2025 TNSR Price Prediction: Expert Analysis and Market Forecast for Tensor's Future Value

Introduction: TNSR's Market Position and Investment Value

Tensor (TNSR) serves as Solana's leading NFT marketplace designed for both traders and creators, establishing itself as a key infrastructure project within the Solana ecosystem since its launch in April 2024. As of December 2025, TNSR has achieved a market capitalization of approximately $28.74 million with a circulating supply of around 334.61 million tokens, currently trading at $0.08589. This asset plays an increasingly important role in facilitating NFT trading and creator engagement on the Solana blockchain.

This article will conduct a comprehensive analysis of TNSR's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies. By examining key metrics such as the token's 24-hour decline of -3.58% and its substantial year-to-date performance, we aim to deliver actionable insights for navigating TNSR's market opportunities and risks.

I. TNSR Price History Review and Current Market Status

TNSR Historical Price Evolution Trajectory

-

April 2024: Token launch and market debut, reaching all-time high (ATH) of $3.89 on April 8, 2024.

-

2024-2025: Significant price decline phase, with TNSR experiencing substantial downward pressure throughout the year.

-

October 2025: Price touched all-time low (ATL) of $0.02852 on October 10, 2025, representing a major market correction.

-

December 2025: Recovery phase initiated, with price currently at $0.08589 as of December 19, 2025, recovering from the previous lows.

TNSR Current Market Situation

As of December 19, 2025, TNSR is trading at $0.08589, representing a recovery of approximately 201% from its all-time low recorded in October 2025. The token displays mixed short-term momentum with a -3.58% decline over the past 24 hours and -0.42% pullback in the last hour, yet demonstrates positive momentum on a 30-day timeframe with a +5.54% gain.

The current market capitalization stands at $28.74 million with a fully diluted valuation of $85.89 million. The circulating supply comprises 334.61 million TNSR tokens out of a total supply of 1 billion tokens, representing a 33.46% circulation ratio. Daily trading volume reached $376,604.91, with the token trading between $0.08368 and $0.08983 over the 24-hour period.

TNSR holds a market ranking of 711 with a market dominance of 0.0026%. The token has attracted 22,667 token holders and is available on 38 cryptocurrency exchanges, demonstrating broad market accessibility. The 1-year performance reflects significant losses, with a -83.05% decline from its launch price levels.

Market sentiment remains cautious, with the current VIX indicator showing "Extreme Fear" conditions in the broader cryptocurrency market, which may continue to influence TNSR's price action in the near term.

Click to view current TNSR Market Price

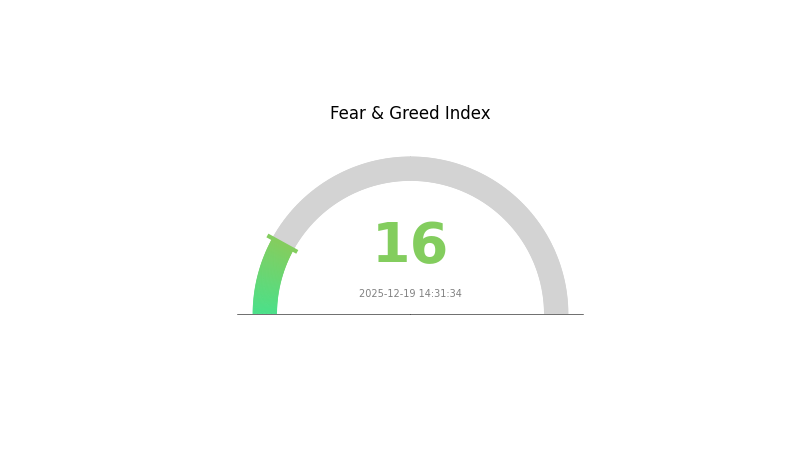

Cryptocurrency Market Sentiment Indicator

Date: 2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 16, signaling widespread panic among investors. This historically low level indicates maximum market pessimism and potential capitulation selling. Such extreme fear conditions often precede significant market rebounds, as fear-driven sell-offs can create compelling entry opportunities for long-term investors. However, caution remains warranted as downward pressure may persist in the short term. Monitor the index closely on Gate.com for sentiment shifts that could signal a potential market reversal or continued downward momentum.

