2025年BTC价格预测:数字黄金可能突破20万美元大关的技术与宏观分析

引言:BTC 的市场地位与投资价值

比特币(BTC)作为加密货币市场的领头羊,自2008年诞生以来已经成为全球最知名和市值最高的数字资产。截至2025年,比特币市值已达2.24万亿美元,流通量约1991.6万枚,价格维持在112718.4美元左右。这种被誉为"数字黄金"的资产,正在全球金融体系和数字经济中发挥着日益关键的作用。

本文将全面分析比特币2025-2030年的价格走势,结合历史规律、市场供需、生态发展和宏观经济环境,为投资者提供专业的价格预测和实用的投资策略。

一、BTC 价格历史回顾与市场现状

BTC 历史价格演变轨迹

- 2013年:比特币首次大规模进入公众视野,价格从年初的13美元涨至年底的1000美元左右

- 2017年:比特币迎来牛市,价格突破20000美元大关,创下当时的历史新高

- 2022年:加密货币市场整体下跌,比特币价格从69000美元的历史高点跌至15000美元左右

BTC 当前市场态势

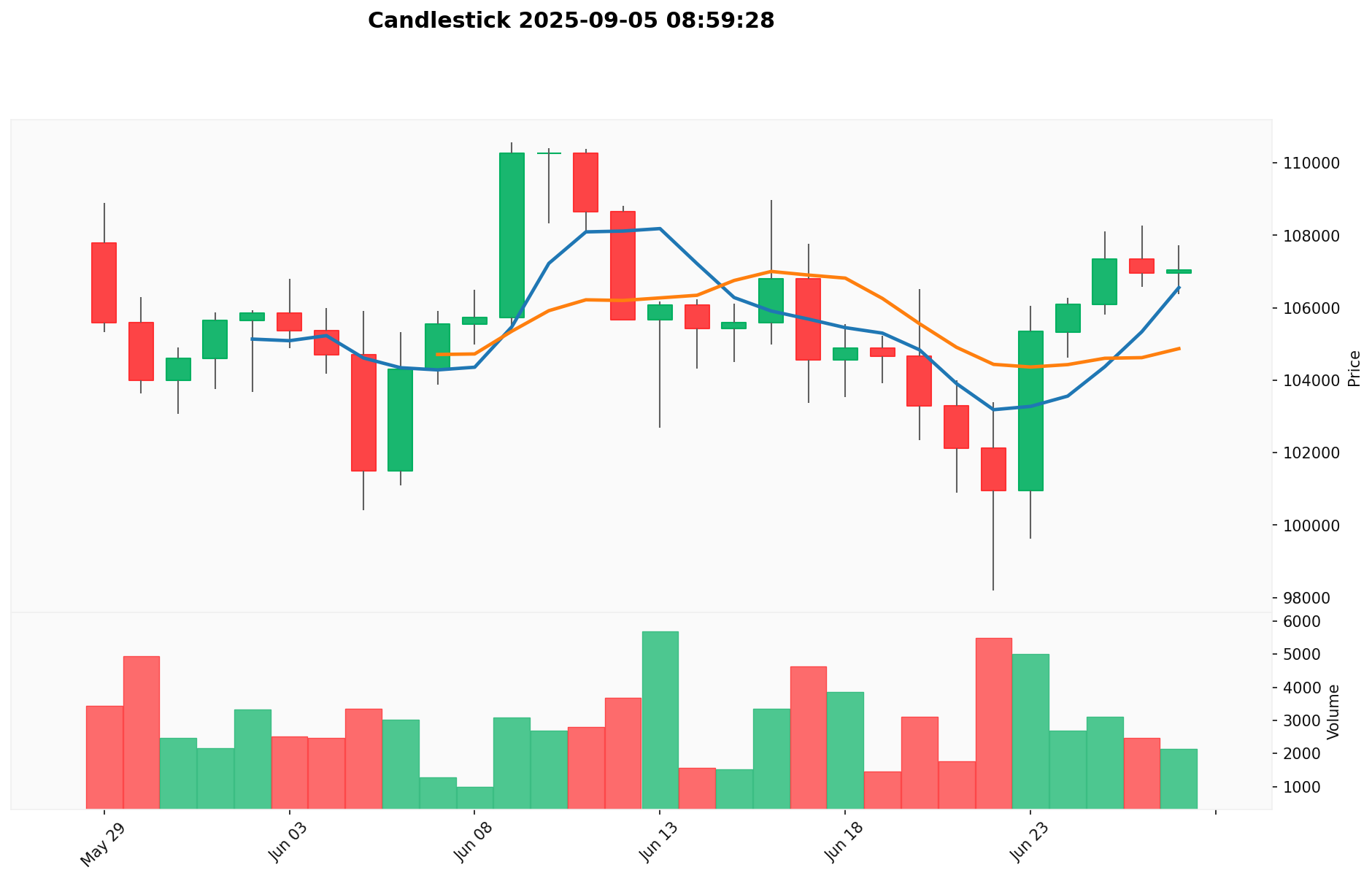

截至2025年9月5日,比特币(BTC)的市场表现如下:

