2025 FAI Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: FAI's Market Position and Investment Value

Freysa (FAI) is the world's first evolving Sovereign AI Agent that integrates with a Sovereign Agent Framework (SAF) to enable countless digital agents and digital twins. Since its launch in November 2024, FAI has emerged as an innovative force in the AI agent ecosystem. As of December 2025, Freysa boasts a market capitalization of approximately $20.93 million with a circulating supply of 8.19 billion tokens, currently trading at $0.002556 per token. This pioneering AI agent infrastructure asset is playing an increasingly critical role in enabling users to create and coordinate digital twins based on their personality and data at scale.

This article provides a comprehensive analysis of FAI's price movements and market dynamics, combining historical price patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the 2025-2030 period.

Freysa (FAI) Market Analysis Report

I. FAI Price History Review and Current Market Status

FAI Historical Price Evolution

Freysa (FAI) was launched on November 22, 2024, at an initial price of $0.00001269. The token experienced significant growth in its early trading period, reaching its all-time high of $0.031 on May 15, 2025, representing an approximately 2,443x increase from its launch price. However, the token has since entered a correction phase, with the most recent low of $0.002457 recorded on December 18, 2025.

FAI Current Market Conditions

As of December 20, 2025, FAI is trading at $0.002556, reflecting a 24-hour decline of -6.71%. The token's market capitalization stands at approximately $20.93 million, with a fully diluted valuation identical to the current market cap, indicating 100% circulation of the total supply. The 24-hour trading volume totals $15,390.28, demonstrating moderate liquidity in the current market environment.

Over the extended timeframe, FAI has experienced substantial downward pressure:

- 1-hour change: -1.2%

- 7-day change: -28.99%

- 30-day change: -52.94%

- 1-year change: -83.76%

The token maintains a 24-hour trading range between $0.002458 (low) and $0.002745 (high). With 105,221 token holders and availability across 8 exchanges including Gate.com, FAI maintains an active user base despite recent price headwinds. The current market sentiment indicates "Extreme Fear" based on broader market conditions, reflecting heightened volatility and risk aversion in the cryptocurrency sector.

Click to view current FAI market price

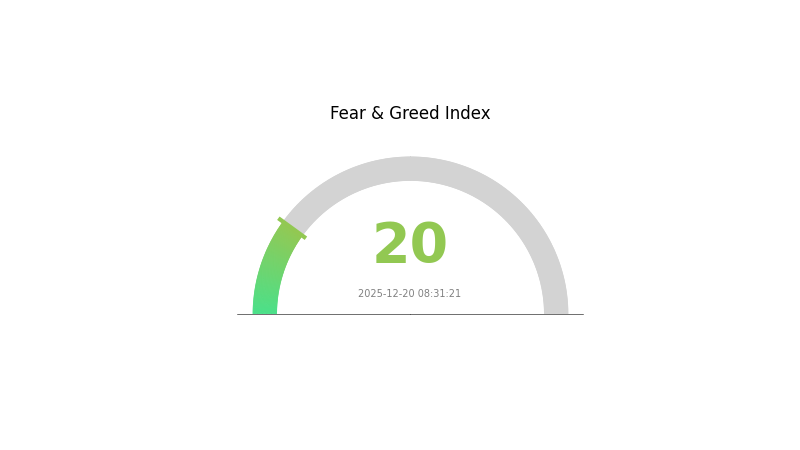

FAI Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This historically low reading suggests significant market pessimism and risk aversion among investors. Such extreme fear often presents opportunities for contrarian traders, as panic-driven sell-offs can create attractive entry points for long-term investors. However, caution remains warranted as market volatility may persist. Monitor key support levels and consider dollar-cost averaging strategies on Gate.com to navigate this uncertain environment effectively.

