Prévision du prix GLM en 2025 : analyse des principaux facteurs et des tendances du marché pour l’évaluation du jeton Chatllama

Introduction : Positionnement de marché et potentiel d’investissement de GLM

Golem (GLM), plateforme décentralisée de location de puissance de calcul basée sur Ethereum, s’est imposée depuis son lancement en 2016 par des avancées déterminantes. En 2025, sa capitalisation boursière atteint 225 200 000 $ avec environ 1 000 000 000 tokens en circulation et un prix stabilisé autour de 0,2252 $. Surnommé le « superordinateur décentralisé », l’actif occupe une place de plus en plus stratégique dans l’univers du calcul distribué et du partage de ressources.

Cette analyse approfondie des perspectives de prix de Golem sur la période 2025-2030 conjugue l’étude des cycles historiques, l’évolution de l’offre et de la demande, le développement de l’écosystème et les facteurs macroéconomiques, afin de fournir aux investisseurs des prévisions professionnelles et des stratégies opérationnelles.

I. Bilan historique et situation actuelle du GLM

Évolution historique du cours GLM

- 2016 : Lancement initial, prix de départ : 0,00913753 $

- 2018 : Record historique de 1,32 $ le 13 avril

- 2020 : Changement de GNT à GLM le 19 novembre

- 2022-2023 : Cycle baissier marqué, repli prononcé du prix

Situation actuelle du marché GLM

Le 24 septembre 2025, GLM cote 0,2252 $, pour une capitalisation de 225 200 000 $. Le volume échangé sur 24 heures s’établit à 172 192,88 $. Sur la dernière journée, le GLM progresse légèrement de 0,98 %, mais perd 6,79 % sur la semaine et 10,45 % sur le mois. Le prix actuel reflète une baisse de 30,20 % sur un an. Le sommet historique reste 1,32 $ (13 avril 2018), le point bas 0,00913753 $ (12 décembre 2016). Le token occupe la 275e place sur le marché crypto, avec une dominance de 0,0054 %.

Cliquez ici pour consulter le cours actuel du GLM

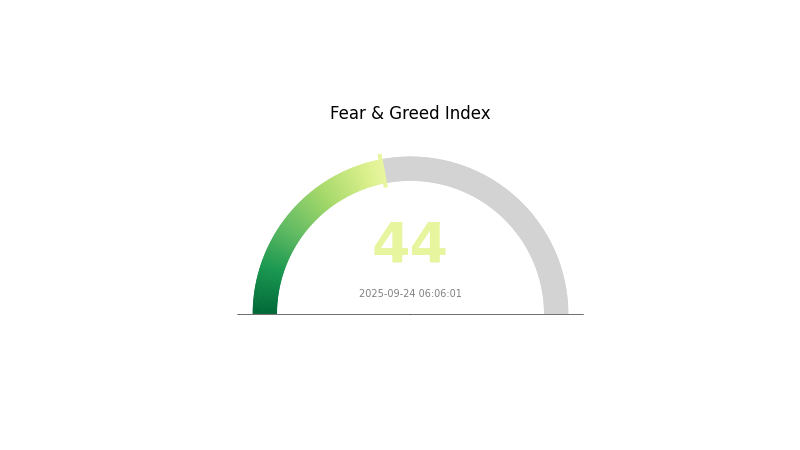

Indicateur du sentiment de marché GLM

24 septembre 2025 — Indice Fear and Greed : 44 (Peur)

Cliquez ici pour voir l’indice Fear & Greed du moment

Actuellement, le marché crypto se caractérise par une prudence accrue : l’indice Fear and Greed à 44 traduit un climat de peur. Les investisseurs deviennent plus averses au risque, ce qui peut limiter les achats. Toutefois, les périodes de crainte offrent souvent des opportunités d’accumulation à moindre coût pour les investisseurs contrariants. Les dynamiques de sentiment évoluent rapidement — une recherche approfondie reste essentielle avant toute prise de position.

