2025 GITCOIN Price Prediction: Expert Analysis and Market Forecast for the Decentralized Funding Platform Token

Introduction: Market Position and Investment Value of GITCOIN

Gitcoin (GITCOIN) is an open-source platform that empowers developers to earn rewards by creating open-source software using technologies such as Python, Rust, Ruby, JavaScript, Solidity, HTML, and CSS. Since its launch in 2021, Gitcoin has established itself as a governance token within the GitcoinDAO ecosystem, dedicated to funding the next generation of public goods. As of December 2025, GITCOIN has achieved a market capitalization of approximately $12.81 million with a circulating supply of approximately 96.38 million tokens, currently trading at $0.1281 per token.

This asset, recognized for its role in decentralized funding and community governance, is playing an increasingly important role in supporting open-source development and public goods financing within the Web3 ecosystem.

This article will provide a comprehensive analysis of GITCOIN's price trends through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Gitcoin (GTC) Market Analysis Report

I. GITCOIN Price History Review and Current Market Status

GITCOIN Historical Price Evolution

-

November 2021: Gitcoin reached its all-time high (ATH) of $22.37 on November 27, 2021, marking the peak of market enthusiasm during the bull cycle.

-

2022-2024: Following the market downturn from the 2021 peak, Gitcoin experienced significant price compression during the bear market period, with continuous depreciation against initial valuations.

-

December 2025: Gitcoin touched its all-time low (ATL) of $0.118188 on December 19, 2025, representing a decline of approximately 82.33% over the one-year period.

GITCOIN Current Market Dynamics

As of December 21, 2025, Gitcoin (GTC) is trading at $0.1281, reflecting a modest 24-hour gain of 0.94%. However, the token shows continued weakness on longer timeframes, with a 7-day decline of -4.33% and a 30-day loss of -15.55%.

Key Market Metrics:

- 24-Hour High/Low: $0.1302 / $0.1254

- Market Capitalization: $12,346,883.62 (based on circulating supply)

- Fully Diluted Valuation (FDV): $12,810,000.00

- Circulating Supply: 96,384,727.71 GTC out of 100,000,000 total supply (96.38% circulated)

- 24-Hour Trading Volume: $12,277.99

- Market Dominance: 0.00039%

- Active Holders: 91,778 addresses

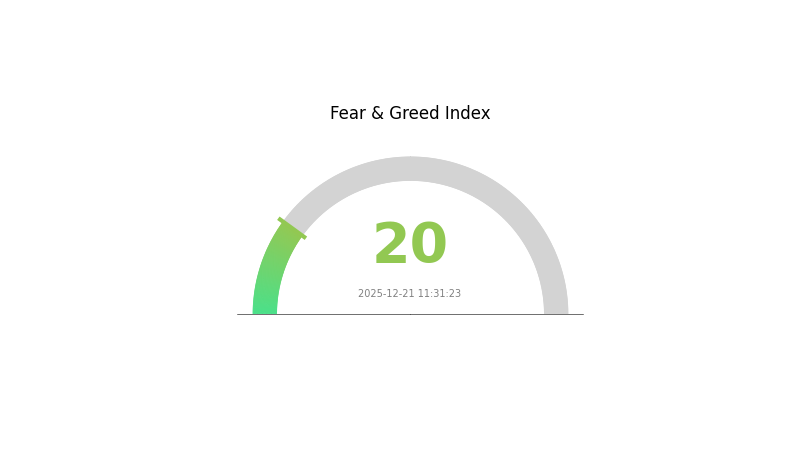

The token is currently listed across 21 exchanges globally. Market sentiment indicates "Extreme Fear" conditions (VIX: 20), suggesting heightened risk aversion in the broader cryptocurrency market.

Visit Gitcoin Market Price on Gate.com for real-time updates

Gitcoin Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The market is experiencing extreme fear, with the index dropping to 20. This indicates significant investor anxiety and risk aversion in the crypto market. Such extreme fear conditions often present contrarian opportunities, as excessive pessimism may have driven prices to attractive levels. However, investors should exercise caution and conduct thorough due diligence before entering positions. Monitor market developments closely and consider dollar-cost averaging strategies to mitigate timing risks during periods of heightened uncertainty.

