توقع سعر 1INCH لعام 2025: هل سيحقق هذا الرمز الخاص ببروتوكول DeFi قفزات جديدة في سوق التداولات اللامركزية؟

مقدمة: مكانة 1INCH في السوق وقيمته الاستثمارية

يعتبر 1inch (1INCH) رمزاً وظيفياً لمنصة التداول 1inch، وقد شهد نمواً ملحوظاً منذ انطلاقه في عام 2020. مع حلول عام 2025، وصل رأس المال السوقي لـ 1INCH إلى 327,517,052 دولاراً، ويبلغ المعروض المتداول نحو 1,397,853,403 رمزاً، ويتراوح السعر قرب 0.2343 دولار. يُعرف هذا الرمز بأنه "منصة تجميع تداولات لامركزية"، ويلعب دوراً محورياً متزايداً في تحسين عمليات التداول وتوفير السيولة بشكل لامركزي.

تتولى هذه المقالة تحليل اتجاهات أسعار 1INCH بين عامي 2025 و2030 بالاستناد إلى الأنماط التاريخية، وتحولات العرض والطلب، وتطور النظام البيئي، والعوامل الاقتصادية الكلية، بهدف توفير توقعات مهنية وخيارات استراتيجية عملية للمستثمرين.

I. مراجعة تاريخ سعر 1INCH والحالة السوقية الراهنة

تسلسل سعر 1INCH عبر السنوات

- 2020: إطلاق رمز 1INCH بسعر ابتدائي يقارب 1.20 دولار

- 2021: ذروة السوق الصاعدة، بلغ السعر أعلى مستوى تاريخي عند 8.65 دولار في 27 أكتوبر

