2025年MINA価格予測:有望な暗号資産の将来の成長性と市場要因を分析

2025年の価格予測分析を通じて、MINAの将来性を徹底解説します。MINAは業界最軽量のブロックチェーンプロトコルとして、高い投資価値が期待されています。主要市場要因や過去の価格推移、専門的な戦略をもとに、より精度の高い取引判断をサポートします。序論:MINAの市場地位と投資価値

MINA(MINA)は、世界最軽量級のブロックチェーンプロトコルとして2021年の登場以来、数々の重要な成果を達成してきました。2025年時点でMINAの時価総額は207,001,873ドル、流通供給量は約1,253,793,335トークン、価格は約0.1651ドルとなっています。「世界最軽量ブロックチェーン」と呼ばれる本資産は、現実世界と暗号資産の間に非公開なゲートウェイを構築する上で、ますます重要な役割を果たしています。

本記事では、2025年~2030年のMINA価格動向について、過去のトレンド、市場需給、エコシステムの進展、マクロ経済環境の分析を総合し、投資家に向けてプロフェッショナルな価格予測と実践的な投資戦略を提供します。

I. MINAの価格推移と現状

MINAの過去価格推移

- 2021年:ローンチ、6月1日に最高値9.09ドル達成

- 2022年:市場不振で価格大幅下落

- 2025年:6月23日に最安値0.147567ドル更新