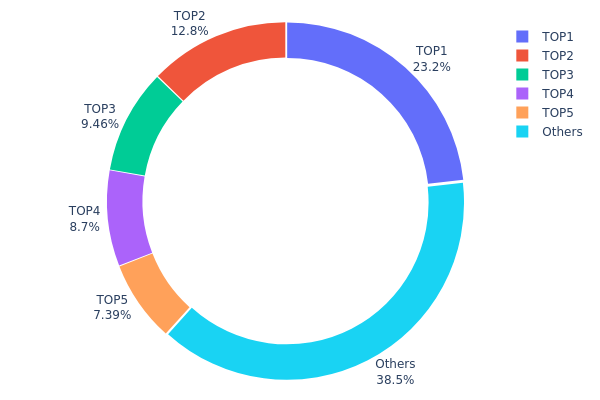

TNSR Holdings Distribution

The address holdings distribution chart illustrates the concentration of TNSR tokens across the blockchain network, revealing how token supply is distributed among individual wallet addresses. This metric serves as a critical indicator for assessing the decentralization level and potential market manipulation risks within the TNSR ecosystem.

Current analysis of the top five addresses indicates a moderate degree of concentration risk. The leading address (FZDZuL...FLQ6ND) controls 23.20% of total holdings, while the top two addresses collectively command 35.95% of the token supply. The top five addresses account for 61.50% of all TNSR tokens in circulation, leaving 38.50% distributed among the remaining holder base. This concentration pattern suggests that while TNSR exhibits some degree of centralization in its early distribution phase, it has not reached critically dangerous levels. The substantial portion held by dispersed smaller holders (38.50%) provides a stabilizing counterweight to the major address accumulations.

The current holdings structure presents moderate risks to market stability. Large holders possess considerable influence over token supply dynamics and could potentially influence price movements through coordinated transactions. However, the absence of any single dominant whale address holding over 25% and the relatively robust tail of smaller investors mitigate extreme manipulation scenarios. This distribution pattern is typical of cryptocurrencies in their growth phase, where early supporters and project-aligned entities maintain significant positions while community adoption gradually redistributes holdings across a broader addressbase.

Click to view current TNSR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | FZDZuL...FLQ6ND | 181912.39K | 23.20% |

| 2 | GzFKSq...TCQZRg | 99999.90K | 12.75% |

| 3 | 9WzDXw...YtAWWM | 74149.99K | 9.46% |

| 4 | FEhNUh...KK7H4J | 68214.75K | 8.70% |

| 5 | DUhy8s...uHyvrc | 57943.11K | 7.39% |

| - | Others | 301570.96K | 38.5% |

II. Core Factors Influencing TNSR's Future Price

Technology Development and Ecosystem Construction

-

Technology Upgrades and AI-DeFi Narrative: TNSR's price is influenced by technology upgrades and the AI-DeFi narrative within the Solana ecosystem. These technological advancements drive ecosystem expansion and innovation.

-

Solana Ecosystem Development: As a prominent NFT protocol within the Solana ecosystem, TNSR's price trajectory is closely tied to broader Solana ecosystem growth, adoption, and development initiatives.

-

Ecosystem Applications: TNSR applications span governance voting, trading fee discounts, and ecosystem incentives. As the ecosystem expands, the utility and application scenarios of TNSR continue to extend, potentially supporting long-term value appreciation.

Macroeconomic Environment

- Market Volatility: TNSR exhibits significant price volatility characterized by sharp rallies followed by pullbacks. The cryptocurrency market remains highly unstable, with price fluctuations driven by news events, economic data, and market sentiment. Price predictions for TNSR in 2025 range between $0.090021 and $0.118444, with potential growth of 173.3% by 2029 if reaching upper price targets, though such projections do not account for sudden and extreme price swings.

III. TNSR Price Forecast 2025-2030

2025 Outlook

- Conservative Prediction: $0.05664-$0.08582

- Neutral Prediction: $0.08582

- Bullish Prediction: $0.1047 (requiring sustained market momentum and positive ecosystem developments)

2026-2028 Medium-Term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth, supported by increasing adoption and protocol improvements

- Price Range Predictions:

- 2026: $0.07335-$0.13432 (11% upside potential)

- 2027: $0.06658-$0.15611 (33% upside potential)

- 2028: $0.07585-$0.18421 (58% upside potential)

- Key Catalysts: Network expansion, strategic partnerships, enhanced tokenomics implementation, and growing institutional interest in the ecosystem