GITCOIN Holdings Distribution

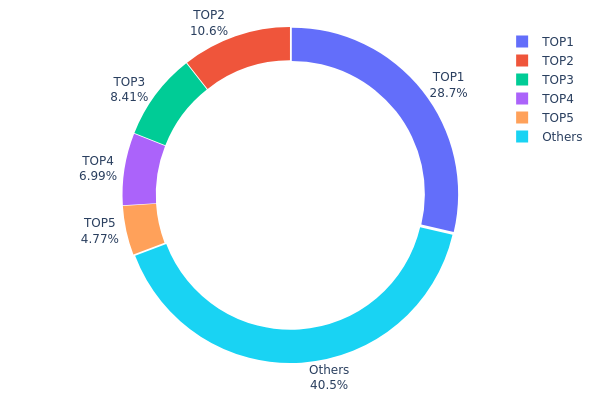

The address holdings distribution map illustrates the concentration of token ownership across the top wallet addresses within the GITCOIN network. This metric provides critical insights into the decentralization characteristics and potential market concentration risks by tracking how tokens are distributed among major holders.

The current holdings data reveals a moderately concentrated distribution pattern. The top five addresses collectively control approximately 59.44% of the total token supply, with the largest holder (0xf977...41acec) commanding 28.68% of all GITCOIN tokens. This level of concentration suggests that decision-making power and potential market influence remain concentrated among a limited number of entities. The remaining 40.56% of tokens distributed among other addresses indicates that while a significant portion of the supply is dispersed, the top-tier holders maintain substantial control over the token's liquidity and market dynamics.

From a market structure perspective, this distribution pattern presents both opportunities and risks. The concentration among top holders creates potential for significant price volatility, as large liquidations or accumulation activities by these addresses could substantially impact market conditions. However, the non-trivial participation of smaller addresses in the "Others" category suggests an emerging broader stakeholder base. The stability of this distribution depends heavily on the nature of these major holders—whether they represent institutional stewards, core developers, or speculative actors will meaningfully influence GITCOIN's decentralization trajectory and long-term market resilience.

Click to view current GITCOIN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 28682.00K | 28.68% |

| 2 | 0x9318...55e551 | 10617.36K | 10.61% |

| 3 | 0x4da8...932a14 | 8408.54K | 8.40% |

| 4 | 0x74be...873f13 | 6990.12K | 6.99% |

| 5 | 0x14d7...90f86c | 4769.69K | 4.76% |

| - | Others | 40532.28K | 40.56% |

II. Core Factors Influencing GITCOIN's Future Price

Supply Mechanism

-

Supply and Demand Dynamics: GTC price movements are primarily driven by market supply and demand relationships. The token's price is sensitive to changes in market circulation and investor sentiment toward the asset.

-

Historical Patterns: GTC has historically experienced price volatility influenced by broader cryptocurrency market conditions, regulatory announcements, and shifts in investor appetite for decentralized finance and community-driven projects.

-

Current Impact: Ongoing market dynamics continue to shape GTC's pricing, with supply-side factors interacting with adoption trends and macroeconomic conditions to determine near-term price trajectories.

Regulatory Environment and Market Sentiment

-

Regulatory Impact: Government policies and regulatory frameworks directly influence market acceptance and valuation of GTC relative to fiat currencies. Negative regulatory announcements such as crackdowns or security concerns can trigger market panic and significant price declines.

-

Market Sentiment: Cryptocurrency prices are highly sensitive to market sentiment, news events, and investor psychology. Even projects with strong fundamentals can experience severe price volatility due to broader market dynamics and sudden shifts in investor confidence.

-

Negative News Catalysts: Security vulnerabilities, regulatory enforcement actions, and adverse industry developments can lead to sharp price corrections as market participants reassess risk exposure.

Macroeconomic Environment

-

Monetary Policy Expectations: Global central bank policies and interest rate decisions influence risk asset valuations, including cryptocurrencies. Changes in monetary policy outlook can impact capital flows into digital assets.

-

Market Risk Factors: Broader macroeconomic conditions, including inflation dynamics, employment data, and geopolitical developments, create an external environment that affects cryptocurrency market volatility and directional bias.

Three、2025-2030 GITCOIN Price Forecast

2025 Outlook

- Conservative Forecast: $0.10248 - $0.12810

- Neutral Forecast: $0.12810

- Bullish Forecast: $0.15884 (requires sustained ecosystem growth and increased developer adoption)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, characterized by stabilizing community participation and expanding use cases within the developer incentive ecosystem.