MINAの市場現況

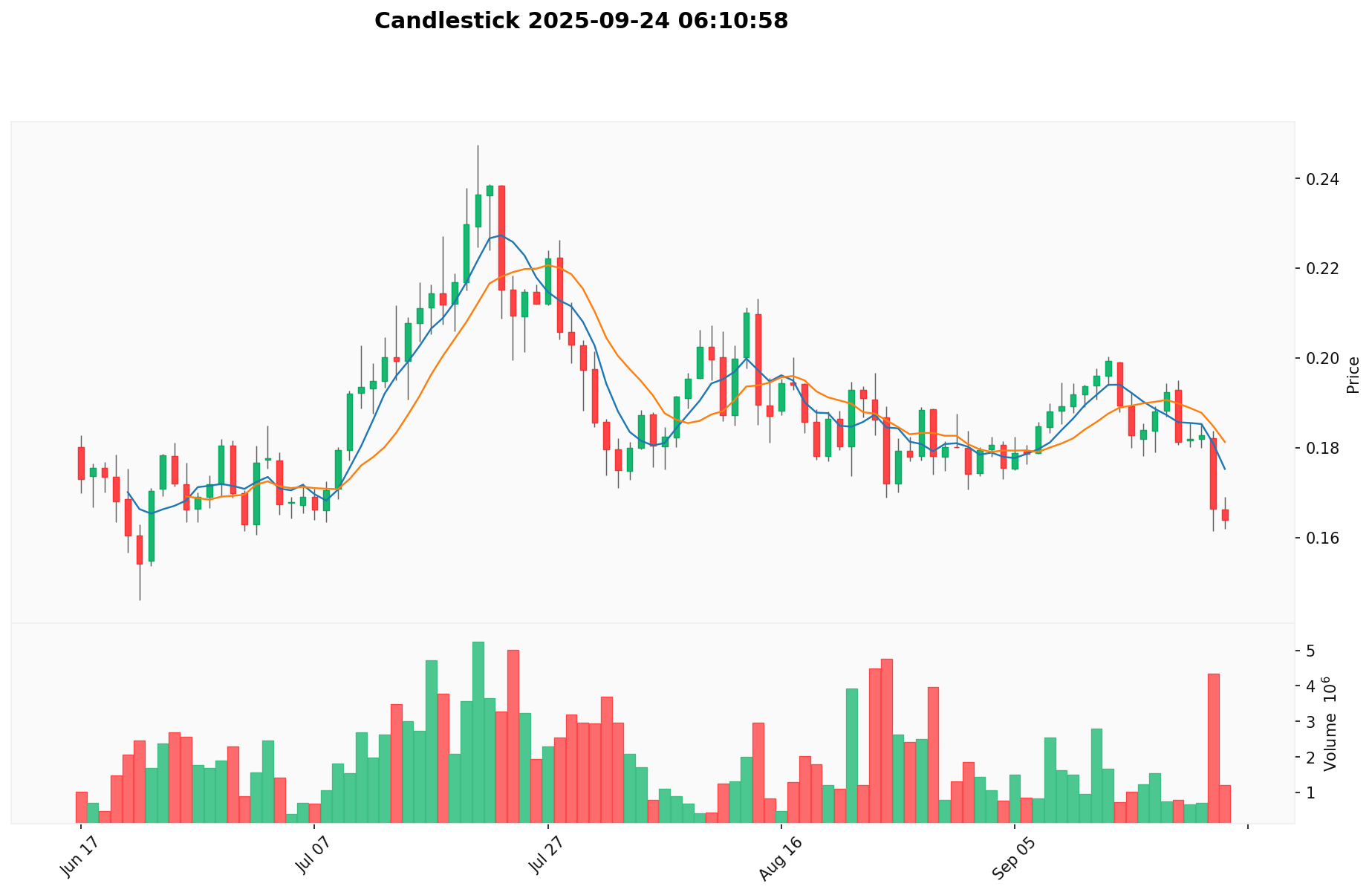

2025年09月24日現在、MINAの価格は0.1651ドルとなっています。過去24時間で0.18%上昇、取引高は225,582.35ドルです。時価総額は207,001,279ドルで、暗号資産市場ランキングは289位です。現在価格は過去最高値から98.18%下落、最安値から11.88%上昇しています。流通供給量は1,253,793,335.84 MINAで総供給量の99.99%を占めます。市場センチメントは「恐怖」領域にあり、VIX指数は44です。

最新のMINA 市場価格はこちら

MINA市場センチメント指標

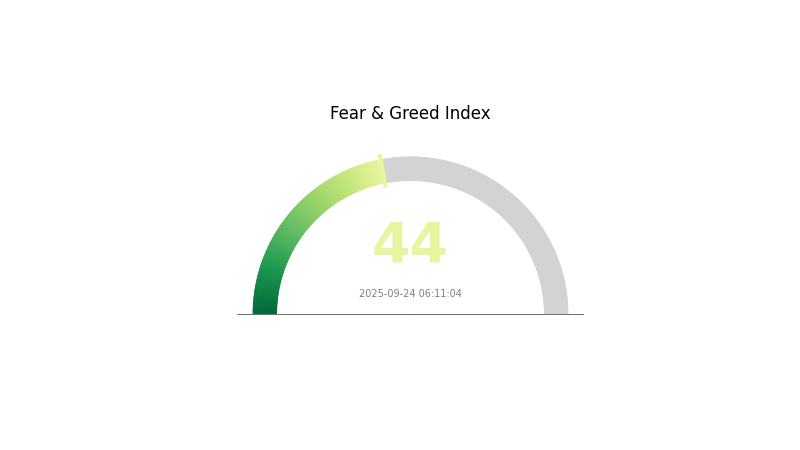

2025年09月24日 恐怖・欲望指数:44(恐怖)

最新の 恐怖・欲望指数はこちら

MINAの市場センチメントは現在「恐怖」状態で、恐怖・欲望指数は44となっています。これは投資家が慎重な姿勢をとっていることを示しており、長期視点の投資家には買い場となる可能性があります。ただし、投資判断の際は十分な調査と慎重な対応が重要です。Gate.comは、こうした不透明な局面でも有用な市場データを提供し、投資家の意思決定を支援します。センチメントは急変するため、情報収集と戦略見直しを心がけてください。