- 当前价格:112718.4美元

- 24小时涨跌幅:1.77%

- 7天涨跌幅:2.36%

- 30天涨跌幅:-1.41%

- 1年涨幅:94.27%

- 历史最高价:124128美元(2025年8月14日)

- 历史最低价:67.81美元(2013年7月6日)

- 市值:2244948236030.40美元

- 市场占比:54.60%

比特币目前处于较高价位,但尚未突破历史最高点。过去24小时和7天内呈现上涨趋势,但30天内略有回调。相比一年前,比特币价格已经上涨了94.27%,显示出强劲的长期增长势头。

点击可查看当前 BTC 市场价格

BTC 市场情绪指标

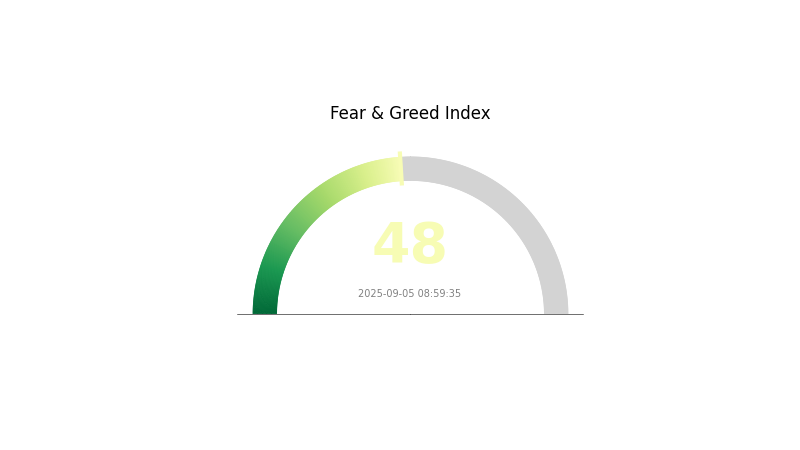

2025-09-05 恐惧与贪婪指数:48(正常)

点击可查看当前恐慌&贪婪指数

今日比特币市场情绪指数处于正常水平,显示市场参与者对当前行情持中立态度。指数为48,位于恐惧与贪婪的平衡点附近,反映出投资者既不过度悲观,也不过分乐观。这种平衡状态通常意味着市场相对稳定,没有明显的趋势倾向。投资者此时应密切关注市场动向,权衡风险与机遇,做出理性判断。建议在做出投资决策前,综合考虑其他技术指标和基本面因素。

BTC 持仓分布

地址持仓分布图展示了比特币网络中各地址所持有的 BTC 数量及占比情况,反映了资产的集中度和分布特征。根据当前数据,前五大地址合计持有约 754.22K BTC,占总供应量的 3.79%。其中,最大单一地址持有 248.60K BTC,占比 1.25%。

这一分布显示,比特币的集中度相对较低,没有出现过度集中的情况。96.21% 的 BTC 分布在其他地址中,表明资产分散程度较高。这种分布结构有利于维持市场的稳定性,降低了大户操纵市场的可能性,同时也体现了比特币良好的去中心化特征。

然而,仍需关注前几大地址的持仓变动,因为它们的大额交易可能引发短期市场波动。总体而言,当前的地址分布结构反映了比特币生态系统的健康状态,有利于长期的价值存储和交换功能的实现。

点击可查看当前 BTC 持仓分布

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248.60K | 1.25% |

| 2 | bc1ql4...8859v2 | 140.57K | 0.71% |

| 3 | 3M219K...DjxRP6 | 140.40K | 0.70% |

| 4 | bc1qgd...jwvw97 | 130.01K | 0.65% |

| 5 | bc1qaz...uxwczt | 94.64K | 0.48% |

| - | Others | 19162.06K | 96.21% |

二、影响 BTC 未来价格的核心因素

供应机制

- 固定总量:比特币总量固定在2100万枚,目前已开采19916431枚。

- 历史规律:比特币供应量的减半通常会导致价格上涨。

- 当前影响:随着供应量接近上限,稀缺性增加可能推动价格上涨。

机构与大户动态

- 机构持仓:多家知名投资机构如Coinbase Ventures、a16z、Pantera Capital等都持有比特币。

- 企业采用:一些大型企业已开始将比特币纳入资产负债表。

宏观经济环境

- 通胀对冲属性:比特币被视为抗通胀资产,在高通胀环境中可能表现良好。

技术发展与生态建设

- 生态应用:比特币生态系统不断发展,包括闪电网络等第二层解决方案。

三、2025-2030年 比特币价格预测

2025年展望

- 保守预测:78841.14美元 - 112630.2美元

- 中性预测:112630.2美元 - 128398.428美元

- 乐观预测:超过128398.428美元(需市场持续看好)

