2025 SQD Price Prediction: Expert Analysis and Market Forecast for Squid Token's Future Value

Introduction: SQD's Market Position and Investment Value

Subsquid (SQD) is a hyper-scalable data access layer protocol that powers decentralized applications by providing essential blockchain indexing services. Since its launch in May 2024, Subsquid has established itself as a critical infrastructure component for dApp development. As of December 2025, SQD's fully diluted valuation has reached approximately $55.53 million, with a circulating supply of 161.4 million tokens and a current price hovering around $0.04153. This innovative indexing protocol is recognized for its ability to deliver exceptional user experiences by providing blockchain applications with the information they need to function optimally.

This article will comprehensively analyze SQD's price trajectory and market dynamics, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for the years ahead.

Subsquid (SQD) Market Analysis Report

I. SQD Price History Review and Current Market Status

SQD Historical Price Trajectory

- May 2024: Project launch and initial trading, SQD reached its all-time high of $0.5 on May 17, 2024

- November 2024: Market correction phase, SQD declined to its all-time low of $0.02288 on November 16, 2024

- December 2024 - Present: Recovery and stabilization period, SQD trading around $0.04153

SQD Current Market Dynamics

As of December 23, 2025, SQD is trading at $0.04153, representing a 3.21% increase over the past 24 hours. The token's 24-hour trading range spans from a low of $0.03956 to a high of $0.044.

Current market statistics indicate:

- Market Capitalization: $6,702,942

- Fully Diluted Valuation: $55,525,610

- 24-Hour Trading Volume: $268,567.06

- Circulating Supply: 161,400,000 SQD (12.07% of total supply)

- Total Supply: 1,337,000,000 SQD

- Market Dominance: 0.0017%

- Active Holders: 16,718

Short-term price performance shows mixed signals:

- 1-hour change: -1.9%

- 7-day change: -2.3%

- 30-day change: -11.08%

- 1-year change: -21.09%

The token demonstrates relatively low trading volume relative to its market cap, with a market sentiment score of 2 indicating extreme fear in the current market environment.

View current SQD market price

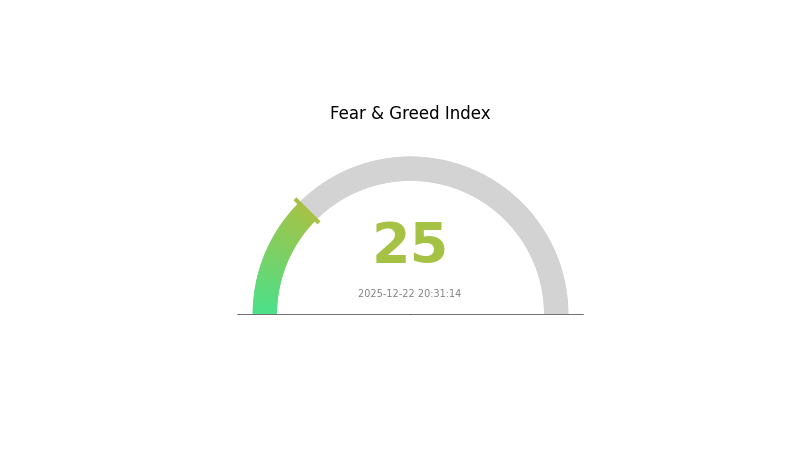

SQD Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 25. This exceptionally low reading indicates widespread pessimism and risk aversion among investors. Market participants are increasingly cautious, with selling pressure dominating recent trading activity. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic-driven price declines may create favorable entry points. However, caution remains advised until market sentiment stabilizes and confidence begins to recover. Monitor key support levels closely during this volatile period.