MINA保有分布

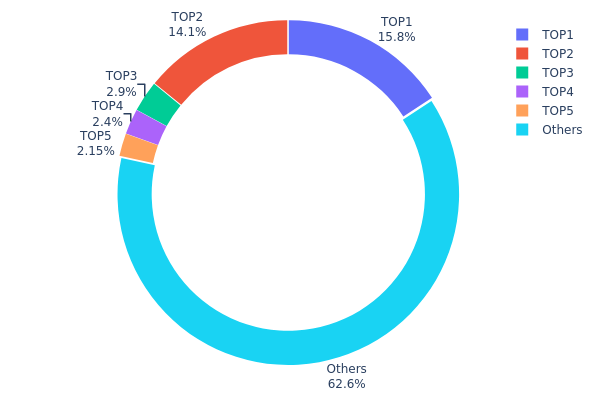

MINAのアドレス保有分布によれば、トークンは上位アドレスに集中しています。トップ2が総供給量の15.82%、14.14%を保有し、合計約30%を占めます。次点の3アドレスはそれぞれ2~3%保有し、上位5アドレスの合計は約37.4%に達します。

この集中分布は、MINAトークンの市場構造が比較的中央集権的であることを示し、市場動向に影響を及ぼす可能性があります。大口保有者(クジラ)が価格・流動性に影響を与えることも想定されますが、62.6%のトークンはその他アドレスに配分されており、ネットワークの広がりも認められます。

現在の保有分布は、MINA価格の安定性やボラティリティへの影響要素となります。大口保有者の動向は市場へ大きな影響を及ぼすことから、アドレスの動きに注目することが重要です。

最新のMINA 保有分布はこちら

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | B62qrQ...6g1ny9 | 198,347.45K | 15.82% |

| 2 | B62qjs...6f7npr | 177,324.72K | 14.14% |

| 3 | B62qp3...x8CxV3 | 36,407.06K | 2.90% |

| 4 | B62qmj...SVovgT | 30,101.92K | 2.40% |

| 5 | B62qiW...CSCVt5 | 26,949.69K | 2.14% |

| - | Others | 784,643.79K | 62.6% |

II. MINA今後の価格変動に影響する主な要因

供給メカニズム

- デフレ型モデル:定期的なトークンバーンにより供給は継続的に減少

- 過去の傾向:供給収縮が歴史的に価格上昇を促進した実績

- 現状の影響:供給減少が引き続き価格成長を支える見込み

機関・クジラ動向

- 企業導入:Franklin Templetonなど伝統金融機関の参入はMINA価格に好影響

マクロ経済の環境

- インフレヘッジ属性:特定条件下でインフレヘッジ機能を発揮

技術進化・エコシステム構築

- Mesaアップグレード:最近のアップグレードが価格動向の起爆剤

- エコシステム応用:BNB Chain拡大によりTVL77.5億ドル(3年ぶり高水準)

III. MINA価格予測 2025~2030年

2025年展望

- 保守予測:0.08761~0.1653ドル

- 中立予測:0.1653~0.19505ドル

- 楽観予測:0.19505~0.22ドル(強い市場心理とプロジェクト進展が条件)

2027~2028年展望

- 市場局面:採用拡大による成長フェーズ期待

- 価格レンジ予測:

- 2027年:0.13722~0.26436ドル

- 2028年:0.18879~0.25172ドル

- 主な材料:技術進化、パートナーシップ拡充、広範な市場動向

2029~2030年長期展望

- 基礎シナリオ:0.24240~0.27997ドル(安定成長・採用前提)

- 楽観シナリオ:0.31754~0.39756ドル(エコシステム大幅拡大・市場独占)

- 革新シナリオ:0.40~0.50ドル(技術革新とメインストリーム化)

