2025 KARRAT Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: KARRAT's Market Position and Investment Value

KARRAT (KARRAT) is a decentralized gaming infrastructure layer supported by a truly decentralized community with a shared vision embracing gaming, entertainment, and AI products for the new era. Since its launch in April 2024, the project has established itself as a blockchain-based solution provider across gaming, entertainment, and transformative AI innovation sectors. As of December 2025, KARRAT's market capitalization has reached $6,750,234, with a circulating supply of approximately 745.6 million tokens trading at around $0.009053 per token. This innovative protocol, designed to animate game and product networks while providing tools to support industry adoption, is playing an increasingly important role in the decentralized gaming and entertainment landscape.

This article will conduct a comprehensive analysis of KARRAT's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for navigating the opportunities and risks in this emerging sector.

KARRAT Price Analysis Report

I. KARRAT Price History Review and Market Status

KARRAT Historical Price Evolution

- April 2024: KARRAT reached its all-time high (ATH) of $1.678 on April 18, 2024, representing a peak market valuation period for the token.

- December 2025: KARRAT hit its all-time low (ATL) of $0.008954 on December 22, 2025, marking a significant decline of 97.69% from its launch price of $0.75.

KARRAT Current Market Position

As of December 23, 2025, KARRAT is trading at $0.009053, reflecting a 24-hour decline of 6.7% with a price range between $0.008954 (low) and $0.010118 (high). The token demonstrates significant downward pressure across multiple timeframes: a 1-hour decline of 3.49%, a 7-day decrease of 22.98%, and a 30-day drop of 22.39%.

The token's market capitalization stands at approximately $6.75 million, with a fully diluted valuation (FDV) of $9.053 million. The circulating supply comprises 745.64 million KARRAT tokens out of a total supply of 1 billion tokens, representing 74.56% circulation. Trading volume over the past 24 hours totals $22,572.64, with the token maintaining a market dominance of 0.00028%. The project maintains 9,421 token holders and is ranked 1,365 in overall cryptocurrency market capitalization.

Market sentiment indicators reveal extreme fear conditions (VIX: 25), reflecting broader cryptocurrency market anxiety.

Check current KARRAT market price

KARRAT Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 25. This indicates severe market pessimism and heightened investor anxiety. Such extreme readings typically present contrarian opportunities for risk-tolerant investors. When fear reaches these levels, capitulation selling often accelerates, potentially creating entry points for long-term holders. However, extreme fear can persist longer than expected, so caution remains warranted. Monitor key support levels and consider dollar-cost averaging rather than lump-sum purchases during such volatile periods on Gate.com.

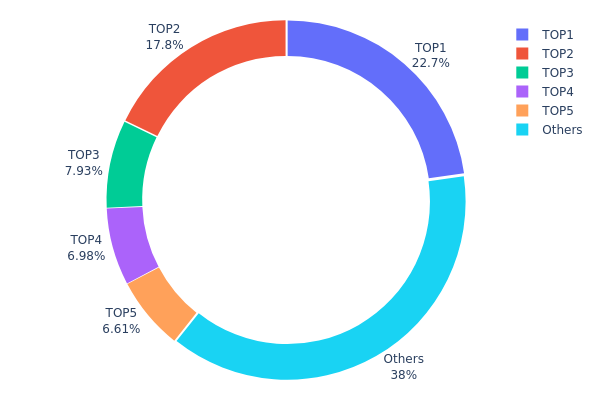

KARRAT Holdings Distribution

The address holdings distribution chart illustrates the concentration of KARRAT tokens across blockchain addresses, providing critical insights into the token's decentralization level and potential market dynamics. By analyzing the proportion of tokens held by top addresses versus the broader holder base, this metric reveals the degree of wealth concentration and the resilience of the token's network structure against potential manipulation or sudden liquidation events.

Current analysis of KARRAT's holdings demonstrates a moderate concentration pattern. The top five addresses collectively control approximately 62.02% of total token supply, with the largest address holding 22.72% and the second-largest holding 17.79%. While these figures indicate significant concentration among major holders, the distribution is not severely skewed, as the remaining addresses collectively represent 37.98% of the token supply. This suggests that KARRAT maintains a relatively distributed holder base beyond the top tier, which provides a stabilizing effect on the ecosystem. However, the combined influence of the top two addresses—accounting for nearly 40.51% of all tokens—warrants attention, as coordinated actions by these entities could potentially exert substantial pressure on market dynamics.

The current holdings structure reflects a market environment characterized by both institutional accumulation and broader retail participation. While the concentration level indicates that KARRAT has not achieved extreme decentralization comparable to widely distributed cryptocurrencies, the presence of a substantial minority holder base (37.98%) suggests reasonable resilience against single-entity market manipulation. This distribution pattern typically correlates with established projects that have attracted significant early investors and strategic backers. Monitoring shifts in this distribution over time will be essential for assessing whether KARRAT's holder base continues to diversify or whether concentration dynamics evolve.