- 2022-2023: فترة ركود الأسواق الرقمية، وتراجع السعر إلى حوالي 0.50 دولار

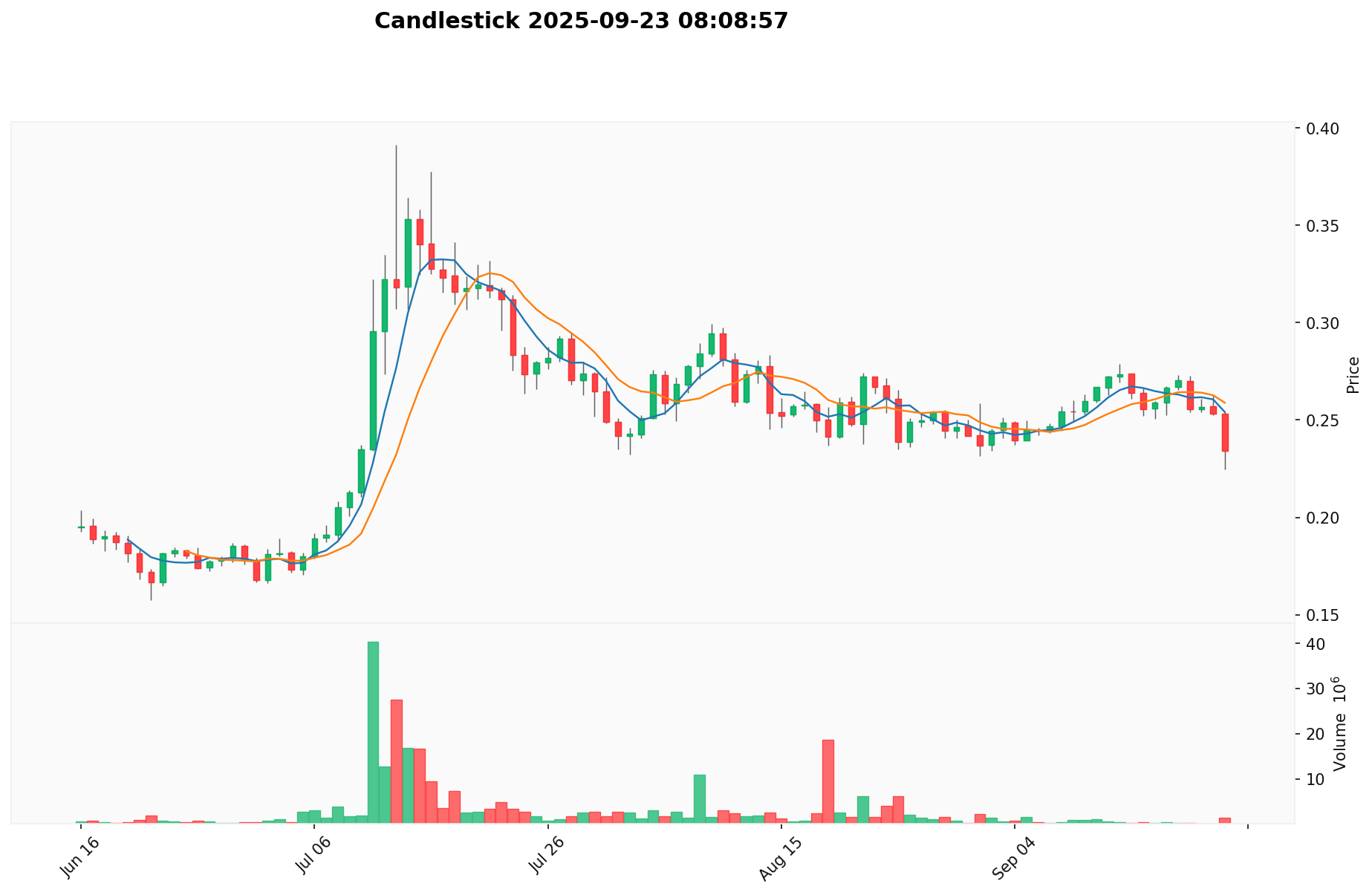

- 2024-2025: بداية انتعاش، مع تذبذب السعر بين 0.20 و0.40 دولار

الحالة السوقية الحالية لـ 1INCH

بتاريخ 23 سبتمبر 2025، يتم تداول 1INCH عند 0.2343 دولار، بحجم تداول يومي يساوي 71,505 دولار. سجل الرمز ارتفاعاً 0.47% على مدار الـ24 ساعة الأخيرة، مع تراجع بنسبة 8.19% خلال الأسبوع الماضي و9.19% خلال الشهر الأخير. ويبلغ رأس المال السوقي الحالي 327,517,052 دولار، ليحتل الرمز المرتبة 227 كواحد من أكبر العملات الرقمية من حيث القيمة السوقية.

يتداول 1INCH حالياً أدنى بكثير من أعلى سعر تاريخي له (8.65 دولار في 27 أكتوبر 2021)، وأعلى من أدنى مستوى وصل إليه (0.149574 دولار في 7 أبريل 2025). ويبلغ حجم المعروض المتداول 1,397,853,403 رمزاً، ما يعادل 93.19% من إجمالي المعروض البالغ 1,499,999,999.997 رمزاً.

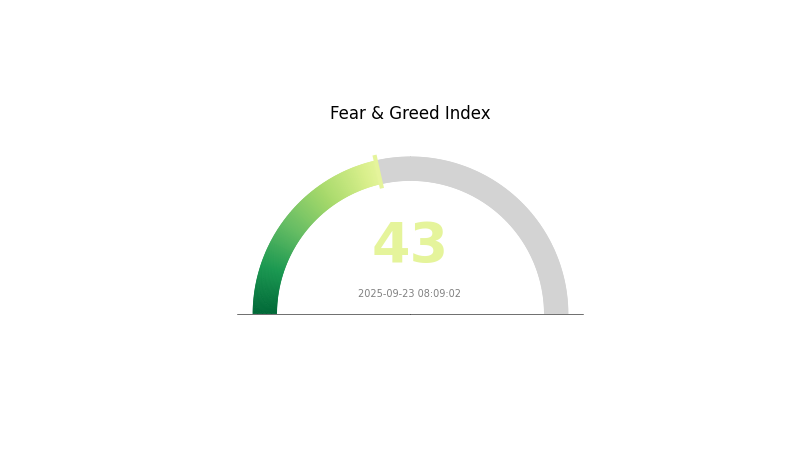

تظهر مؤشرات السوق، مثل مؤشر الخوف والطمع للعملات الرقمية، مستوى 43 حالياً، ما يعكس حالة "خوف" في السوق ويعبر عن احتمالية انخفاض القيمة أو ضعف الثقة بين المستثمرين.