2027-2028年展望

- 市场阶段预期:可能进入快速增长期

- 价格区间预测:

- 2027年:130275.973434美元 - 203729.447817美元

- 2028年:107831.086308855美元 - 205392.5453502美元

- 关键催化剂:机构投资增加、全球宏观经济环境改善

2030年长期展望

- 基准情景:216517.9748900025美元(全球加密货币采用率稳步提升)

- 乐观情景:318281.423088303675美元(比特币被广泛接受为储值资产)

- 变革情景:超过318281.423088303675美元(比特币成为全球主流支付方式)

- 2030-09-05:比特币 318281.423088303675美元(达到预测期内最高价)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 128398.428 | 112630.2 | 78841.14 | 0 |

| 2026 | 156668.6082 | 120514.314 | 114488.5983 | 6 |

| 2027 | 203729.447817 | 138591.4611 | 130275.973434 | 22 |

| 2028 | 205392.5453502 | 171160.4544585 | 107831.086308855 | 51 |

| 2029 | 244759.449875655 | 188276.49990435 | 144972.9049263495 | 67 |

| 2030 | 318281.423088303675 | 216517.9748900025 | 132075.964682901525 | 92 |

四、BTC 专业投资策略与风险管理

BTC 投资方法论

(1)长期持有策略

- 适合人群:具有长期投资视野、能够承受短期波动的投资者

- 操作建议:

- 定期定额投资,平滑价格波动

- 关注比特币的基本面发展,而非短期价格波动

- 采用冷钱包存储大部分资产,确保安全

(2)主动交易策略

- 技术分析工具:

- 移动平均线:用于判断中长期趋势

- 相对强弱指标(RSI):用于判断超买超卖状态

- 波段操作要点:

- 结合宏观经济形势和比特币生态系统发展进行判断

- 设置止损,控制单次交易风险

BTC 风险管理框架

(1)资产配置原则

- 保守投资者:5-10%

- 积极投资者:10-20%

- 专业投资者:20-30%

(2)风险对冲方案

- 期权策略:购买看跌期权保护下行风险

- 多元化投资:配置其他加密资产或传统资产分散风险

(3)安全存储方案

- 硬件钱包推荐:Ledger、Trezor等知名品牌

- 多重签名方案:使用多重签名钱包增加安全性

- 安全注意事项:妥善保管私钥,警惕钓鱼网站和社会工程学攻击

五、BTC 潜在风险与挑战

BTC 市场风险

- 价格波动风险:比特币价格可能出现剧烈波动

- 流动性风险:在极端市场条件下可能面临流动性不足

- 市场操纵风险:大户操纵可能导致价格非理性波动

BTC 监管风险

- 政策不确定性:各国对比特币的监管态度可能发生变化

- 合规风险:交易所和相关服务可能面临监管压力

- 税收政策风险:比特币相关税收政策可能趋严

BTC 技术风险

- 网络安全风险:比特币网络可能面临黑客攻击

- 扩容问题:随着用户增加,网络可能面临扩容挑战

- 量子计算威胁:未来量子计算机可能对现有加密算法构成威胁

六、结论与行动建议

BTC 投资价值评估

比特币作为数字黄金具有长期投资价值,但短期内仍面临价格波动、监管不确定性等风险。投资者需权衡收益与风险,根据自身情况作出决策。

BTC 投资建议

✅ 新手:建议小额试水,学习相关知识,逐步增加投资

✅ 经验投资者:可根据风险承受能力适度配置,关注市场动态

✅ 机构投资者:考虑将比特币作为资产配置的一部分,注意风险管理

BTC 交易参与方式

- 加密货币交易所:注册知名交易所账户进行交易

- 场外交易(OTC):通过OTC平台进行大额交易

- 比特币ETF:通过传统金融市场投资比特币ETF产品

加密货币投资风险极高,本文不构成投资建议。投资者应根据自身风险承受能力谨慎决策,建议咨询专业财务顾问。永远不要投资超过你能承受损失的资金。

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What Is Crypto Staking? – Everything You Need to Know About Staking

What is the Metaverse and How Does It Work? A Quick Overview

What Is Coin Lending? How Does Coin Lending Work?

What is MULTI: A Comprehensive Guide to Multi-Chain Blockchain Technology and Its Applications

What is ALKIMI: A Comprehensive Guide to Decentralized Programmatic Advertising Platform