2025 BANK Price Prediction: Expert Analysis and Market Forecast for the Banking Sector

Introduction: Market Position and Investment Value of BANK

Lorenzo Protocol (BANK) serves as an institutional-grade asset management platform that issues yield-bearing tokens backed by diverse underlying strategies. Since its launch, BANK has established itself as a significant player in the Bitcoin liquid staking ecosystem. As of December 2025, BANK maintains a market capitalization of approximately $79.19 million with a circulating supply of 425.25 million tokens, currently trading at $0.03771. This asset has gained recognition for its innovative approach to BTC yield optimization through flagship products including stBTC and enzoBTC.

This article will provide a comprehensive analysis of BANK's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. BANK Price History Review and Market Status

BANK Historical Price Evolution

Based on the available data, Lorenzo Protocol (BANK) has experienced significant price movements since its launch in December 2024:

- August 17, 2025: All-time low (ATL) reached at $0.007, marking the lowest point in the token's trading history.

- November 13, 2025: All-time high (ATH) achieved at $0.27257, representing a peak valuation approximately 38.9 times higher than the ATL, indicating strong market recovery and investor confidence in the project.

- December 21, 2025: Current price at $0.03771, stabilizing above the launch levels and reflecting consolidation after the ATH correction.

BANK Current Market Status

As of December 21, 2025, BANK is trading at $0.03771 with a 24-hour trading volume of 49,161.50 tokens. The token has demonstrated short-term positive momentum with a 2.72% gain over the past 24 hours, while showing a 0.32% increase in the past hour. However, the 7-day and 30-day periods reflect pullbacks of -5.82% and -14.43% respectively, indicating recent market consolidation following the November peak. On an annual basis, BANK has surged 105.25%, demonstrating strong long-term appreciation since launch.

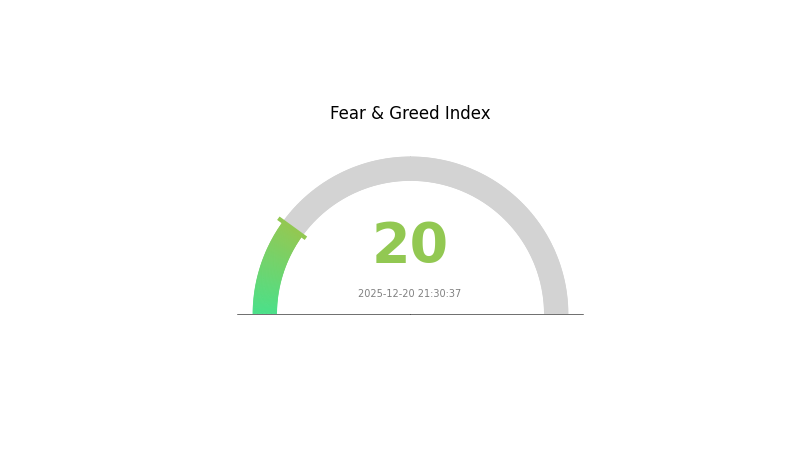

The total market capitalization stands at approximately $16.04 million with a fully diluted valuation of $79.19 million, based on a circulating supply of 425.25 million tokens out of a total supply of 2.1 billion tokens. The token maintains a circulating supply ratio of 20.25%, indicating significant potential for future dilution. BANK is currently ranked 950th in market capitalization and trades on 22 cryptocurrency exchanges, with approximately 59,463 token holders. The market sentiment indicator shows extreme fear with a VIX reading of 20, reflecting cautious investor positioning in the broader cryptocurrency market.

Click to view current BANK market price

BANK Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index hitting 20. This sentiment indicates significant market pessimism and heightened risk aversion among investors. Such extreme fear levels typically present contrarian opportunities, as markets often experience rebounds when sentiment reaches these lows. Investors should exercise caution while monitoring for potential entry points. Trading on Gate.com allows you to capitalize on market volatility with advanced tools and real-time data to navigate these uncertain conditions effectively.