اضغط للاطلاع على السعر السوقي الحالي لـ 1INCH

مؤشر معنويات السوق لـ 1INCH

مؤشر الخوف والطمع في 2025-09-23: 43 (خوف)

اضغط للاطلاع على مؤشر الخوف والطمع الحالي

تشير معنويات سوق 1INCH إلى حالة حذرة، إذ سجل مؤشر الخوف والطمع قيمة 43، مما يدل على جو سلبي بين المستثمرين. يعكس ذلك الاتجاه الضغوط البيعية وعدم اليقين في السوق، لكنه قد يمثل فرصة للمستثمرين المخالفين للاتجاه العام في فترات الخوف. وكما هو متعارف عليه، ننصح المستثمرين بإجراء البحث اللازم وتقييم قدرتهم على تحمل المخاطر قبل اتخاذ أي قرار استثماري. يمكن متابعة بيانات السوق عبر Gate.com لمواكبة تطورات السوق.

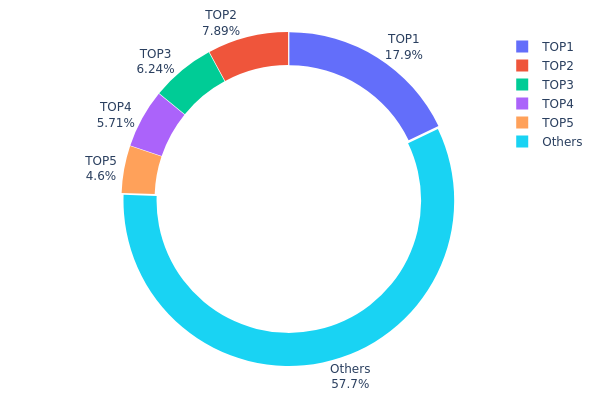

توزيع ملكية رمز 1INCH

تشير بيانات توزيع الملكية للعناوين إلى هيكل ملكية معتدل التركيز؛ حيث يمتلك أكبر عنوان 17.87% من إجمالي المعروض، فيما تسيطر العناوين الأربعة التالية على نسب تتراوح بين 4.60% و7.88%. ويستحوذ أكبر خمسة عناوين على 42.29% من إجمالي الرموز، بينما تُوزع النسبة الباقية (57.71%) بين بقية الحائزين.

هذا النمط يعكس مركزية نسبية في الملكية، مما قد يؤثر على ديناميكيات السوق ويزيد من التقلبات في حال تحرك كبار الحائزين بكميات كبيرة. من جهة أخرى، فإن انتشار أكثر من نصف الرموز بين حائزين أصغر يمنح نوعاً من التوازن وقد يعزز استقرار السوق.

ورغم عدم وجود مركزية مفرطة، إلا أن توزيع الملكية يبرز تأثير كبار الحائزين على منظومة 1INCH، ويؤكد أهمية مراقبة تحركات العناوين الكبرى وتوسيع التوزيع لتحقيق المزيد من اللامركزية والمتانة السوقية.

اضغط لمشاهدة توزيع الملكية الحالي لـ 1INCH

| الترتيب | العنوان | كمية الحيازة | نسبة الحيازة (%) |

|---|---|---|---|

| 1 | 0x9a0c...7501d7 | 268147.31K | 17.87% |

| 2 | 0x6630...d5a7ba | 118336.98K | 7.88% |

| 3 | 0x5e89...7cd7d1 | 93589.26K | 6.23% |

| 4 | 0x225d...32086e | 85704.79K | 5.71% |

| 5 | 0x4942...52dfd0 | 69000.00K | 4.60% |

| - | باقي الحائزين | 865221.65K | 57.71% |

II. العوامل الأساسية المؤثرة في مستقبل سعر 1INCH

التطور التقني وبناء النظام البيئي

-

تحديث البروتوكول: يعمل 1inch باستمرار على تطوير خوارزميات التجميع وتوسيع دعم المزيد من منصات التداول والسلاسل، لتحسين السيولة وكفاءة التداول.