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.13746-$0.23495 by 2029 (86% potential appreciation), declining to $0.15791-$0.20726 by 2030 (130% cumulative gain), reflecting market maturation and consolidation

- Bullish Scenario: $0.23495-$0.25000 range (assuming accelerated adoption, successful protocol upgrades, and expanding DeFi integration)

- Transformative Scenario: $0.30000+ range (extreme favorable conditions including breakthrough technological innovations, mainstream institutional adoption, and significant market-wide bull cycle expansion)

- 2030-12-31: TNSR reaching $0.20726 as potential support level (market consolidation phase initiated)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1047 | 0.08582 | 0.05664 | 0 |

| 2026 | 0.13432 | 0.09526 | 0.07335 | 11 |

| 2027 | 0.15611 | 0.11479 | 0.06658 | 33 |

| 2028 | 0.18421 | 0.13545 | 0.07585 | 58 |

| 2029 | 0.23495 | 0.15983 | 0.13746 | 86 |

| 2030 | 0.20726 | 0.19739 | 0.15791 | 130 |

TNSR Professional Investment Strategy and Risk Management Report

IV. TNSR Professional Investment Strategy and Risk Management

TNSR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Risk-averse investors seeking exposure to the Solana NFT ecosystem with a 12+ month investment horizon

- Operational Recommendations:

- Accumulate TNSR during market downturns, particularly when the token trades below $0.10

- Dollar-cost averaging (DCA) approach: invest fixed amounts monthly to reduce timing risk

- Hold tokens through market cycles, targeting exits during ATH periods or when fundamental developments justify reallocation

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: Monitor support levels near $0.08-$0.09 and resistance at $0.10-$0.12 for entry and exit signals

- Volume Analysis: Watch 24-hour volume trends relative to the 376,604.91 USDT average to confirm breakout validity

-

Wave Trading Key Points:

- Exploit volatility within the 24-hour range ($0.08368 - $0.08983) for intraday profits

- Identify trend reversals when price action contradicts the broader -3.58% daily and -9.54% weekly downtrend

- Set stop-losses at 2-3% below entry points to manage downside risk

TNSR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Moderate Investors: 2-5% of portfolio allocation

- Aggressive Investors: 5-10% of portfolio allocation

(2) Risk Hedging Strategies

- Diversification Approach: Combine TNSR holdings with Solana (SOL) and stablecoins to reduce single-token concentration risk

- Position Sizing: Limit individual TNSR trades to 3-5% of total capital to contain potential losses

(3) Secure Storage Solutions

- Hot Wallet Strategy: Use Gate Web3 Wallet for active trading and frequent transactions, balancing accessibility with reasonable security measures

- Cold Storage Approach: Transfer significant TNSR holdings to hardware wallets for long-term storage, minimizing exposure to online vulnerabilities

- Critical Security Considerations:

- Never share private keys or seed phrases with third parties

- Enable two-factor authentication (2FA) on all exchange and wallet accounts

- Verify smart contract addresses before executing transfers

- Keep software and security tools updated to defend against emerging threats

- Use strong, unique passwords and consider password managers

V. TNSR Potential Risks and Challenges

TNSR Market Risks

- High Volatility: TNSR exhibits extreme price swings, with a year-to-date decline of -83.05% and a 52-week trading range from $0.02852 to $3.89, creating significant losses for poor timing

- Illiquidity Risk: Daily trading volume of $376,604.91 USDT may be insufficient to absorb large institutional positions without significant price slippage

- Market Sentiment Dependency: As an NFT marketplace token, TNSR is highly sensitive to broader crypto market sentiment and NFT sector trends, making it vulnerable to rapid sentiment shifts

TNSR Regulatory Risks

- NFT Classification Uncertainty: Regulatory bodies globally continue to refine guidance on NFT and digital collectibles, creating potential legal ambiguity for Tensor's operational framework

- Jurisdiction-Specific Restrictions: Certain countries may restrict or prohibit NFT trading platforms, impacting Tensor's user base and revenue generation

- Tax Compliance Complexity: NFT transactions carry complex tax implications that differ by jurisdiction, potentially creating regulatory friction for users

TNSR Technology Risks

- Solana Network Dependency: TNSR operates exclusively on the Solana blockchain; network outages, congestion, or technical failures directly impact platform functionality

- Smart Contract Vulnerabilities: NFT marketplace smart contracts carry inherent security risks including potential exploits, bugs, or unintended interactions that could compromise user assets