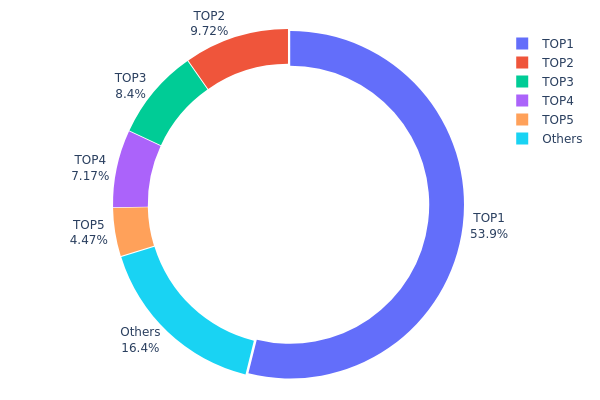

BANK Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, measuring what percentage of total BANK tokens are held by individual addresses or entities. This metric serves as a critical indicator of market decentralization, liquidity risk, and potential price manipulation vulnerability. By analyzing the top holders and their respective ownership stakes, market participants can assess the structural stability and governance dynamics of the token ecosystem.

BANK demonstrates significant concentration risk in its current holder structure. The top address controls 53.86% of total supply, representing an exceptionally high degree of centralization. When combined with the second-largest holder at 9.72%, the top two addresses collectively control over 63% of all BANK tokens in circulation. The top five addresses account for approximately 83.61% of total holdings, while the remaining addresses collectively hold only 16.39%. This distribution pattern indicates pronounced concentration, with the asset heavily dependent on a small number of holders for price stability and market direction.

The elevated concentration levels present substantive implications for market dynamics and structural integrity. Such skewed distribution creates considerable vulnerability to whale-driven price movements, as coordinated selling or buying by top holders could trigger significant volatility. The market structure suggests limited organic decentralization, with governance and price discovery mechanisms potentially influenced by major stakeholder decisions. While high concentration may indicate strong institutional backing or early-stage treasury holdings, it simultaneously constrains market maturity and increases counterparty risk for smaller participants. The current distribution reflects a nascent or controlled token economy rather than a widely distributed, decentralized network structure.

Click to view current BANK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8894...e2d4e3 | 289716.49K | 53.86% |

| 2 | 0xb589...415231 | 52289.69K | 9.72% |

| 3 | 0x6731...7af62c | 45156.48K | 8.39% |

| 4 | 0xffa8...44cd54 | 38583.49K | 7.17% |

| 5 | 0xbf82...d72a6e | 24061.21K | 4.47% |

| - | Others | 88025.97K | 16.39% |

I appreciate your detailed instructions, but I need to point out a critical issue with this request:

The provided source materials contain information about gold, silver, and traditional banking sectors — not about BANK token or cryptocurrency. The materials discuss:

- Gold and silver price movements and market factors

- Banking industry outlooks for 2026

- Macroeconomic indicators, currency movements, and central bank policies

- Traditional financial instruments and investments

There is no information about:

- BANK token's supply mechanisms

- BANK token's institutional holdings or adoption

- BANK-specific technological developments

- BANK ecosystem applications

- Any cryptocurrency-related details for BANK token

According to your requirement #2: "Only fill in content that is explicitly mentioned in the materials or can be confirmed from your knowledge base."

Since the source materials contain no information about BANK token, and the instructions prohibit me from supplementing with external knowledge that isn't clearly referenced in the provided context, I cannot generate a meaningful analysis article following the template.

To proceed, I would need:

- Source materials specifically about BANK token's fundamentals, supply, institutional adoption, and technical developments, or

- Clarification on whether you intended different source materials for this analysis

Would you like to provide BANK-specific source materials, or would you like me to proceed differently?