- Price Range Forecast:

- 2026: $0.12769 - $0.18077

- 2027: $0.10214 - $0.17509

- Key Catalysts: Expansion of grant distribution mechanisms, increased mainstream recognition of decentralized governance models, and broader Web3 developer community engagement.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.12814 - $0.23774 (assumes steady adoption of the grant ecosystem and moderate market expansion)

- Bullish Scenario: $0.19708 - $0.22552 (assumes accelerated institutional participation and protocol innovations driving 58% cumulative gains through 2029)

- Transformational Scenario: $0.19077 - $0.22721 (assumes breakthrough in ecosystem sustainability, mainstream developer adoption, and strategic partnerships reaching 67% growth by 2030)

Note: Price predictions are based on historical data analysis and market trend projections. Investors should conduct their own due diligence and consider risk management strategies when trading on platforms such as Gate.com. Actual market performance may deviate significantly from forecasts.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15884 | 0.1281 | 0.10248 | 0 |

| 2026 | 0.18077 | 0.14347 | 0.12769 | 11 |

| 2027 | 0.17509 | 0.16212 | 0.10214 | 26 |

| 2028 | 0.23774 | 0.16861 | 0.12814 | 31 |

| 2029 | 0.22552 | 0.20317 | 0.19708 | 58 |

| 2030 | 0.22721 | 0.21435 | 0.19077 | 67 |

GITCOIN Professional Investment Strategy and Risk Management Report

IV. GITCOIN Professional Investment Strategy and Risk Management

GITCOIN Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Community developers, open-source advocates, and long-term believers in public goods funding

- Operation Recommendations:

- Accumulate GITCOIN tokens during market downturns when the token price experiences significant corrections, positioning for potential recovery as the platform grows

- Hold tokens to participate in GitcoinDAO governance decisions regarding platform development and fund allocation

- Reinvest rewards from active participation in the Gitcoin platform back into token holdings to compound your position

(2) Active Trading Strategy

- Price Action Monitoring:

- Track the 24-hour price volatility: Currently trading at $0.1281 with a 24-hour high of $0.1302 and low of $0.1254, indicating tight consolidation

- Monitor weekly and monthly trends: The 7-day decline of -4.33% and 30-day decline of -15.55% suggest ongoing bearish pressure that may present entry opportunities for contrarian traders

- Wave Trading Key Points:

- Identify support levels near the recent all-time low of $0.118188 (reached December 19, 2025) as potential buying zones

- Watch for resistance around previous swing highs to determine exit points for short-term positions

GITCOIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional Investors: Up to 10-15% of portfolio allocation (with appropriate hedging mechanisms)

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Implement systematic purchases over time to reduce the impact of price volatility and avoid timing the market incorrectly

- Position Sizing Discipline: Never allocate more than your predetermined portfolio percentage to GITCOIN, maintaining strict position management to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Approach: Use Gate.com Web3 Wallet for active trading and frequent transactions, balancing convenience with moderate security measures

- Cold Storage Method: Transfer long-term holdings to hardware wallets or secure self-custody solutions to protect against exchange-level security risks

- Security Precautions: Enable two-factor authentication on all exchange accounts, use unique passwords for each platform, regularly verify contract addresses before transactions, and never share private keys or seed phrases with third parties

V. GITCOIN Potential Risks and Challenges

GITCOIN Market Risk

- Severe Price Volatility: GITCOIN has declined 82.33% over the past year, dropping from historical highs of $22.37 (November 27, 2021) to current lows of $0.1281, demonstrating extreme volatility and the speculative nature of the asset

- Limited Liquidity Depth: With only $12,277.99 in 24-hour trading volume across 21 exchanges and a relatively modest market cap of $12.81 million, the token faces liquidity constraints that could amplify price movements during large trades

- Market Sentiment Deterioration: The sustained bearish trend over multiple timeframes (negative 1-hour, 7-day, 30-day, and year-to-date performance) suggests diminished investor confidence and potential continued downward pressure

GITCOIN Regulatory Risk

- Governance Token Classification: Regulatory uncertainty surrounding the classification of GITCOIN as a governance token versus a security could trigger compliance issues or trading restrictions in certain jurisdictions

- DAO Regulatory Framework: As Gitcoin operates through GitcoinDAO structure, evolving regulatory frameworks around decentralized autonomous organizations could impact platform operations and token utility

- Geographic Restrictions: Different countries may impose varying restrictions on GITCOIN trading or holding, potentially limiting market access and reducing overall liquidity