- 2030年12月31日:MINA 0.39756ドル(楽観ピーク予測)

| 年 | 予測最高値 | 予測平均値 | 予測最安値 | 騰落率 |

|---|---|---|---|---|

| 2025 | 0.19505 | 0.1653 | 0.08761 | 0 |

| 2026 | 0.22342 | 0.18018 | 0.13513 | 9 |

| 2027 | 0.26436 | 0.2018 | 0.13722 | 22 |

| 2028 | 0.25172 | 0.23308 | 0.18879 | 41 |

| 2029 | 0.31754 | 0.2424 | 0.21331 | 46 |

| 2030 | 0.39756 | 0.27997 | 0.20158 | 69 |

IV. MINA専門投資戦略とリスク管理

MINA投資手法

(1) 長期保有戦略

- 対象:ブロックチェーン革新に長期で投資したい投資家

- 運用提案:

- 市場の下落局面でMINAを積立

- 最低2~3年は保有し成長を目指す

- 安全な非カストディアルウォレットで管理

(2) アクティブトレード戦略

- テクニカル分析ツール:

- 移動平均線:50日・200日MAでトレンド判断

- RSI:過熱・底値水準を監視

- スイングトレードの重要点:

- 損切り設定で下落リスク管理

- 大幅上昇時は一部利確推奨

MINAリスク管理体制

(1) 資産配分原則

- 保守的投資家:暗号資産ポートフォリオの1~3%

- 積極投資家:5~10%

- プロ投資家:最大15%

(2) リスクヘッジ戦略

- 分散投資:MINAと他資産でポートフォリオバランスを確保

- 損切り注文:損失を限定するために活用

(3) セキュアな保管体制

- ハードウェアウォレット:Gate Web3 Wallet推奨

- ソフトウェアウォレット:公式Minaウォレット

- セキュリティ対策:2FA、強力パスワード、秘密鍵バックアップ

V. MINAの潜在リスクと課題

MINA市場リスク

- 高いボラティリティ:価格が大きく変動しやすい

- 採用限定性:長期価値提案への影響懸念

- 競争激化:他の軽量型ブロックチェーンの台頭リスク

MINA規制リスク

- 不透明な規制環境:不利な法規制リスク

- コンプライアンス課題:金融規制当局からの監視対象

- 法的位置付け:証券認定時は取引に影響

MINA技術リスク

- ネットワークセキュリティ:プロトコル脆弱性の懸念

- スケーラビリティ課題:利用増加時の問題発生余地

- 開発遅延:予定機能リリースへの影響

VI. 結論および推奨アクション

MINAの投資価値評価

MINAは、軽量型でありながらプライバシー機能を備えた独自価値を提供します。長期的な成長ポテンシャルは認められますが、短期変動や採用課題などリスクにも留意が必要です。

MINA投資の推奨

✅ 初心者:十分な調査の上、少額・長期保有を推奨 ✅ 経験者:ドルコスト平均法戦略(DCA戦略)を推奨 ✅ 機関投資家:分散型ポートフォリオへの組み入れ検討

MINA取引参加方法

- 現物取引:Gate.comなどで利用可能

- ステーキング:ネットワーク運営への参加と報酬の獲得

- DeFi対応:Minaベースの新しいDApps活用

暗号資産投資は非常に高いリスクを伴います。本記事は投資助言ではありません。投資判断は自身のリスク許容度に応じて慎重に行い、専門家の助言を活用してください。余剰資金を超える投資は避けてください。

FAQ

MINA Coinに将来性はありますか?

はい、MINA Coinには高い将来性が期待されています。革新的な技術と、Arbitrum・Cardanoとの2024年の協業可能性があり、Web3エコシステムでの成長と普及が期待されています。

MINAの上昇余地はどの程度ですか?

MINAは2025年末までに0.19ドル到達の可能性があります。長期予測に基づけば、市場動向次第でさらなる成長も想定されます。

MINAは有望な購入対象ですか?

はい、MINAは技術的な革新性や成長可能性があり、暗号資産市場における有望な投資対象と考えられます。

Decentraland(MANA)の2030年価格予測は?

専門家の予測によれば、Decentraland(MANA)は2030年に5.15~6.17ドルに到達する可能性があります。

共有

内容