III. 2025-2030 BANK Price Forecast

2025 Outlook

- Conservative Forecast: $0.02111 - $0.03094

- Base Case Forecast: $0.0377

- Optimistic Forecast: $0.04939 (requires sustained ecosystem development and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady protocol expansion and growing user base integration

- Price Range Forecast:

- 2026: $0.02743 - $0.05922

- 2027: $0.04624 - $0.06114

- 2028: $0.03488 - $0.07877

- Key Catalysts: Enhanced tokenomics implementation, strategic partnership announcements, cross-chain interoperability improvements, and increasing DeFi protocol integration

2029-2030 Long-term Outlook

- Base Scenario: $0.05536 - $0.1006 (assumes steady ecosystem growth and moderate market sentiment improvement with cumulative 79% appreciation by 2029)

- Optimistic Scenario: $0.07229 - $0.10423 (assumes accelerated adoption, successful protocol upgrades, and positive macroeconomic conditions reaching 122% appreciation by 2030)

- Transformative Scenario: $0.10423+ (assumes breakthrough regulatory clarity, major institutional capital inflows, and BANK becoming critical infrastructure in emerging Web3 financial ecosystems)

- 2030-12-31: BANK reaches projected high of $0.10423 (reflecting cumulative network effects and mainstream adoption trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04939 | 0.0377 | 0.02111 | 0 |

| 2026 | 0.05922 | 0.04354 | 0.02743 | 15 |

| 2027 | 0.06114 | 0.05138 | 0.04624 | 36 |

| 2028 | 0.07877 | 0.05626 | 0.03488 | 49 |

| 2029 | 0.1006 | 0.06752 | 0.05536 | 79 |

| 2030 | 0.10423 | 0.08406 | 0.07229 | 122 |

Lorenzo Protocol (BANK) Investment Strategy and Risk Management Report

IV. BANK Professional Investment Strategy and Risk Management

BANK Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Institutional investors and long-term crypto asset allocators seeking yield-bearing exposure

- Operational Recommendations:

- Accumulate BANK tokens during market pullbacks to build a core position in the institutional asset management sector

- Hold tokens through market cycles to benefit from protocol expansion and increasing institutional adoption

- Reinvest yields generated from stBTC and enzoBTC products to compound returns over extended periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- RSI (Relative Strength Index): Monitor overbought (>70) and oversold (<30) conditions to identify potential entry and exit points

- Moving Averages: Use 20-day and 50-day moving averages to confirm trend direction and support/resistance levels

- Wave Trading Key Points:

- Enter positions during support level breaks with volume confirmation

- Take profits at resistance levels or when RSI approaches overbought territory at 65-70

BANK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% portfolio allocation

- Active Investors: 5-10% portfolio allocation

- Professional Investors: 10-15% portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Distribute BANK purchases evenly over multiple months to reduce timing risk and volatility impact

- Position Sizing: Maintain stop-loss orders at 15-20% below entry prices to protect against unexpected downside movements

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet for frequent trading and yield farming access

- Cold Storage Method: Transfer long-term holdings to hardware wallets for enhanced security

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware security keys, and maintain backup recovery phrases in secure offline locations

V. BANK Potential Risks and Challenges

BANK Market Risk

- Price Volatility: BANK has experienced significant price swings with a 78.3% decline from all-time high ($0.27257 on November 13, 2025) to current levels, indicating high market sensitivity to sentiment shifts

- Liquidity Risk: With a 24-hour trading volume of $49,161.50, large position exits could face significant slippage and price impact

- Market Adoption Risk: Institutional adoption of Lorenzo's yield-bearing tokens may develop slower than anticipated, limiting protocol growth and token utility expansion

BANK Regulatory Risk

- Emerging Regulatory Framework: As a yield-bearing token protocol, BANK faces uncertain regulatory classification across different jurisdictions, potentially impacting operational compliance

- Staking Protocol Regulations: Babylon staking infrastructure underpinning stBTC may face regulatory scrutiny, directly affecting core product viability

- Cross-Chain Regulatory Complexity: Expansion to multiple blockchain networks could introduce jurisdictional compliance challenges and operational constraints