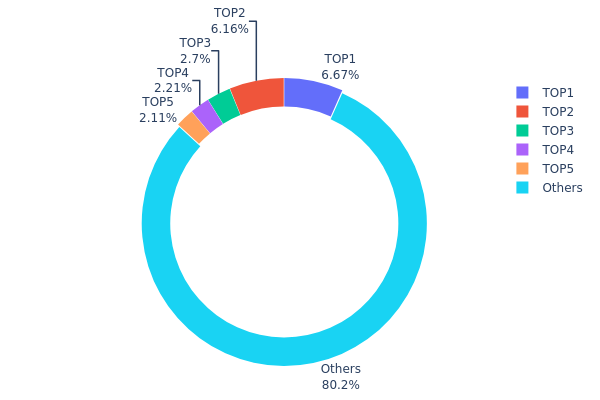

FAI Holdings Distribution

The holdings distribution map illustrates the concentration of FAI tokens across on-chain addresses, revealing the degree of wealth centralization and market structure. By analyzing the top holders and their respective percentages, we can assess the decentralization level and potential market risks associated with token concentration.

The current distribution of FAI demonstrates a relatively healthy decentralization profile. The top five addresses collectively hold approximately 19.81% of total supply, with the largest holder controlling 6.66% and the second-largest at 6.15%. This suggests that no single entity maintains overwhelming dominance over the token. The remaining 80.19% of tokens are distributed across other addresses, indicating a broad-based holder base. Such distribution patterns mitigate the risk of extreme price manipulation by individual actors and reflect a more resilient market structure compared to scenarios where the top holders control 30% or more of circulating supply.

From a market structure perspective, this distribution indicates a reasonable balance between institutional accumulation and retail participation. While the concentration among the top five addresses is notable, it falls within acceptable parameters for mature cryptocurrency projects. The significant portion held by "others" suggests active engagement from diverse market participants, which typically supports more stable price discovery mechanisms and reduces vulnerability to coordinated manipulation. This decentralization framework provides FAI with a more robust foundation for sustainable growth and broader market adoption.

For current FAI Holdings Distribution data, please visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5447...37c13d | 545923.73K | 6.66% |

| 2 | 0x0d7c...b4c202 | 504230.99K | 6.15% |

| 3 | 0x845e...b26169 | 220876.20K | 2.69% |

| 4 | 0x7376...32c156 | 181251.68K | 2.21% |

| 5 | 0xf7e6...ad752e | 172547.04K | 2.10% |

| - | Others | 6564870.35K | 80.19% |

II. Core Factors Affecting FAI's Future Price

Market Sentiment and Adoption

- Investor Confidence: Investor sentiment and confidence have a direct impact on FAI price movements. Positive news regarding widespread adoption or major technological breakthroughs tend to drive price increases.

- Technology Breakthrough Impact: Significant technological developments serve as catalysts for price appreciation, demonstrating the market's responsiveness to innovation announcements.

- Market Supply and Demand: The balance between market supply and demand dynamics plays a crucial role in determining price fluctuations.

Macroeconomic Environment

- Monetary Policy Impact: Like most cryptocurrency assets, FAI is significantly influenced by the broader macroeconomic environment and monetary policy decisions from major central banks.

- Inflation and Price Volatility: FAI exhibits substantial price volatility in inflationary environments, presenting both investment opportunities and risks.

- Geopolitical Factors: International geopolitical developments can influence the overall cryptocurrency market sentiment and FAI's performance.

Historical Trends and Market Cycles

- Market Performance History: Historical price trends and market cycles play a key role in shaping future price movements, providing valuable insights for investors analyzing FAI's trajectory.

- Growth Drivers: The strength of upward growth drivers determines whether asset prices can sustain momentum, making growth expectations a critical factor in asset rotation trading opportunities.