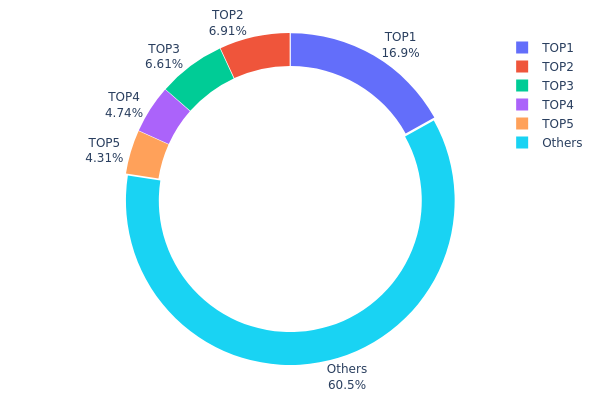

SQD Holdings Distribution

The address holdings distribution chart represents the concentration of token ownership across the top wallet addresses and the broader holder base. It provides critical insights into the decentralization level, liquidity dynamics, and potential market concentration risks associated with a cryptocurrency asset. By analyzing how tokens are distributed among major holders versus retail participants, this metric helps assess market maturity and vulnerability to large-scale price manipulation.

Current data reveals that SQD exhibits moderate concentration characteristics. The top five addresses collectively control approximately 39.43% of total token supply, with the largest holder commanding 16.89%. While this concentration level is not exceptional within the cryptocurrency market, it warrants attention. The top address holds 224.3 million tokens, representing a significant portion that could influence market movements if liquidated or deployed strategically. The secondary tier holders (addresses 2-5) maintain holdings between 4.30% and 6.90%, indicating a somewhat distributed structure beyond the dominant position.

The remaining 60.57% distributed across other addresses demonstrates a reasonable degree of decentralization, suggesting that retail and mid-tier investors constitute the majority stakeholder base. This distribution pattern reduces extreme concentration risk compared to highly centralized projects, though the top five holders' combined 39.43% stake still represents material influence over supply dynamics. The current structure indicates a moderately healthy market composition where large holders possess sufficient capital to provide liquidity support, while the broader base offers resilience against extreme volatility scenarios caused by single-entity actions.

Click to view current SQD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x36e2...fcae4e | 224300.00K | 16.89% |

| 2 | 0xb31a...ac9a51 | 91698.47K | 6.90% |

| 3 | 0x2677...6cb310 | 87800.00K | 6.61% |

| 4 | 0x86ac...50d8b6 | 62892.59K | 4.73% |

| 5 | 0x360a...de970a | 57167.76K | 4.30% |

| - | Others | 803661.50K | 60.57% |

Core Factors Influencing SQD's Future Price

II. Core Factors Affecting SQD's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The U.S. Federal Reserve's employment data and inflation trajectory will significantly influence SQD's price direction. Recent data shows unemployment rising to 4.6%, a four-year high, with wage growth slowing and inflation pressure fading. This scenario could support potential rate cuts in 2026, potentially increasing liquidity and benefiting alternative assets like SQD.

-

Market Sentiment and Capital Flows: Broader cryptocurrency market dynamics play a crucial role. Recent institutional fund flows, such as Ethereum spot ETF outflows, demonstrate how shifts in capital allocation can impact mid-cap tokens. SQD's price will be influenced by overall sentiment toward Layer 1 and infrastructure tokens in the crypto ecosystem.

-

Regulatory Environment: Regulatory clarity remains a critical factor for SQD's price trajectory. Changes in cryptocurrency regulations across major jurisdictions could either accelerate adoption or create headwinds for the token's growth.

Technology Development and Ecosystem Building

-

Project Development: SQD's future price is significantly influenced by technological advancements within the Subsquid protocol. Community engagement and continuous improvements to the platform's infrastructure are essential drivers of long-term value creation.

-

Market Trends and Innovation: SQD's positioning within the broader blockchain indexing and data infrastructure space will determine its competitive advantage. Adoption of new features and improvements to the platform's utility will directly impact investor confidence and price performance.