Click to view current KARRAT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6de6...db1398 | 227232.82K | 22.72% |

| 2 | 0x0c4e...a9c1a9 | 177932.47K | 17.79% |

| 3 | 0x0c3c...4f5db1 | 79290.59K | 7.92% |

| 4 | 0xca5f...4755ad | 69816.31K | 6.98% |

| 5 | 0xe57a...f660d9 | 66139.23K | 6.61% |

| - | Others | 379588.56K | 37.98% |

II. Core Factors Influencing KARRAT's Future Price

Institutional and Major Holder Dynamics

-

Institutional Adoption: Animoca Brands, a leading blockchain gaming investor, has announced a strategic partnership with AMGI Studios, the creator and developer of the blockchain game "My Pet Hooligan." Animoca Brands has begun acquiring additional KARRAT tokens from the public market. KARRAT serves as both a utility and governance token for AMGI Studios. Animoca Brands will leverage its expertise to support Studio Chain, an upcoming Layer 2 blockchain designed for gaming and media, while providing market strategy guidance, token economics consultation, and liquidity support for KARRAT.

-

Ecosystem Development: The introduction of Studio Chain, a dedicated L2 blockchain for gaming and media applications, represents significant infrastructure development for the KARRAT ecosystem. This dedicated blockchain environment is expected to enhance the token's utility and adoption within gaming and media sectors.

Technology Development and Ecosystem Building

-

Studio Chain Launch: Studio Chain represents a major technological milestone for KARRAT's ecosystem. As a dedicated L2 blockchain optimized for gaming and media applications, it will provide improved scalability and transaction efficiency for projects built upon it, directly supporting increased adoption and utility of the KARRAT token.

-

Gaming Ecosystem Expansion: The partnership with "My Pet Hooligan" and support from Animoca Brands demonstrates active ecosystem growth. This blockchain game integration provides real-world use cases for KARRAT as both a utility token for in-game transactions and a governance token for protocol decisions.

III. 2025-2030 KARRAT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00796–$0.00915

- Neutral Forecast: $0.00915 (average expectation)

- Optimistic Forecast: $0.00943 (with sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing adoption and protocol maturation driving incremental value appreciation.

- Price Range Prediction:

- 2026: $0.00771–$0.01264

- 2027: $0.00767–$0.0148

- Key Catalysts: Enhanced tokenomics, ecosystem expansion, strategic partnerships, and growing institutional interest in emerging blockchain projects.

2028-2030 Long-term Outlook

- Base Case: $0.01368–$0.01752 by 2028, advancing to $0.01615–$0.02253 by 2030 (assuming steady network growth and mainstream adoption acceleration)

- Optimistic Case: $0.02235 by 2029 with strong fundamentals and favorable market conditions (assuming breakthrough utility adoption and significant DeFi integration)

- Transformational Case: Potential for significant outperformance beyond $0.02253 (contingent on transformative protocol innovations, major enterprise partnerships, or broader cryptocurrency market expansion)

- 2030-12-31: KARRAT projected at $0.02253 (representing cumulative 183% appreciation from 2025 baseline, reflecting long-term value accumulation thesis)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00943 | 0.00915 | 0.00796 | 1 |

| 2026 | 0.01264 | 0.00929 | 0.00771 | 2 |

| 2027 | 0.0148 | 0.01096 | 0.00767 | 21 |

| 2028 | 0.01752 | 0.01288 | 0.00915 | 42 |

| 2029 | 0.02235 | 0.0152 | 0.01368 | 67 |

| 2030 | 0.02253 | 0.01877 | 0.01615 | 107 |

KARRAT Investment Analysis Report

IV. KARRAT Professional Investment Strategy and Risk Management

KARRAT Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Community-focused participants and infrastructure believers who support decentralized gaming ecosystems

- Operational Recommendations:

- Establish a core position during market stabilization phases and maintain exposure to the protocol's long-term development

- Monitor quarterly updates on protocol adoption across gaming, entertainment, and AI sectors

- Reinvest any protocol rewards or incentives to compound holdings over extended periods

(2) Active Trading Strategy

- Price Action Analysis:

- Monitor the 24-hour price volatility: KARRAT has experienced -6.7% decline in the last 24 hours, trading at $0.009053

- Track weekly and monthly trends: -22.98% (7D) and -22.39% (30D) declines indicate sustained downward pressure

- Wave Trading Key Points:

- Identify support levels near the 24-hour low of $0.008954

- Watch for resistance formation around $0.010118 (24-hour high)

- Consider entry opportunities when trading volume increases relative to the current 24-hour volume of $22,572.64

KARRAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency portfolio allocation

- Active Investors: 2-5% of total cryptocurrency portfolio allocation

- Professional Investors: 5-10% of total cryptocurrency portfolio allocation, with systematic rebalancing quarterly

(2) Risk Hedging Approaches

- Position Sizing: Limit single trades to 1-3% of total trading capital to mitigate individual token volatility

- Stop-Loss Implementation: Set stop-loss orders at 15-20% below entry points given the token's historical volatility

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active traders requiring frequent transactions