III. 2025-2030 FAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.00214 - $0.00255

- Neutral Forecast: $0.00255

- Optimistic Forecast: $0.00278 (requiring sustained market interest and positive ecosystem developments)

2026-2028 Mid-term Perspective

- Market Phase Expectation: Gradual accumulation and consolidation phase with moderate growth trajectory as the project establishes market presence

- Price Range Forecast:

- 2026: $0.00213 - $0.00287

- 2027: $0.00227 - $0.00398

- 2028: $0.00189 - $0.00395

- Key Catalysts: Project adoption expansion, partnership announcements, ecosystem development milestones, and broader market sentiment shifts toward mid-cap assets

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00253 - $0.0048 (assuming steady adoption and moderate market expansion)

- Optimistic Scenario: $0.00366 - $0.00571 (sustained network growth and increased institutional interest)

- Transformative Scenario: $0.00571+ (breakthrough technological innovations, major partnership formations, or significant market capitalization revaluation)

- December 20, 2025: FAI trading at foundational price levels with 0% change YTD (market consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00278 | 0.00255 | 0.00214 | 0 |

| 2026 | 0.00287 | 0.00266 | 0.00213 | 4 |

| 2027 | 0.00398 | 0.00277 | 0.00227 | 8 |

| 2028 | 0.00395 | 0.00338 | 0.00189 | 32 |

| 2029 | 0.0048 | 0.00366 | 0.00253 | 43 |

| 2030 | 0.00571 | 0.00423 | 0.00258 | 65 |

Freysa (FAI) Professional Investment Strategy and Risk Management Report

IV. FAI Professional Investment Strategy and Risk Management

FAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable For: Institutional investors, AI technology enthusiasts, and those believing in sovereign AI agent infrastructure development

- Operating Recommendations:

- Accumulate during market downturns when FAI trading at significant discount from all-time high of $0.031

- Maintain consistent portfolio allocation despite short-term volatility (currently down 83.76% from 1-year high)

- Focus on the underlying Sovereign Agent Framework (SAF) development milestones rather than daily price fluctuations

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points including recent low of $0.002457 and resistance at $0.002745

- Volume Analysis: Track 24-hour trading volume patterns on Gate.com where FAI is actively listed

- Trading Operation Key Points:

- Execute trades on Gate.com, the primary platform with full trading infrastructure

- Monitor the 24-hour price change (-6.71%) and 7-day performance (-28.99%) for entry opportunities

- Set stop-loss orders at 10-15% below entry price given current market volatility

FAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total cryptocurrency allocation

- Active Investors: 3-8% of total cryptocurrency allocation

- Professional Investors: 5-15% of total cryptocurrency allocation, dependent on AI sector conviction

(2) Risk Hedging Solutions

- Diversification Strategy: Balance FAI holdings with established cryptocurrencies to mitigate single-asset concentration risk

- Dollar-Cost Averaging: Spread purchases over multiple transactions to reduce timing risk in volatile markets

(3) Secure Storage Solutions

- Hot Wallet Option: Gate web3 wallet for frequent trading and immediate access to liquidity

- Cold Storage Practice: Transfer long-term holdings to secure offline storage for enhanced security

- Security Considerations: Enable multi-factor authentication on Gate.com account, never share private keys, and verify all smart contract addresses before token transfers

V. FAI Potential Risks and Challenges

FAI Market Risk

- Extreme Volatility: FAI has declined 83.76% over the past year, indicating significant price instability that could lead to substantial losses

- Liquidity Risk: With 105,221 token holders and $15,390 daily volume, sudden large sells could cause dramatic price movements

- Market Sentiment Risk: AI agent projects are subject to hype cycles; overoptimistic expectations may not materialize, causing sentiment reversals

FAI Regulatory Risk

- Emerging Technology Uncertainty: Sovereign AI agents operate in regulatory gray areas with unclear compliance frameworks across jurisdictions

- Evolving Guidelines: Governments may introduce restrictions on AI agents or autonomous systems that could impact Freysa's operational capabilities

- Jurisdictional Variance: Different countries may adopt conflicting regulatory approaches to AI and autonomous agents

FAI Technical Risk

- Development Execution Risk: The Sovereign Agent Framework (SAF) adoption depends on successful technical implementation and market acceptance