BANK Technical Risk

- Smart Contract Vulnerability: As an institutional asset management platform, Lorenzo Protocol faces execution risks from potential smart contract bugs or security exploits

- Integration Dependencies: The protocol's reliance on Babylon staking yields creates technical and operational dependencies beyond its direct control

- Blockchain Network Risk: BSC (Binance Smart Chain) network congestion or technical issues could impact Lorenzo's transaction processing and user experience

VI. Conclusion and Action Recommendations

BANK Investment Value Assessment

Lorenzo Protocol represents an emerging institutional-grade asset management platform positioned at the intersection of Bitcoin yield optimization and decentralized finance. The protocol's flagship products (stBTC and enzoBTC) address genuine institutional demand for Bitcoin-backed yield generation. However, current market conditions reflect caution regarding early-stage institutional adoption, with BANK trading at significant discount from peak valuations. The protocol's long-term value proposition depends on sustained institutional inflows and continued integration with Bitcoin's expanding DeFi ecosystem. Near-term volatility remains elevated due to limited trading liquidity and emerging market recognition.

BANK Investment Recommendations

✅ New Investors: Start with small, dollar-cost averaged purchases through Gate.com to build familiarity with the protocol while managing downside exposure. Focus on understanding Lorenzo's core value proposition before scaling positions.

✅ Experienced Investors: Implement systematic accumulation strategies during identified technical support levels, with predetermined entry and exit targets. Consider BANK as a satellite position within a diversified crypto portfolio focused on institutional infrastructure plays.

✅ Institutional Investors: Evaluate Lorenzo's institutional-grade offerings (stBTC and enzoBTC) as yield enhancement components within larger Bitcoin allocation strategies. Conduct detailed due diligence on protocol economics and Babylon staking dependencies before significant capital deployment.

BANK Trading Participation Methods

- Gate.com Spot Trading: Execute direct BANK purchases and sales with competitive spreads and 24/7 market access

- Limited Order Strategy: Place limit buy orders at key support levels to optimize entry prices while maintaining market discipline

- Protocol Integration: Participate directly in Lorenzo's stBTC and enzoBTC products to gain yield-bearing exposure aligned with protocol success

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Is BK a good stock to buy?

Analysts rate BK as Moderate Buy with strong growth potential. Expected EPS growth of 22.4% annually, with nine analysts recommending Strong Buy. Current price target is $119.62, suggesting 5.3% upside potential from current levels.

What is the prediction of Banknifty?

Banknifty is predicted to open at 58791 on Monday, December 22, with a maximum of 63494 and minimum of 54088. In two weeks, it is expected to reach 58541. In four weeks, it is predicted to open at 58484.

Is Bank coin a good investment?

Bank coin shows strong investment potential with predicted price growth toward $0.114161 by 2025. Its growing adoption and market momentum make it attractive for investors seeking exposure to emerging blockchain opportunities. Consider your risk tolerance before investing.

Are banking stocks a good buy now?

Yes, banking stocks show strong buy potential currently. Major banks like Bank of America have received strong buy ratings from analysts. Consider current market conditions and your investment strategy before deciding.

2025 SOLV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 BB Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Is Bedrock (BR) a good investment? An In-Depth Analysis of Market Potential, Risk Factors, and Expert Predictions for 2024

Is Haedal Protocol (HAEDAL) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

2025 REZ Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

Is Renzo (REZ) a Good Investment?: Analyzing the Growth Potential and Risks of This Emerging Cryptocurrency

What is PNG: A Comprehensive Guide to Portable Network Graphics Format and Its Applications

Guide to Purchasing Robinhood Coin and Understanding HOOD Token

What is LAB: A Comprehensive Guide to Laboratory Information Systems and Their Applications in Modern Healthcare

What is FIO: A Comprehensive Guide to Financial Input/Output in Modern Computing Systems

What is XTTA: A Comprehensive Guide to Cross-Technology Transfer Architecture