the 24-hour low of 0.01531 with increasing volume

- Set profit-taking targets at resistance levels, referencing the all-time high of 0.5273 as the ultimate target

- Implement strict stop-loss orders 5-10% below entry points to protect against sudden reversals

TSTBSC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Active Investors: 3-5% portfolio allocation maximum

- Professional Investors: Up to 10% portfolio allocation with hedging strategies

(2) Risk Mitigation Approaches

- Portfolio Diversification: Balance TSTBSC holdings with established cryptocurrency assets to reduce concentration risk

- Position Sizing: Strictly limit individual positions to predefined percentages of total capital to prevent catastrophic losses

- Regular Rebalancing: Quarterly portfolio reviews to maintain target allocation ratios

(3) Secure Storage Solutions

- Self-Custody Best Practices: Store TSTBSC tokens in secure wallets with private key management under your full control

- Exchange Storage: For active traders, maintain minimal holdings on Gate.com for immediate liquidity and trading capability

- Security Considerations: Enable all available security features including two-factor authentication, withdrawal whitelisting, and regular address verification; never share private keys or seed phrases with third parties

V. TSTBSC Potential Risks and Challenges

TSTBSC Market Risk

- Extreme Volatility: TSTBSC exhibits significant price fluctuations, with a 24-hour decline of -6.29% and historical volatility ranging from 0.00378 to 0.5273, creating substantial downside exposure

- Liquidity Constraints: With a market cap of only 14.5 million USD and 21 trading venues, liquidity may be insufficient for large position entries or exits, potentially resulting in significant slippage

- Low Trading Volume: The 24-hour volume of 23,603.94 represents limited market activity, indicating potential difficulty in executing large orders at desired prices

TSTBSC Regulatory Risk

- Emerging Market Classification: As a test token deployed on BSC networks, TSTBSC operates in a less-regulated environment with uncertain future regulatory frameworks

- Compliance Uncertainty: Regulatory changes targeting meme tokens or test tokens could adversely impact token utility, trading permissions, or project viability

- Geographic Restrictions: Some jurisdictions may restrict or prohibit trading of test tokens, limiting market access and reducing token demand

TSTBSC Technical Risk

- Smart Contract Vulnerability: As a BEP-20 token, potential undiscovered bugs or exploits in the contract code (address: 0x86bb94ddd16efc8bc58e6b056e8df71d9e666429) could result in total loss of capital

- Network Dependency: TSTBSC's operation on BSC infrastructure exposes it to network congestion, technical failures, or blockchain reorganization events

- Token Concentration: With 94.38% of total supply in circulation and 44,762 token holders, large holders possess significant price manipulation capabilities

VI. Conclusion and Action Recommendations

TSTBSC Investment Value Assessment

TSTBSC is explicitly designed as an educational test token with no inherent utility beyond learning purposes. The token's 15,812.96% annual return reflects extreme volatility rather than fundamental value creation. While the 0.01537 current price presents apparent entry opportunities relative to the 0.5273 all-time high, investors should recognize that this is a highly speculative instrument designed for educational purposes. The limited market liquidity, concentrated holder distribution, and test-token classification present significant downside risks that far exceed typical cryptocurrency assets.

TSTBSC Investment Recommendations

✅ Beginners: Limit participation to small, non-essential capital amounts (under 1% of portfolio) solely for educational understanding of token mechanics and market dynamics; treat this exclusively as a learning tool rather than a wealth-building investment

✅ Experienced Investors: Consider tactical positions capped at 3-5% of portfolio allocation with strict stop-loss orders at 10-15% below entry; utilize technical analysis to identify optimal entry points during low-volume periods

✅ Institutional Investors: Avoid direct TSTBSC allocation; if exposure is required for research purposes, utilize Gate.com infrastructure for regulated market access and maintain positions below 1% of trading capital

TSTBSC Trading Participation Methods

- Gate.com Spot Trading: Execute direct TSTBSC purchases and sales through Gate.com's spot market interface with real-time order matching and transparent pricing

- Limit Order Placement: Set predefined buy orders at support levels (0.01531) and sell orders at resistance levels (0.01661) to automate trading based on technical signals

- Portfolio Monitoring: Utilize Gate.com's portfolio tracking tools to monitor real-time price movements, calculate percentage gains/losses, and manage risk metrics

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must assess their individual risk tolerance and financial situation before making allocation decisions. Strongly recommend consulting with professional financial advisors. Never invest capital you cannot afford to lose completely. TSTBSC's classification as an educational test token amplifies risk exposure beyond standard cryptocurrency investments.

FAQ

Is TST coin a good investment?

TST coin presents promising potential with its zero transaction fees and growing ecosystem. Strong fundamentals and increasing adoption suggest positive investment prospects. Consider your risk tolerance and do thorough research before investing.

What is the future price of TST?

Based on current market analysis, TST is projected to reach approximately $0.011025 by 2027, reflecting a 10.25% growth rate. This forecast considers ongoing market trends and token fundamentals.

What factors affect TSTBSC price movement?

TSTBSC price is influenced by supply/demand dynamics, protocol upgrades, trading volume, macroeconomic factors like interest rates, market sentiment, and broader cryptocurrency trends.

How has TST price performed historically?

TST has demonstrated significant volatility in its price history. The token has reached notable all-time highs and currently trades in the range of $0.00017434 to $0.0001748 over 24-hour periods, reflecting active market participation and dynamic price movements.

What is the current market cap and trading volume of TSTBSC?

As of December 21, 2025, TSTBSC has a market cap of $14.8 million. The trading volume data is currently undisclosed. With a circulating supply of approximately 943.8 million tokens, TSTBSC continues to maintain its position in the crypto market.

NKN ($NKN) Price Prediction: Can Decentralized Networks Push It to $0.50 in 2025?

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

Greater Fool Theory Explained: Buying for the Next Buyer, Not Value

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

Buying ALON Tokens: A Beginner's Guide

Is Sweat Economy (SWEAT) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors

Is NuriTopia (NBLU) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is Sperax (SPA) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook in 2024

Is KernelDao (KERNEL) a good investment?: A Comprehensive Analysis of Token Value, Market Potential, and Risk Factors