GITCOIN Technical Risk

- Smart Contract Vulnerability Exposure: The token operates on Ethereum (contract address: 0xde30da39c46104798bb5aa3fe8b9e0e1f348163f), inheriting risks associated with smart contract code and potential exploitation of undiscovered vulnerabilities

- Platform Dependency: GITCOIN's value is directly tied to the continued development and adoption of the Gitcoin platform; technical issues, platform failures, or reduced developer engagement could diminish token utility

- Network Congestion Impact: As an ERC-20 token, GITCOIN is subject to Ethereum network congestion, which can increase transaction costs and reduce platform usability during periods of high activity

VI. Conclusion and Action Recommendations

GITCOIN Investment Value Assessment

GITCOIN represents a utility token for an open-source development platform focused on funding public goods through a decentralized governance model. While the project addresses a genuine market need by incentivizing open-source software development and community contributions, the token has experienced significant depreciation from historical highs, currently trading at only 0.57% of its all-time high value. The relatively small market cap of $12.81 million and limited trading volume indicate a niche asset with substantial risk exposure. Investors should view GITCOIN as a long-term, speculative investment thesis aligned with the broader adoption of decentralized platforms for public goods funding, rather than as a near-term wealth generation vehicle.

GITCOIN Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) through dollar-cost averaging on Gate.com over 3-6 months to understand the project while minimizing timing risk. Focus on understanding the Gitcoin platform's mission before committing capital.

✅ Experienced Investors: Implement a hybrid strategy combining 70% long-term holdings for governance participation and 30% active trading positions to capitalize on volatility. Use technical analysis to identify support levels near $0.118 and resistance near $0.135 for tactical entries and exits.

✅ Institutional Investors: Consider strategic positions (5-10% allocation) with structured hedging through complementary DeFi positions. Engage directly with GitcoinDAO governance to understand fund allocation decisions and platform roadmap before larger commitments.

GITCOIN Trading Participation Methods

- Gate.com Spot Trading: Purchase GITCOIN directly through Gate.com's spot market using USD or stablecoin pairs for straightforward long-term accumulation

- Liquidity Pool Participation: Provide liquidity for GITCOIN trading pairs on decentralized protocols to generate yield while supporting market depth

- DAO Participation: Hold GITCOIN tokens to participate in GitcoinDAO governance votes, enabling direct influence over platform development and grant allocation decisions

Cryptocurrency investing carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult qualified financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

What is the prediction for GTC stock?

Based on current market analysis, GTC is predicted to increase by 5% in the coming week, potentially reaching $0.128167. Long-term trends suggest continued growth driven by ecosystem development and increasing adoption.

Is Gitcoin a cryptocurrency?

Yes, Gitcoin (GTC) is a cryptocurrency built on the Ethereum blockchain. It has a circulating supply of approximately 96 million tokens and serves as the governance token for the Gitcoin platform.

What factors influence Gitcoin (GTC) price movements?

GTC price is influenced by market sentiment, trading volume, technological developments in the blockchain ecosystem, user adoption trends, and overall crypto market conditions.

What was Gitcoin's historical price performance?

Gitcoin has shown volatility in recent months. In early November 2025, the price traded around $0.1805-$0.1935, fluctuating within a range of $0.1776-$0.196. The token demonstrated typical crypto market patterns with moderate price swings.

What are the risks of investing in Gitcoin (GTC) tokens?

GTC carries risks including regulatory uncertainty for governance tokens, market volatility, competition in funding platforms, and governance execution challenges. Community voting outcomes may impact token value unpredictably.

Is HTX DAO (HTX) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

Is DAO Maker (DAO) a Good Investment?: Analyzing the Potential and Risks in the Current Crypto Market

Is Stella (ALPHA) a Good Investment?: Analyzing Potential Returns and Risks in the Current Crypto Market

2025 DEXE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Dorayaki (DORA) a Good Investment?: Analyzing Its Potential in the Cryptocurrency Market

Is AladdinDAO (ALD) a Good Investment?: Analyzing the Potential and Risks of This DeFi Protocol Token in Today's Market

Exploring BlockDAG: The Future of Blockchain Innovation

Exploring Swell Network: The Ultimate Guide to Liquid Staking in Crypto

Exploring THORChain: The Ultimate Cross-Chain Liquidity Solution

Exploring the Fundamentals of Web3 Technology

Understanding Web3 Community Building: Essential Guide to PAWS