- Cross-Chain Limitations: Current functionality is restricted to the Solana network, limiting TNSR's utility if the broader ecosystem shifts toward multi-chain solutions

VI. Conclusion and Action Recommendations

TNSR Investment Value Assessment

Tensor (TNSR) operates as a governance and utility token for Solana's leading NFT marketplace, offering meaningful exposure to the digital collectibles ecosystem. The token currently trades at $0.08589 with a market capitalization of $28.74 million and a fully diluted valuation of $85.89 million, representing approximately 33.46% circulation of its one billion token supply. While TNSR provides strategic positioning within the Solana economy, the -83.05% year-to-date decline and 24-hour negative momentum of -3.58% indicate recent bearish pressure. The token's value fundamentally depends on Tensor marketplace adoption, NFT sector recovery, and Solana ecosystem growth, making it suitable only for risk-tolerant investors with conviction in long-term NFT market development.

TNSR Investment Recommendations

✅ Newcomers: Begin with micro-allocations (1-2% of portfolio) through dollar-cost averaging, limiting individual trades to amounts you can comfortably lose. Use Gate.com's educational resources to understand NFT marketplace mechanics and token economics before increasing exposure.

✅ Experienced Investors: Deploy 3-5% portfolio allocation using technical analysis to identify optimal entry points near support levels. Implement disciplined stop-loss protocols at 2-3% below entry and consider rotating positions based on relative strength within the Solana ecosystem.

✅ Institutional Investors: Conduct deep due diligence on Tensor's market share within the Solana NFT ecosystem, user retention metrics, and platform revenue sustainability. Negotiate significant position accumulation through OTC channels to minimize market impact, and establish custodial arrangements through established infrastructure providers.

TNSR Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold TNSR tokens directly on the exchange platform, leveraging competitive trading fees and Gate.com's security infrastructure for immediate exposure

- Gate Web3 Wallet Integration: Transfer TNSR to Gate Web3 Wallet for self-custody, enabling direct participation in Tensor platform governance while maintaining private key control

- Dollar-Cost Averaging Programs: Establish recurring purchases at fixed intervals through Gate.com's automated tools to systematically build positions while reducing timing risk

Cryptocurrency investments carry extreme risk and may result in total capital loss. This report does not constitute investment advice. All investors must conduct independent research, assess personal risk tolerance, and consult qualified financial advisors before deploying capital. Never invest funds you cannot afford to lose completely.

FAQ

What is TNSR crypto?

TNSR is a governance token for Solana's leading NFT marketplace, enabling decentralized control and ecosystem participation. It empowers traders and supports the platform's protocols and operations.

Who is the owner of TNSR coin?

TNSR coin is owned and led by Richard Wu, who serves as CEO. Kamran Rawji is the co-founder and CTO. The project is backed by a dedicated team in the Tensor ecosystem.

What is the current price of TNSR and what factors influence it?

TNSR's price is determined by market demand, trading volume, and overall crypto market sentiment. Factors include adoption rates, technological developments, and macroeconomic conditions affecting the broader blockchain ecosystem.

What is TNSR's price prediction for 2025?

TNSR price prediction for 2025 shows minimal value based on current analysis. However, 2026 forecasts suggest recovery with minimum price around $0.091191229, averaging $0.09773767 per token according to machine gradient and WalletInvestor analysis.

What are the risks and opportunities for TNSR investment?

TNSR presents volatility and liquidity risks typical of crypto assets, but offers significant opportunities in the expanding blockchain ecosystem. Strong fundamentals and growing adoption could drive substantial returns for strategic investors.

What Factors Are Driving the Current Price Volatility in the Crypto Market?

Is Tensor (TNSR) a good investment?: A comprehensive analysis of opportunities and risks in the emerging AI infrastructure market

How to convert SOL to USD: Real-time Solana price calculator

2025 PENGUPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 RAYPrice Prediction: Analyzing Growth Factors and Market Potential for RAY Token in the Coming Years

2025 POPCAT Price Prediction: Exploring Future Market Trends and Investment Potential in the Digital Feline Economy

Xenea Daily Quiz Answer 20 december 2025

Ethereum 2.0: Staking Rewards and Market Insights

Your Comprehensive Guide to Web3 Identity Verification with Galxe Passport

Understanding Ethereum Inscriptions: Beginner's Guide to Ethscriptions

Coin Burning and Its Influence on Market Value