III. SQD Price Forecast for 2025-2030

2025 Outlook

- Conservative Estimate: $0.02966 - $0.03500

- Neutral Estimate: $0.03500 - $0.04244

- Optimistic Estimate: $0.04000 - $0.04244 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Accumulation and gradual appreciation phase with increasing utility adoption and ecosystem expansion

- Price Range Forecast:

- 2026: $0.03764 - $0.06064

- 2027: $0.03637 - $0.07018

- 2028: $0.05888 - $0.08559

- Key Catalysts: Enhanced protocol functionality, institutional adoption acceleration, market cycle recovery, and expanded DeFi integration on Gate.com and other trading platforms

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04828 - $0.08339 (assuming stable market conditions and moderate adoption growth)

- Optimistic Scenario: $0.05087 - $0.08559 (supported by widespread ecosystem adoption and positive macroeconomic sentiment)

- Transformative Scenario: $0.07315 - $0.08218 (predicated on breakthrough technology implementation and mainstream institutional participation)

- 2030-12-31: SQD reaching $0.08218 average price (reflecting sustained long-term value appreciation and market maturation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04244 | 0.0412 | 0.02966 | 0 |

| 2026 | 0.06064 | 0.04182 | 0.03764 | 0 |

| 2027 | 0.07018 | 0.05123 | 0.03637 | 23 |

| 2028 | 0.08559 | 0.0607 | 0.05888 | 46 |

| 2029 | 0.08339 | 0.07315 | 0.04828 | 76 |

| 2030 | 0.08218 | 0.07827 | 0.05087 | 88 |

Subsquid (SQD) Professional Investment Strategy and Risk Management Report

IV. SQD Professional Investment Strategy and Risk Management

SQD Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, long-term value believers in blockchain data infrastructure, and risk-averse investors seeking exposure to indexing protocols

- Operational Recommendations:

- Establish a core position during market downturns when SQD trades below $0.035, accumulating gradually over 3-6 months

- Hold through market cycles, targeting a 2-3 year minimum investment horizon to benefit from ecosystem growth

- Reinvest staking rewards or governance distributions to compound returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key levels at $0.03956 (24H low), $0.04153 (current price), and $0.044 (24H high) to identify entry and exit points

- Moving Averages: Use 50-day and 200-day moving averages to confirm trend direction and momentum shifts

- Swing Trading Considerations:

- Take advantage of the -2.3% weekly decline and -11.08% monthly decline to identify potential reversal zones

- Watch for volume expansion above 268,567 daily volume as confirmation of directional moves

- Set tight stop-losses at 5-7% below entry points given the asset's volatility profile

SQD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation, with strict stop-loss orders at -5% below entry price

- Aggressive Investors: 3-5% of portfolio allocation, allowing for higher volatility tolerance and active rebalancing

- Professional Investors: 5-10% of portfolio allocation with diversified entry points and hedging strategies

(2) Risk Hedging Approaches

- Dollar-Cost Averaging (DCA): Invest fixed amounts monthly to reduce timing risk and smooth out entry prices across market cycles

- Diversification Strategy: Balance SQD holdings with complementary blockchain infrastructure assets and traditional digital asset exposure

(3) Secure Storage Solutions

- Hardware Wallet Alternative: While specialized hardware wallets are not recommended in this analysis, ensure private key management through secure offline storage methods

- Exchange-Based Security: Maintain only active trading amounts on Gate.com, utilizing their advanced security features and withdrawal whitelist functionality

- Security Best Practices: Enable two-factor authentication (2FA), use complex passwords, never share seed phrases, and regularly audit wallet permissions

V. SQD Potential Risks and Challenges

SQD Market Risks

- Price Volatility: SQD has experienced a 57.4% decline from its all-time high of $0.50 (May 17, 2024) to the current price of $0.04153, indicating significant downside risk and potential for continued depreciation

- Liquidity Risk: With 24-hour trading volume of only $268,567 and market cap of $6.7 million, SQD faces substantial liquidity constraints that could result in slippage during large transactions