- Cold Storage Approach: For long-term holders, utilize hardware solutions with multi-signature verification protocols

- Security Precautions: Never share private keys, enable two-factor authentication on all exchange accounts, and regularly verify smart contract addresses before any token transfers

V. KARRAT Potential Risks and Challenges

KARRAT Market Risks

- Extreme Price Volatility: The token has declined 97.69% over the past year from its all-time high of $1.678 (April 18, 2024) to current levels around $0.009053, demonstrating severe downside risk

- Low Trading Liquidity: 24-hour trading volume of $22,572.64 is relatively modest, potentially causing significant price slippage during larger buy or sell orders

- Market Sentiment Deterioration: The current neutral market emotion indicator combined with persistent downtrend suggests weak buying pressure and potential further declines

KARRAT Regulatory Risks

- Decentralized Protocol Governance: The reliance on KARRATco (DAO) for decision-making introduces uncertainties regarding policy implementation and protocol direction changes

- Emerging Technology Regulatory Uncertainty: As the protocol operates in gaming, entertainment, and AI sectors, evolving regulations in these jurisdictions could impact protocol adoption and utility

- Smart Contract Compliance: ERC-20 token operations remain subject to evolving regulatory frameworks across different blockchain jurisdictions

KARRAT Technology Risks

- Protocol Adoption Rate: The success of KARRAT depends on achieving meaningful adoption across gaming, entertainment, and AI applications; slower-than-expected adoption could impact long-term value

- Smart Contract Security: Any vulnerability in the underlying ERC-20 contract at address 0xacd2c239012d17beb128b0944d49015104113650 could pose risks to token holders

- Competition in Infrastructure Layer: Other decentralized gaming and AI infrastructure protocols may offer superior solutions or network effects, limiting KARRAT's market penetration

VI. Conclusion and Action Recommendations

KARRAT Investment Value Assessment

KARRAT presents a high-risk, speculative investment opportunity positioned in the emerging decentralized gaming and AI infrastructure sector. The protocol's ambitious vision of serving gaming, entertainment, and transformative AI innovations through a community-driven DAO structure offers long-term potential. However, the severe 97.69% annual decline, low market liquidity, and modest trading volume ($22,572.64 daily) raise significant concerns about near-term price stability and market confidence. With only 9,421 token holders and a market cap of approximately $6.75 million relative to a fully diluted valuation of $9.05 million, KARRAT remains in early-stage development with substantial execution risks.

KARRAT Investment Recommendations

✅ Beginners: Start with micro-position allocations (0.5-1% of cryptocurrency portfolio) only after thorough research into the protocol's gaming and AI partnerships; utilize Gate.com's educational resources before trading

✅ Experienced Investors: Consider strategic accumulation during support levels near $0.008954, while maintaining strict position sizing and stop-loss discipline; monitor protocol governance announcements and community development milestones

✅ Institutional Investors: Conduct comprehensive due diligence on KARRATco (DAO) governance mechanisms and protocol adoption metrics across target verticals before considering significant allocations; diversify exposure across multiple blockchain gaming infrastructure plays

KARRAT Trading Participation Methods

- Exchange Trading: Trade KARRAT directly on Gate.com with support for ERC-20 token swaps and competitive trading fees

- Direct Holding: Purchase and store KARRAT tokens in Gate.com Web3 Wallet for participation in protocol governance voting and potential future airdrops

- Liquidity Provision: Advanced users may explore liquidity provision opportunities to earn fees, though this carries impermanent loss risks given current market volatility

Cryptocurrency investments carry extreme risk and this report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Why is karrat crypto down?

Karrat crypto is down due to a -19.80% price decline in the last week, underperforming compared to the global cryptocurrency market and similar Ethereum Ecosystem cryptocurrencies.

What is karrat crypto coin?

KARRAT is a cryptocurrency that enhances gaming, entertainment, and AI-driven experiences through blockchain technology. It powers decentralized applications and digital ecosystems in the Web3 space.

What is the price prediction for KARRAT in 2025?

Based on current market analysis with a 5% annual growth rate, KARRAT is predicted to reach approximately $0.205 by late December 2025. This projection reflects moderate growth trajectory throughout the year.

What is TRG: Understanding the Tactical Response Group in Law Enforcement

Is GameGPT (DUEL) a good investment?: Analyzing the potential and risks of this blockchain gaming token

2025 MYTH Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 ARIA Price Prediction: Expert Analysis and Future Outlook for Artificial Intelligence Trading Assistant Token

Is AriaAI (ARIA) a good investment?: A Comprehensive Analysis of Market Potential, Tokenomics, and Risk Factors

Is Adventure Gold (AGLD) a good investment?: A Comprehensive Analysis of Potential Returns and Market Risks

Guide to Purchasing Pepe Unchained (PEPU) Securely Online

Exploring the Potential of Helium's Integration with Solana Blockchain

Effortless NFT Creation: Streamlined Solutions for Web3 Innovators

A Beginner's Guide to Digital Web3 Wallets

What is SCOR: A Comprehensive Guide to Supply Chain Operations Reference Model