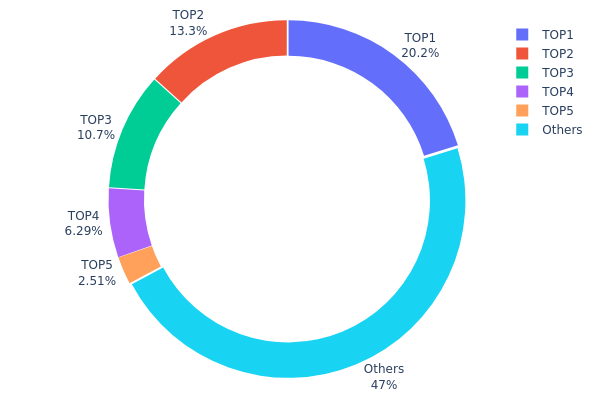

Répartition des avoirs GLM

L’analyse de la distribution des adresses éclaire le degré de concentration des tokens GLM. Les principaux détenteurs se distinguent nettement : la première adresse détient 20,23 % du total, les cinq premières concentrent 53,02 % de l’offre.

Ce niveau de concentration soulève la question du risque de manipulation et de volatilité. Plus de la moitié des tokens sont entre cinq adresses, ce qui expose le marché à des ventes ou accumulations susceptibles d’influencer fortement la dynamique de GLM. Il faut toutefois noter que 46,98 % des tokens sont distribués sur d’autres adresses, témoignant d’une certaine décentralisation.

La structure actuelle révèle une centralisation modérée qui affecte la stabilité du marché et l’exposition aux mouvements de gros porteurs. Ce constat n’implique pas un risque immédiat, mais souligne l’importance de surveiller attentivement les volumes détenus par les grandes adresses.

Cliquez ici pour consulter la répartition actuelle des avoirs GLM

| Classement | Adresse | Quantité détenue | Part détenue (%) |

|---|---|---|---|

| 1 | 0x8791...af117c | 160 982,42 K | 20,23 % |

| 2 | 0x413e...9c303f | 105 920,53 K | 13,31 % |

| 3 | 0x70a0...10e476 | 85 101,45 K | 10,69 % |

| 4 | 0x7da8...7f6cf9 | 50 001,00 K | 6,28 % |

| 5 | 0x5a52...70efcb | 20 000,00 K | 2,51 % |

| - | Autres | 373 524,38 K | 46,98 % |

II. Principaux facteurs d’influence sur le prix futur de GLM

Dynamique institutionnelle et « whales »

- Adoption corporate : GLM est notamment utilisé par Mafengwo, Focus Media, Mengniu Group et Kingsoft Office.

Environnement macroéconomique

- Vertus de couverture contre l’inflation : Au sein de l’écosystème IA, GLM peut jouer un rôle de protection contre l’inflation dans un contexte technologique en profonde évolution.

- Facteurs géopolitiques : Les événements internationaux, en particulier ceux qui influent sur l’adoption et le développement de l’IA, peuvent peser sur la valorisation du GLM.

Innovation technologique et développement de l’écosystème

- GLM-4 : Modèle de dernière génération capable d’automatiser l’appel d’outils selon l’intention utilisateur.

- GLM-4 All Tools : Version avancée, intégrant des fonctionnalités étendues d’appel d’outils.

- Applications écosystémiques : Projets phares tels que ChatGLM et FinGLM, modèle dédié au secteur financier.

III. Prévisions de prix GLM 2025-2030

Perspectives 2025

- Scénario prudent : 0,19176 $ – 0,2256 $

- Scénario neutre : 0,2256 $ – 0,27 $

- Scénario optimiste : 0,27 $ – 0,30456 $ (dépend d’un redressement marqué du marché et d’une adoption IA renforcée)

Perspectives 2027-2028

- Phase attendue : Croissance potentielle, volatilité accrue

- Fourchettes de prix prévisionnelles :

- 2027 : 0,21794 $ – 0,31749 $

- 2028 : 0,22875 $ – 0,40471 $

- Facteurs majeurs : Percées en IA et machine learning, intégration étendue de GLM dans les plateformes décentralisées

Perspectives 2029-2030

- Scénario de base : 0,34899 $ – 0,40134 $ (sous hypothèse d’une croissance régulière du secteur IA et blockchain)

- Scénario optimiste : 0,40134 $ – 0,45369 $ (si les cas d’usage IA décentralisés progressent rapidement)

- Scénario transformationnel : 0,45369 $ – 0,50 $ (si GLM devient la référence du calcul décentralisé IA)