-

الدمج عبر السلاسل: تواصل شبكة 1inch تطوير حلول الدمج بين السلاسل لجعل التداول عبر شبكات البلوكشين المختلفة أكثر انسيابية.

-

تطبيقات النظام البيئي: تشكل محفظة 1inch، وبروتوكول أوامر الحد، وحوكمة لامركزية (DAO) ركائز رئيسية لدفع تبني المستخدمين وتعزيز فاعلية الرمز.

III. توقعات سعر 1INCH للفترة 2025-2030

توقعات عام 2025

- توقع محافظ: 0.15008 – 0.20000 دولار

- توقع محايد: 0.20000 – 0.23450 دولار

- توقع متفائل: 0.23450 – 0.25092 دولار (مشروط بتحسن ظروف السوق)

توقعات 2027-2028

- المرحلة المتوقعة في السوق: فترة نمو محتملة

- نطاق السعر المتوقع:

- 2027: 0.23955 – 0.34222 دولار

- 2028: 0.26978 – 0.44545 دولار

- محركات النمو: توسع قطاع DeFi، وتحديثات البروتوكول

توقعات 2029-2030 بعيدة المدى

- سيناريو أساسي: 0.37958 – 0.45359 دولار (في ظل نمو مستقر للسوق)

- سيناريو متفائل: 0.45359 – 0.52163 دولار (مع تبني قوي للتمويل اللامركزي)

- سيناريو تحويلي: 0.52163 – 0.55000 دولار (في حال حدوث قفزة تقنية في منصات التداول اللامركزي)

- 31-12-2030: سعر 1INCH عند 0.52163 دولار (ذروة محتملة)

| السنة | أعلى سعر متوقع | متوسط السعر المتوقع | أدنى سعر متوقع | نسبة التغير |

|---|---|---|---|---|

| 2025 | 0.25092 | 0.2345 | 0.15008 | 0 |

| 2026 | 0.32766 | 0.24271 | 0.17718 | 3 |

| 2027 | 0.34222 | 0.28518 | 0.23955 | 21 |

| 2028 | 0.44545 | 0.3137 | 0.26978 | 33 |

| 2029 | 0.52761 | 0.37958 | 0.2695 | 62 |

| 2030 | 0.52163 | 0.45359 | 0.37195 | 93 |

IV. استراتيجيات الاستثمار المهنية وإدارة المخاطر لـ 1INCH

منهجية الاستثمار في 1INCH

(1) استراتيجية الاحتفاظ طويل الأجل

- موجهة للمستثمرين ذوي تحمل المخاطر والرؤية طويلة الأجل

- توصيات التنفيذ:

- تجميع رموز 1INCH أثناء انخفاض الأسعار

- الحفاظ على الاستثمار لمدة لا تقل عن 1-2 سنة لتجاوز التقلبات

- تخزين الرموز في محفظة أجهزة مؤمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: لتحديد الاتجاهات ونقاط الانعكاس

- مؤشر القوة النسبية (RSI): لرصد حالات التشبع البيعي أو الشرائي

- نقاط التداول المتأرجح:

- تحديد مناطق الدخول والخروج بدقة بناءً على المؤشرات الفنية

- استخدام أوامر وقف الخسارة للحد من المخاطر

إطار إدارة المخاطر لـ 1INCH

(1) مبادئ توزيع الأصول

- المستثمر المحافظ: 1–3% من محفظة العملات الرقمية

- المستثمر الجريء: 5–10% من المحفظة

- المستثمر المحترف: حتى 15% من المحفظة

(2) حلول التحوط وإدارة المخاطر

- تنويع الاستثمار بين عدة عملات رقمية

- تفعيل أوامر وقف الخسارة للحد من المخاطر المحتملة

(3) حلول التخزين الآمن

- اقتراح استخدام محفظة أجهزة Gate Web3 Wallet

- استخدام المحفظة الرقمية الرسمية لـ 1inch

- تفعيل المصادقة الثنائية واختيار كلمات مرور قوية

V. المخاطر والتحديات المحتملة لـ 1INCH

مخاطر سوق 1INCH

- تذبذب السعر بشكل كبير: تقلبات عالية في سوق العملات الرقمية

- مخاطر السيولة: صعوبات في تنفيذ تداولات كبيرة

- تزايد المنافسة مع منصات تجميع تداولات رقمية جديدة

مخاطر تنظيمية لـ 1INCH

- غياب وضوح البيئة التنظيمية: احتمال تصعيد القيود على مشاريع DeFi

- تحديات الامتثال الدولي: تنوع التشريعات وضوابط التنظيم في عدة أسواق

- خطر تصنيف الرمز كأداة مالية (Security)

مخاطر تقنية لـ 1INCH

- ثغرات العقود الذكية: احتمالية تعرض البروتوكول لهجمات برمجية

- ازدحام الشبكة: ارتفاع رسوم الغاز وبطء المعاملات على Ethereum

- إخفاقات المزود: احتمالية توفير بيانات أسعار غير صحيحة تؤثر على التداولات

VI. الخلاصة وتوصيات الاستثمار

تقييم القيمة الاستثمارية لـ 1INCH

يعد 1INCH استثماراً عالي المخاطر ومرتفع الإمكانات في قطاع التمويل اللامركزي. تكمن قيمته بعيدة المدى في كونه منصة تجميع تداولات رائدة، بينما تبرز مخاطر التقلبات التنظيمية والقصيرة الأجل بشكل ملحوظ.

توصيات الاستثمار في 1INCH

- المبتدئون: البدء بمبالغ صغيرة، والتركيز على التعرف على مفاهيم DeFi

- المستثمرون ذوو الخبرة: تخصيص 5–10% من المحفظة الرقمية، والمراقبة النشطة للاتجاهات السوقية

- المؤسسات: إجراء فحص دقيق، واعتبار 1INCH جزءاً من استراتيجية تنويع قطاع DeFi

طرق المشاركة في تداول 1INCH

- التداول الفوري: شراء واحتفاظ برموز 1INCH عبر Gate.com

- التحصيص (Staking): المشاركة في الحوكمة وكسب المكافآت

- توفير السيولة: دعم تجمعات 1inch لتحقيق عوائد محتملة

الاستثمار في العملات الرقمية شديد المخاطر، وهذه المادة لا تعتبر نصيحة استثمارية. ينبغي للمستثمر اتخاذ القرار بحذر وفقاً لقدرة تحمل المخاطر لديه، ويُنصح باستشارة خبراء ماليين. يُفضل تجنب الاستثمار بأكثر مما يمكنك تحمل خسارته.

الأسئلة الشائعة

هل من الممكن أن يصل 1inch إلى 10 دولارات؟

قد يصل 1inch إلى 10 دولارات بحلول عام 2025، إذا استمرت ابتكاراته وحصل على تبنٍّ أوسع في سوق DeFi، مع العلم أن السوق الرقمي يتسم بتقلبات مرتفعة.

هل تعتبر عملة 1INCH خياراً استثمارياً جيداً؟

تبدي عملة 1INCH إمكانات واعدة للنمو في 2025، ويجعلها انتشار ميزات DeFi واعتمادها المتزايد خياراً جذاباً للمستثمرين في العملات الرقمية.

هل من المتوقع أن يتعافى 1inch؟

من المرجح أن يشهد 1inch تعافياً مع توسع قطاع التمويل اللامركزي وزيادة الاعتماد على منصات التداول اللامركزية، ما يعزز قيمة الاستخدام لبروتوكول التجميع.

ما هو توقع سعر الإطلاق لعملة PI في عام 2025؟

وفقاً لاتجاهات السوق والتحليلات المهنية، يُتوقع أن يبدأ تداول عملة PI بين 0.10 و0.15 دولار للرمز عام 2025، مع التنويه أن هذه التقديرات قد تختلف عن الأسعار الفعلية.

مشاركة

المحتوى