- Market Saturation: Competition from established indexing protocols may limit SQD's market share growth and token appreciation potential

SQD Regulatory Risks

- Classification Uncertainty: Potential regulatory classification of SQD as a security rather than a utility token could trigger enforcement actions or trading restrictions

- Geographic Restrictions: Regulatory crackdowns in major markets could reduce trading volume and liquidity on available platforms

- Compliance Changes: Evolution of global crypto regulations could impose additional operational or technical requirements on the Subsquid Network

SQD Technical Risks

- Protocol Vulnerabilities: Smart contract bugs or security exploits in the indexing protocol could compromise network integrity and token value

- Scalability Challenges: Failure to deliver on hyper-scalability promises could undermine the project's core value proposition

- Competition from Established Solutions: Pressure from mature indexing protocols with greater adoption and infrastructure investment

VI. Conclusions and Action Recommendations

SQD Investment Value Assessment

Subsquid Network presents a specialized play in the blockchain data infrastructure sector, offering exposure to critical indexing services that power decentralized applications. However, the 57.4% decline from all-time highs, combined with limited liquidity and modest market capitalization, reflects investor skepticism regarding near-term growth prospects. The project's technical merit in providing hyper-scalable data access is undermined by current market conditions, elevated competition, and uncertain tokenomics sustainability. Investors should approach SQD as a high-risk, speculative position suitable only for portfolios with substantial risk tolerance.

SQD Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of portfolio) through dollar-cost averaging on Gate.com, focusing on understanding the project fundamentals before increasing allocation. Prioritize learning about indexing protocols and blockchain infrastructure before committing capital.

✅ Experienced Investors: Consider tactical positions (2-5% allocation) using technical analysis to identify support levels, with predetermined exit strategies and hedging mechanisms. Actively monitor development progress and ecosystem adoption metrics.

✅ Institutional Investors: Structure positions through diversified entry strategies across market cycles (5-10% allocation maximum), with comprehensive due diligence on team credentials, tokenomics sustainability, and competitive positioning within the data infrastructure landscape.

SQD Trading Participation Methods

- Spot Trading on Gate.com: Purchase SQD directly using USDT or other stablecoins, with immediate settlement and custody options

- Limit Orders: Set buy orders at technical support levels ($0.035-$0.038 range) to optimize entry prices during volatility

- Portfolio Rebalancing: Periodically adjust SQD allocation based on performance against broader crypto market indices and portfolio objectives

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and financial circumstances. Consult qualified financial advisors before investing. Never invest funds you cannot afford to lose completely.

FAQ

What is sqd in crypto?

SQD is an ERC-20 token native to the SQD Network ecosystem. It rewards node operators for providing computation and storage resources, and enables community members to delegate SQD to trustworthy operators, ensuring network security and permissionless participation.

Why is SQD important?

SQD is important because it powers efficient blockchain indexing and data querying for Web3 applications. It enables developers to access real-time blockchain data quickly, supporting the infrastructure layer essential for decentralized apps and ecosystem growth.

Is subsquid on Coinbase?

Yes, Subsquid (SQD) is available on Coinbase. You can buy, sell, and trade SQD directly on the platform. Check Coinbase's official site for current availability and supported regions in your area.

What is the best AI crypto prediction for 2030?

By 2030, AI crypto revenues are projected to reach $10.2 billion. Blockchain technology will likely drive significant AI advancements, reflecting increasing adoption across the industry.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

2025 GUA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Discover Innovative Features of Solana Saga Mobile Device

Is Star Atlas (ATLAS) a good investment?: A Comprehensive Analysis of Risks, Potential Returns, and Market Prospects in the Metaverse Gaming Sector

Maximize Profits with Solana Yield Farming

Is Konnect (KCT) a good investment?: A Comprehensive Analysis of Price Performance, Market Potential, and Risk Factors