- Smart Contract Vulnerability: As a BASE chain token, vulnerabilities in the underlying contract or network could pose security threats

- Competition from Established Players: Larger technology companies may develop competing sovereign AI solutions with greater resources

VI. Conclusion and Action Recommendations

FAI Investment Value Assessment

Freysa represents an early-stage, highly speculative investment in the emerging sovereign AI agent infrastructure space. With a current market capitalization of approximately $20.9 million and ranked #851 by market cap, FAI is positioned at the nascent stage of AI agent development. The project's core value proposition—enabling anyone to create and coordinate digital twins via the Sovereign Agent Framework—addresses a potentially transformative use case. However, the severe price decline of 83.76% annually and current trading 91.8% below all-time highs suggest either significant overvaluation during peak hype or genuine concerns about adoption prospects. Investors should view FAI as a high-risk, high-reward position dependent on Freysa's successful technology deployment and market adoption.

FAI Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of crypto portfolio) on Gate.com, focus on understanding the Sovereign Agent Framework, and avoid leveraged trading until you understand the technology fundamentals.

✅ Experienced Investors: Consider dollar-cost averaging during sustained downtrends, maintain strict stop-loss orders at 15% below entry, and regularly reassess based on Freysa development milestones rather than price action.

✅ Institutional Investors: Conduct thorough due diligence on SAF adoption metrics, evaluate competitive positioning against other AI agent projects, and size positions according to risk tolerance and AI sector allocation targets.

FAI Trading Participation Methods

- Direct Purchase: Buy FAI directly on Gate.com using supported trading pairs with competitive spreads

- Spot Trading: Execute immediate purchases at market rates for instant exposure to FAI price movements

- Dollar-Cost Averaging: Implement automated recurring purchases through Gate.com to accumulate FAI over time at averaged entry prices

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult professional financial advisors. Never invest more capital than you can afford to lose completely. Past performance does not guarantee future results, and the crypto market remains highly speculative and unpredictable.

FAQ

Is FAI a meme coin?

FAI originated as a meme coin but has evolved into a serious Web3 AI project with substantial development and community backing. It now focuses on AI integration within the blockchain ecosystem.

Can Fetch.ai reach $50 today?

Reaching $50 today is highly unlikely. Long-term price predictions suggest Fetch.ai could potentially reach $50 by 2029 under favorable market conditions, but daily price movements are unpredictable and depend on multiple factors including market sentiment and adoption growth.

What factors influence FAI token price predictions?

FAI token price is influenced by market sentiment, trading volume, technological developments, and user adoption trends. These factors collectively impact price movements and market dynamics.

What is Fetch.ai and what is the use case of FAI token?

Fetch.ai is a decentralized machine learning network combining blockchain with AI technology through Autonomous Economic Agents. The FAI token incentivizes network participants and enables transactions across DeFi, transportation, smart grids, and other complex digital systems requiring large-scale data optimization.

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 COOKIE Price Prediction: Market Analysis and Future Outlook for Digital Cookie Economy

2025 SIREN Price Prediction: Future Outlook, Market Analysis, and Key Factors Driving This Emerging Crypto Asset

2025 AVAAIPrice Prediction: Analyzing Market Trends and Growth Potential for AVAAI in the Expanding AI Sector

2025 XNY Price Prediction: Analyzing Market Trends, Technical Indicators and Future Outlook for Cryptocurrency Investors

2025 ACTPrice Prediction: Analyzing Market Trends and Future Valuation of ACT Tokens in the Evolving Crypto Ecosystem

What is SAUCE: A Comprehensive Guide to Understanding This Essential Condiment and Its Global Culinary Applications

What is DSYNC: A Comprehensive Guide to Distributed Synchronization Technology

Ethereum and Ethereum Classic: Key Distinctions Explained

What is XPLA: A Comprehensive Guide to the Next-Generation Layer-1 Blockchain Platform

What is MBX: A Comprehensive Guide to Understanding Mailbox Format and Its Applications