- 31 décembre 2030 : GLM à 0,45352 $ (projection sur pic potentiel)

| Année | Prix maximal prévu | Prix moyen prévu | Prix minimal prévu | Évolution (%) |

|---|---|---|---|---|

| 2025 | 0,30456 | 0,2256 | 0,19176 | 0 |

| 2026 | 0,27303 | 0,26508 | 0,13784 | 17 |

| 2027 | 0,31749 | 0,26906 | 0,21794 | 19 |

| 2028 | 0,40471 | 0,29327 | 0,22875 | 30 |

| 2029 | 0,45369 | 0,34899 | 0,25127 | 54 |

| 2030 | 0,45352 | 0,40134 | 0,38529 | 78 |

IV. Stratégies d’investissement professionnelles et gestion du risque GLM

Approches d’investissement GLM

(1) Stratégie de conservation longue durée

- Public cible : Investisseurs axés sur le potentiel à long terme

- Recommandations :

- Accumuler du GLM lors des baisses de marché

- Fixer des paliers de prise de profit

- Securiser les actifs sur wallet matériel

(2) Stratégie active de trading

- Outils d’analyse technique :

- Moyennes mobiles : Suivi des tendances court et long terme

- RSI : Détection de phases de surachat et de survente

- Points stratégiques pour le swing trading :

- Surveillance du sentiment de marché et des actualités

- Utilisation d’ordres stop-loss pour encadrer le risque

Cadre de gestion des risques GLM

(1) Principes d’allocation d’actifs

- Investisseur prudent : 1 à 3 %

- Investisseur dynamique : 5 à 10 %

- Investisseur professionnel : 10 à 15 %

(2) Mécanismes de couverture du risque

- Diversification : Répartition sur plusieurs cryptomonnaies

- Stop-loss : Limitation des pertes potentielles

(3) Sécurisation du stockage

- Hot wallet recommandé : Portefeuille Gate web3

- Stockage à froid : Wallet matériel pour la détention à long terme

- Mesures de sécurité : Activation de la double authentification, conservation rigoureuse des clés privées

V. Risques et défis potentiels pour GLM

Risques de marché GLM

- Volatilité élevée : Fluctuations de prix marquées

- Sentiment de marché : Sensibilité aux tendances globales du secteur crypto

- Concurrence : Autres solutions de calcul blockchain

Risques réglementaires GLM

- Réglementation incertaine : Survenance possible de nouveaux textes

- Restrictions transfrontalières : Statut légal variable selon les pays

- Contraintes de conformité : Adaptation aux normes réglementaires évolutives

Risques techniques GLM

- Vulnérabilité des smart contracts : Risque de faille ou bug

- Scalabilité du réseau : Limits face à une montée de la demande

- Barrières à l’adoption : Complexité pour les utilisateurs sans expertise technique

VI. Conclusion et recommandations opérationnelles

Évaluation du potentiel d’investissement GLM

GLM offre des perspectives solides sur le marché du calcul décentralisé, mais reste soumis à une volatilité ponctuelle et aux problématiques d’adoption à court terme.

Recommandations pour l’investissement GLM

✅ Débutants : Entrer avec des positions modérées, privilégier l’apprentissage

✅ Investisseurs aguerris : Inclure GLM dans une démarche de diversification

✅ Institutionnels : Évaluer GLM dans une stratégie blockchain globale

Modalités de participation au trading GLM

- Spot trading : Achat/vente du GLM sur Gate.com

- Staking : Participation aux programmes de staking GLM (selon disponibilité)

- DeFi : Exploration des solutions de finance décentralisée autour des tokens GLM

L’investissement en cryptomonnaie implique un niveau de risque très élevé. Cet article n’est pas un conseil en investissement. Chacun doit prendre ses décisions en fonction de sa propre tolérance au risque et consulter l’avis de professionnels financiers. N’investissez jamais plus que ce que vous êtes prêt à perdre.

FAQ

Le réseau Golem est-il une solution pertinente ?

Oui, le réseau Golem possède de solides atouts. Il offre des ressources de calcul décentralisées capables de transformer le secteur, et son approche innovante peut impacter de nombreux domaines.

Quelle est la projection de prix pour GRT en 2025 ?

Selon les analyses de marché, le prix du GRT devrait atteindre au moins 0,090 $, avec une moyenne autour de 0,093 $ en 2025. Ces prévisions traduisent un potentiel haussier pour le token The Graph.

Quelle est la valeur actuelle du token GLM ?

Au 24 septembre 2025, le GLM s’établit à 0,2265 $, soit une hausse de 1,48 % sur 24 heures.

Quelle est l’utilité du token GLM ?

GLM constitue le moyen de paiement central du réseau Golem, servant à récompenser et inciter les fournisseurs de services pour leur contribution à l’écosystème.

Partager

Contenu